- The Bybit hack has elevated fears over centralized alternate safety vulnerabilities

- US President Donald Trump’s commerce tariffs are growing market uncertainty

- Trump’s crypto guarantees could have began as being nice, however they may find yourself proving catastrophic

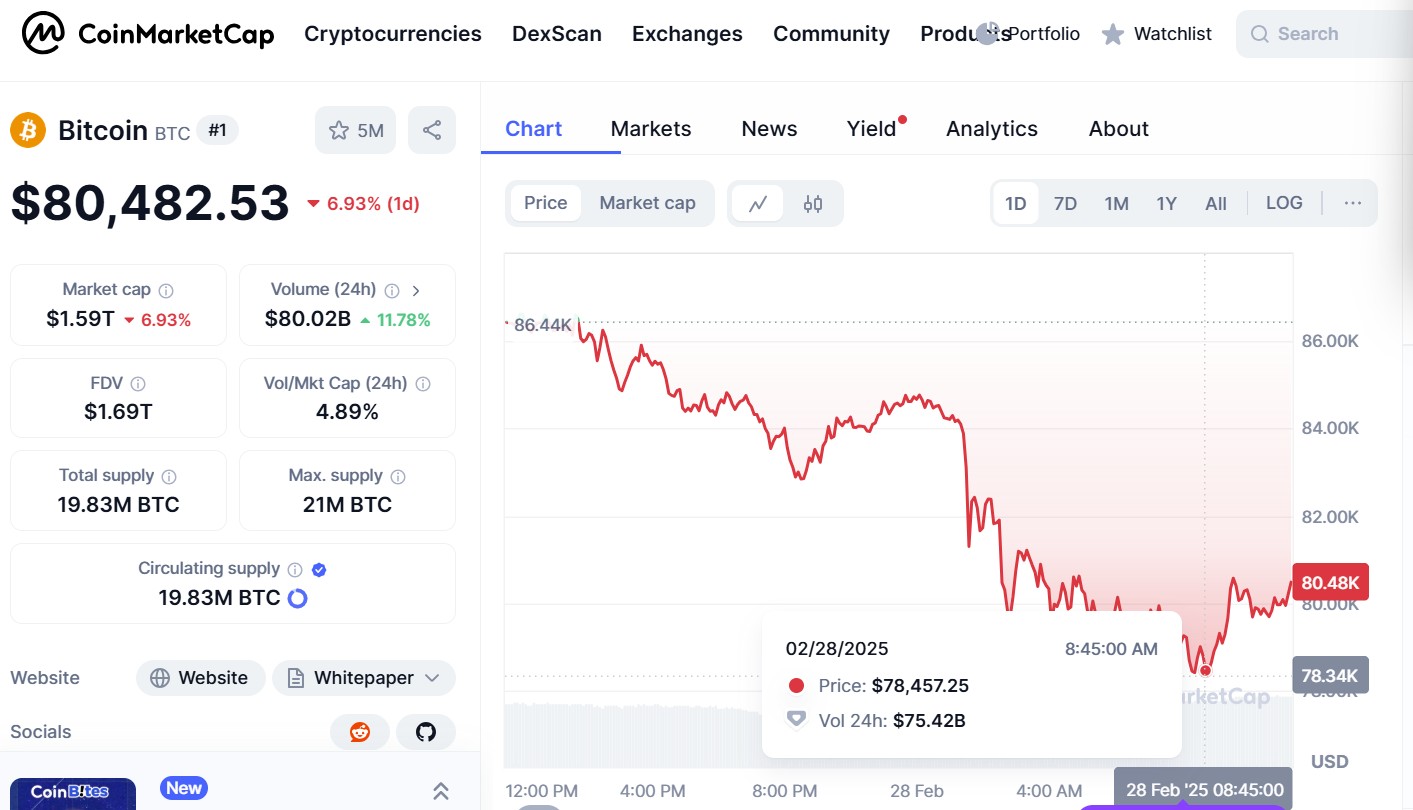

Three issues are contributing to the drop in crypto costs, which has seen Bitcoin fall 7.50% over 24 hours to $78,000, in accordance with Unity Wallet’s COO.

It’s a big drop from Bitcoin’s all-time excessive, which reached $109,000 in January forward of US President Donald Trump’s inauguration.

In accordance with James Toledano, it appears like optimism across the crypto market post-election created a bubble and that the “reality post-inauguration is now setting in – and hard,” he stated to CoinJournal.

In Toledano’s view, the Bybit hack on the crypto alternate final Friday—which resulted within the theft of practically $1.5 billion price of Ethereum—is likely one of the contributing elements affecting crypto costs.

Undermining investor confidence, it has led to panic withdrawals and a market-wide selloff throughout the board. Whereas Bybit’s CEO, Ben Zhou, shortly responded to the hack, the state of affairs has elevated “fears about centralized exchange security vulnerabilities—which only solidifies the case for self-custodial services,” Toledano continued.

Dom Harz, co-founder of BOB (“Build on Bitcoin”), a hybrid Layer-2, stated to CoinJournal the theft at Bybit is a “stark reminder of the industry’s fundamental issues,” including:

“We’ve been hypnotized by price spikes, memecoin frenzies, and media spectacles, forgetting that crypto was meant to be a new financial system—one built on decentralized protocols that make finance accessible to everyone. Bybit just gave us a $1.5 billion reminder that we are nowhere near that reality.”

Trump’s tariffs

The continued market selloff follows Trump’s commerce tariff announcement earlier this week.

Throughout his election marketing campaign, the US president made guarantees relating to crypto, stating that America would be the “crypto capital of the planet.”

Since coming into the White Home, he has appointed pro-crypto people to reshape authorities businesses, specifically Paul Akins because the incoming chair of the US Securities and Trade Fee (SEC).

Mark Uyeda is at the moment appearing chair of the SEC.

Trump additionally signed an govt order to ascertain a crypto working group to offer regulatory readability. It’s additionally anticipated that the working group will look into the potential of a nationwide crypto stockpile.

But, regardless of these steps, Trump’s commerce wars—which may quickly hit the EU, the world’s largest buying and selling bloc, with a 25% tariff—is growing market uncertainty.

In accordance with Toledano, Trump’s tariffs are “harming the global economy” and that many within the crypto area really feel let down by the US president.

“The promise was great and the reality is potentially proving to be catastrophic,” he added. “It does make me wonder if Trump understands that financial verticals are interlinked and increasingly converging.”

Greatest financial threat

The third contributing issue affecting market costs—in accordance with Toledano—are questions across the general governance of the US.

An article by Chatham Home means that the most important financial threat from Trump’s presidency is a lack of confidence in US governance. It reads that whereas Trump’s insurance policies could seem gentle within the quick time period, steps that undermine the US and its worldwide allies may have lasting results.

“I rarely get spooked from the peaks and troughs that crypto presents but when I combine what’s happening with traditional equities volatility, I think there is cause for concern right now,” stated Toledano.