- Regardless of a market-wide value decline at first of final week, the crypto market recovered as Bitcoin closed the week at $102,800.

- Bitcoin has now reached a brand new all-time excessive of $106,000.

- In the meantime, US spot crypto ETFs proceed to log consecutive constructive days of inflows.

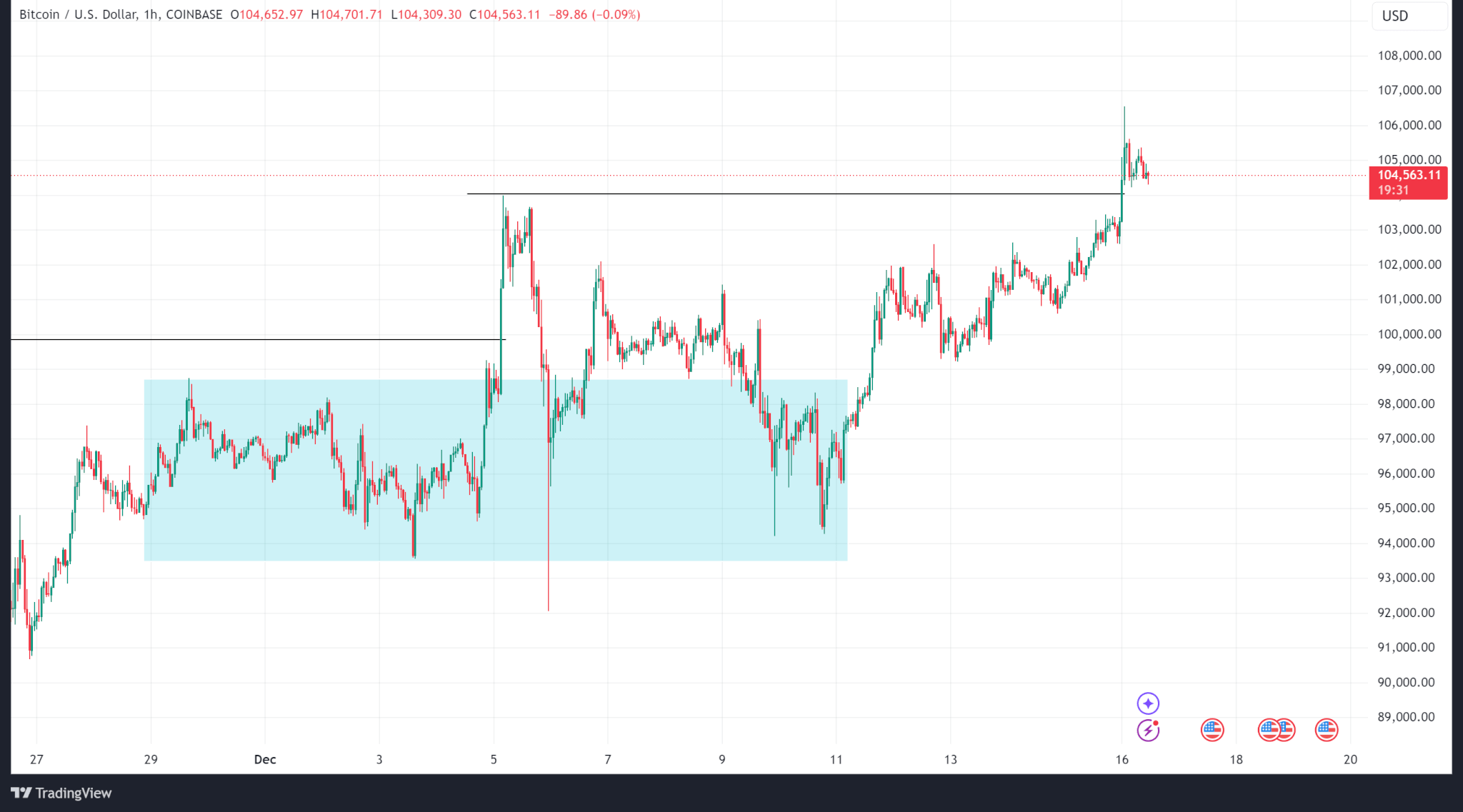

Bitcoin

Bitcoin has logged new highs of $106,400 since its dip final week to $94,000, pushed largely by constructive ETF inflows as US spot Bitcoin ETFs file one other week of consecutively constructive day by day inflows.

From Dec. 9 to Dec. 13, $2.17 billion flowed into the highest 10 US spot BTC ETFs.

