Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Tron (TRX) Sharpe Ratio suggests the cryptocurrency’s worth could also be removed from overheating, an indication that the coin may have extra upside potential.

Tron Sharpe Ratio Is Nonetheless Considerably Under Overheating Zone

In a CryptoQuant Quicktake put up, an analyst has talked concerning the newest pattern within the Sharpe Ratio of Tron. The “Sharpe Ratio” refers to an indicator that compares the returns of an asset in opposition to the danger related to it.

The numerator within the ratio, the ‘returns’ portion, is outlined because the distinction between the common return of the coin and the risk-free return (that’s, the theoretical return concerned with an asset carrying zero threat) over a given interval. The denominator, the ‘risk’ half, is the asset’s commonplace deviation of returns over the identical window (in different phrases, its volatility).

Associated Studying

When the worth of this metric is bigger than 1, it means the cryptocurrency is printing returns that outweigh its threat. Alternatively, it being below the brink suggests the asset’s efficiency has been lackluster in comparison with its volatility.

Now, here’s a chart that exhibits the pattern within the Tron Sharpe Ratio over the previous few years:

As displayed within the above graph, the Tron Sharpe Ratio fell beneath the 1 stage earlier, however its worth has since returned above the mark. In line with the quant, the metric being above the extent has traditionally accompanied bullish worth motion.

An especially excessive worth, nonetheless, has confirmed to be an overheating sign, with the asset tending to reach at a high. “Whenever the Adjusted Sharpe Ratio climbs above 40, it often signals a market that’s overheating,” explains the analyst. “In the past, readings over 40 have lined up well with local tops.”

To date since its return above 1, the Tron Sharpe Ratio has solely managed to achieve a excessive of 8.3, which is clearly considerably beneath this cutoff. This pattern may imply that TRX hasn’t been too overheated.

“With TRX’s Sharpe Ratio still far from historical peaks, the data suggests there’s plenty of upside room for a potential bull run in 2025,” says the quant. It now stays to be seen how the coin will develop within the close to future, given this sample.

Associated Studying

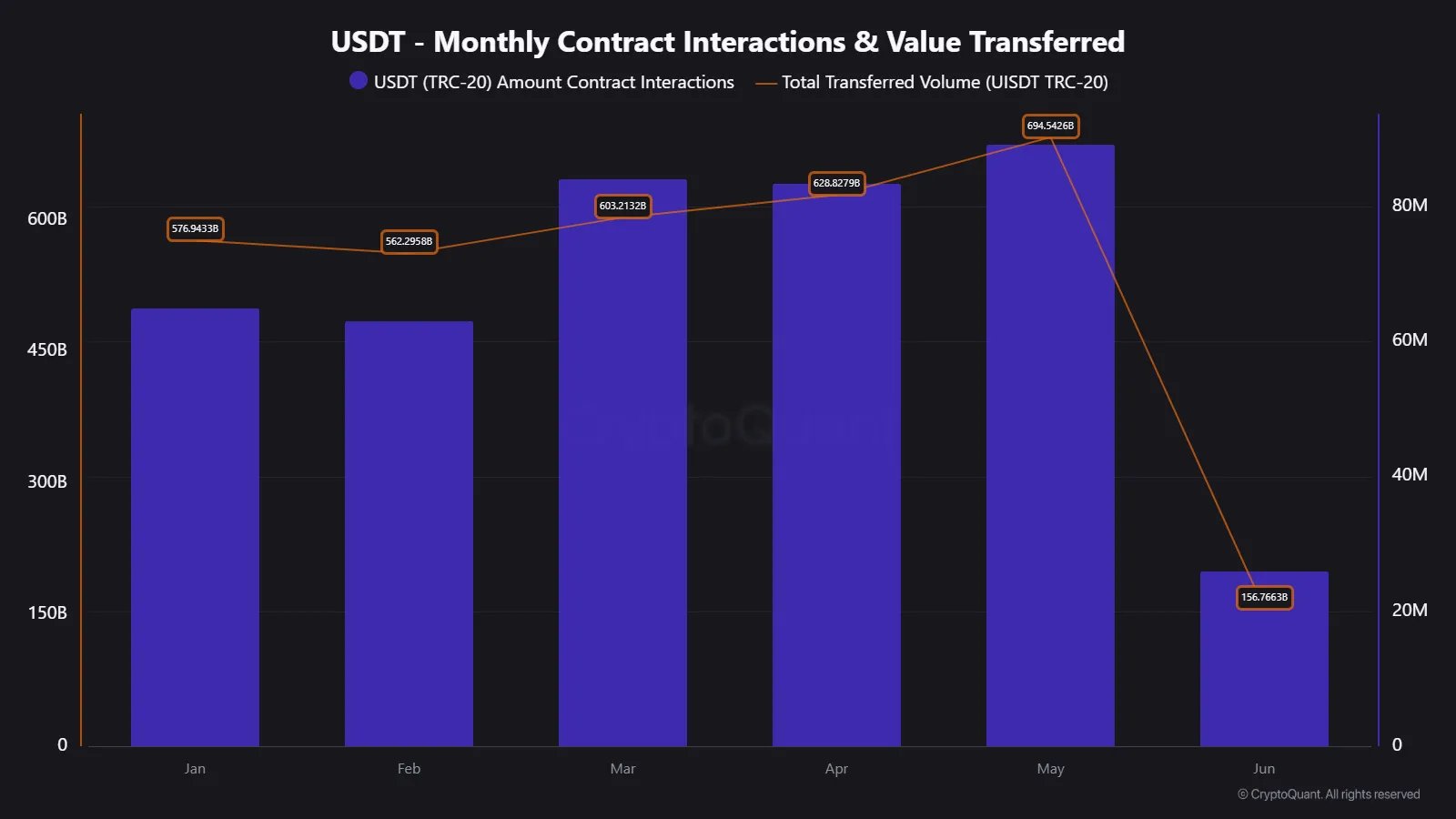

In another information, the Tron community set a brand new file in USDT transaction quantity final month, as CryptoQuant group analyst Maartunn has identified in an X put up.

In whole, the month of Might noticed over $694 billion in USDT transaction quantity on the Tron community. Round $411 billion of those transfers have been of a dimension that’s usually related to the whales.

TRX Value

On the time of writing, Tron is buying and selling round $0.272, down 1% within the final week.

Featured picture from iStock.com, CryptoQuant.com, chart from TradingView.com