The newest fund flows report from CoinShares reveals sustained outflows from crypto asset funding merchandise, signaling continued warning from traders amid world financial pressures.

In accordance with the agency’s information, final week marked the third consecutive week of outflows, totaling $795 million throughout varied crypto-related funds. These withdrawals come amid the current tariff disputes, notably pushed by current US coverage shifts, dampen sentiment throughout monetary markets.

Bitcoin Dominates Outflows Whereas Altcoins See Blended Exercise

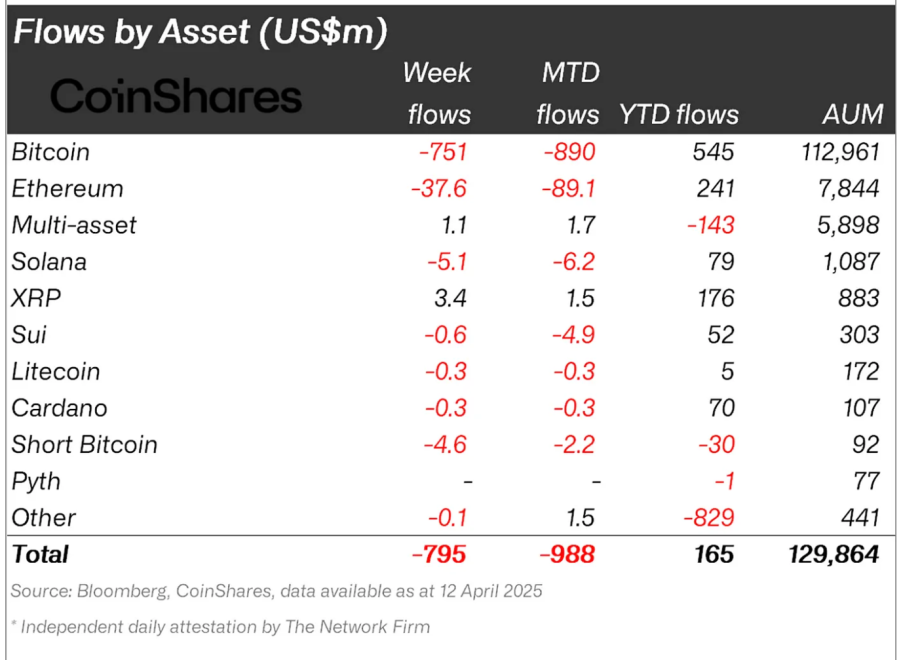

The report reveals that Bitcoin skilled probably the most vital outflows final week, with $751 million withdrawn from associated funding merchandise. Regardless of this, the asset nonetheless holds a optimistic web influx year-to-date of $545 million.

CoinShares additional reported that the outflows had been broadly distributed throughout completely different nations and asset managers, highighting the worldwide nature of investor warning. Even short-Bitcoin merchandise, which generally profit from bearish sentiment, recorded outflows totaling $4.6 million.

Ethereum adopted with $37.6 million in outflows, reflecting the second-largest withdrawal amongst digital belongings for the week. Different notable altcoins additionally noticed average outflows, together with Solana ($5.1 million), Aave ($780,000), and Sui ($580,000).

In distinction, a couple of smaller belongings recorded slight inflows, suggesting some traders could also be diversifying amid broader declines. XRP led the beneficial properties amongst altcoins with $3.5 million in inflows, adopted by Ondo, Algorand, and Avalanche with inflows beneath $500,000 every.

Recorded Rebound As Costs Rise

CoinShares’ head of analysis, James Butterfill, famous that the damaging pattern, which started in early February, has led to a cumulative $7.2 billion in outflows, successfully wiping out almost all of the year-to-date inflows. As of now, web inflows for 2025 stand at solely $165 million.

Nevertheless, a quick restoration in asset costs towards the tip of final week helped stabilize the overall belongings beneath administration (AuM), which rose 8% from their lowest level on April 8 to $130 billion.

This turnaround follows President Trump’s current pause on tariffs, a transfer that contributed to broader market optimism within the latter a part of the week.

Thus far, Bitcoin has now seen roughly 10% surge previously week alone as its worth at present hovers above $84,000—a slight retracement from the $85,315 24-hour excessive seen earlier at present.

Curiously, Ethereum wasn’t left behind this time within the surge. Over the identical interval, Ethereum has additionally elevated by almost 10% with its worth at present buying and selling at a worth of $1,660, on the time of writing, marking a 4.3% uptick previously day.

XRP, Solana and different altcoins has additionally seen their share of a major enhance with XRP hovering by 19.1% previously 7 days and Solana growing by 29.8% in the identical interval.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.