Present value motion reveals Bitcoin has damaged its earlier excessive of $104,000 and trades at $104,500 after reaching a brand new excessive of $106,600.

The Fed price coverage choice developing on Dec. 18 may considerably influence value motion. Expectations are hawkish with extra managed slashes shifting into subsequent 12 months, which may negatively influence dangerous belongings like Bitcoin.

Price technicals help a hawkish stance as Bitcoin’s value may push downward to seize liquidity at decrease ranges round $100,000.

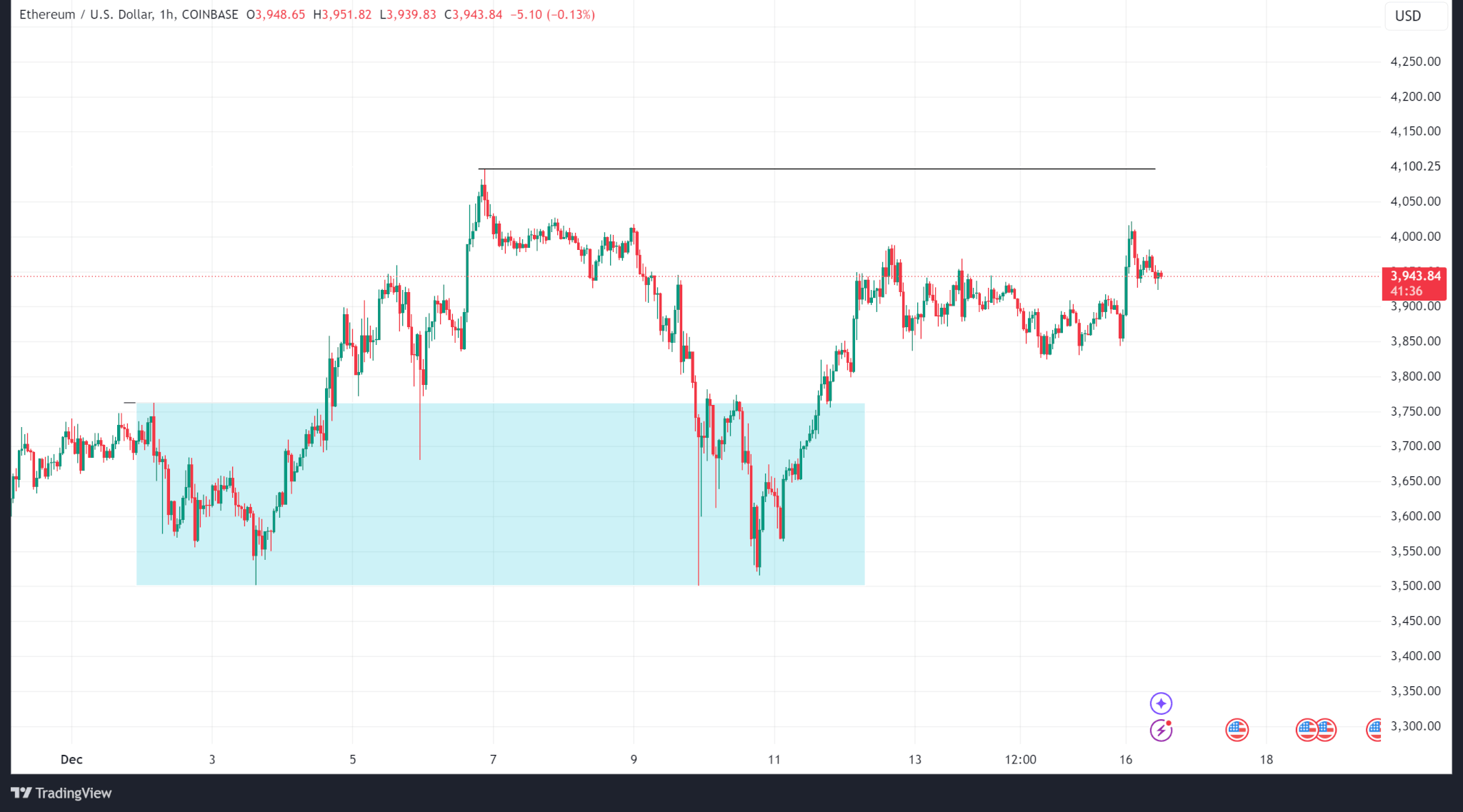

Ethereum

The second-largest crypto rebounded from a weekly low of $3,500 to a neighborhood excessive of $4,000. In contrast to Bitcoin, it has not damaged the earlier excessive shaped on the $4,100 stage.

In the meantime, Ethereum spot ETF inflows remained constructive all through final week, totalling $854.8 million.

Ethereum trades at $3,950 on the time of publishing.

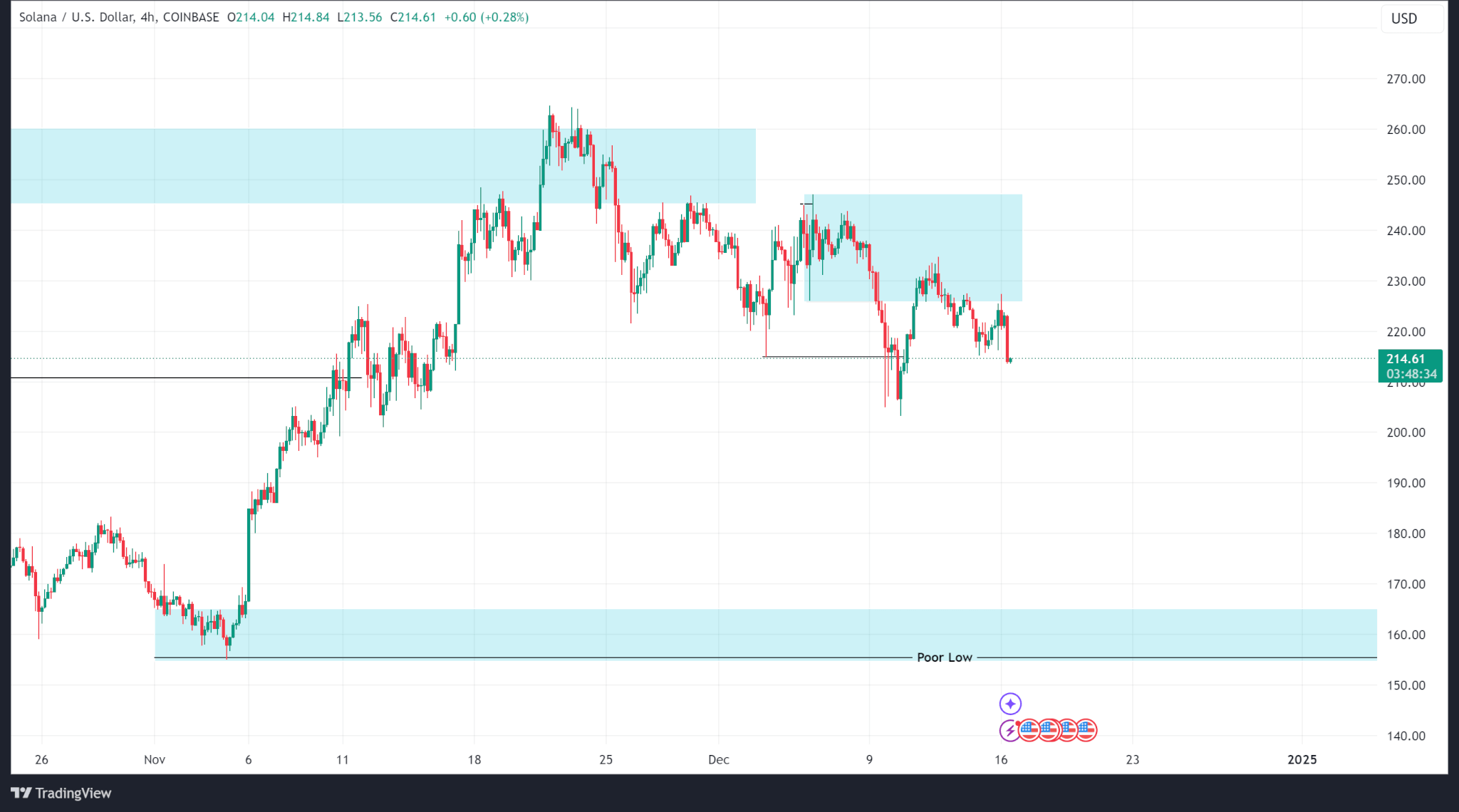

Solana

In contrast to Bitcoin and Ethereum which have rebounded since final week, Solana’s value has declined since failing to shut above its all-time excessive of $260 on the day by day timeframe.

Price motion on intermediate time frames (H4/H1) reveals rejection and sells from native provide zones which can proceed till a logical demand zone at $160. Solana’s value might want to break above $247 on the H4 and finally shut above the all-time excessive on the day by day timeframe to renew its bullish movement.

Solana trades at $214 on the time of publishing.

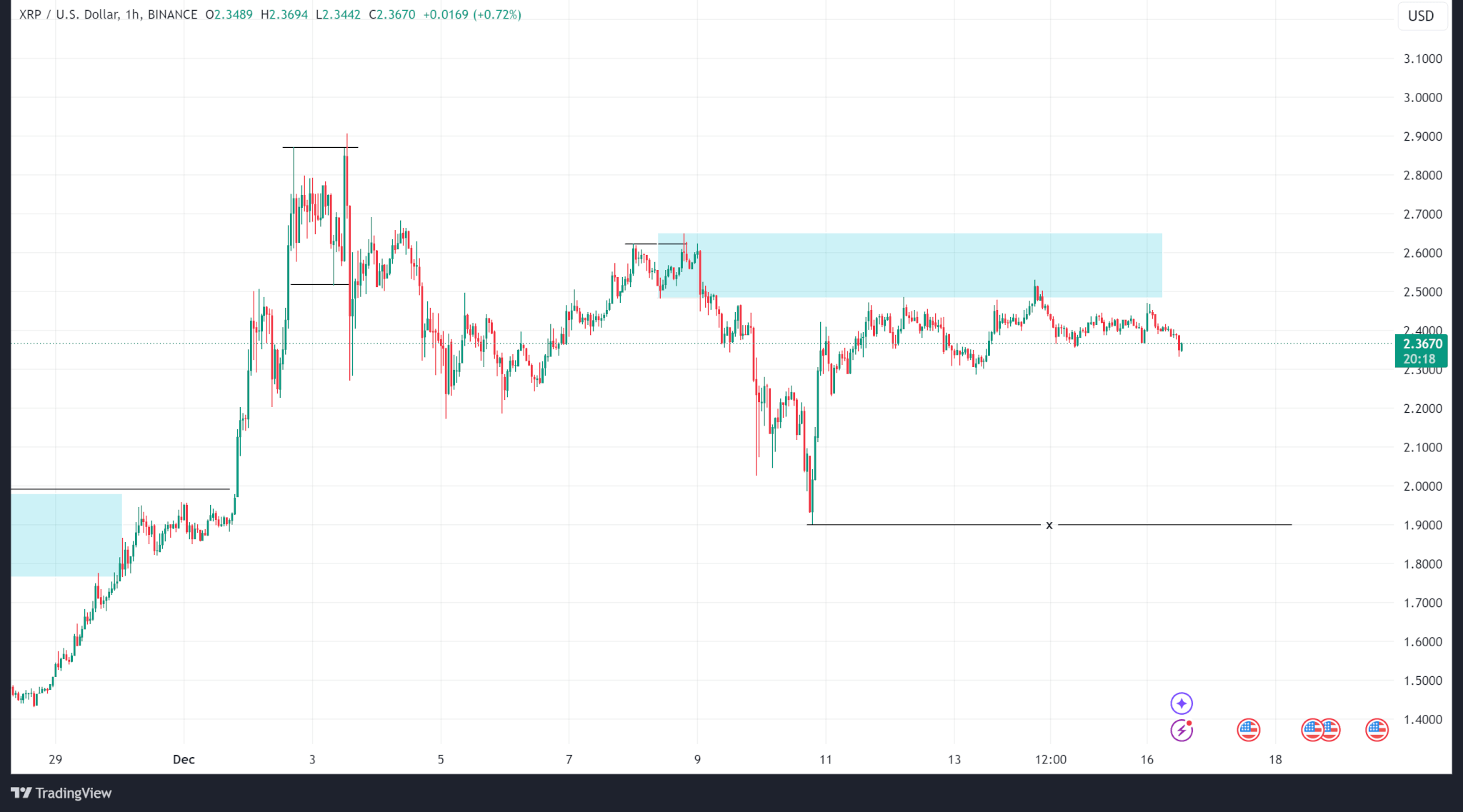

Ripple

Ripple’s value motion has been extremely bullish following its authorized wins and anticipated adjustments to the US regulatory panorama. The crypto surpassed its former all-time excessive of $1.99 and shaped a brand new ATH of $2.90 on Dec. 3.

Newer value motion reveals a pullback from highs as the worth shaped a brand new native provide zone, rejected, and bought from it. A continuation of the present pattern would see value take liquidity on the $1.90 stage whereas a reversal would see value break above $2.65.

Ripple trades at $2.36 on the time of publishing.