In the USA, Technique proved the Bitcoin treasury mannequin. In Asia, Metaplanet took the baton ran with it. Now in Europe, a brand new title is rising as a pacesetter in stability sheet transformation—The Blockchain Group (ALTBG).

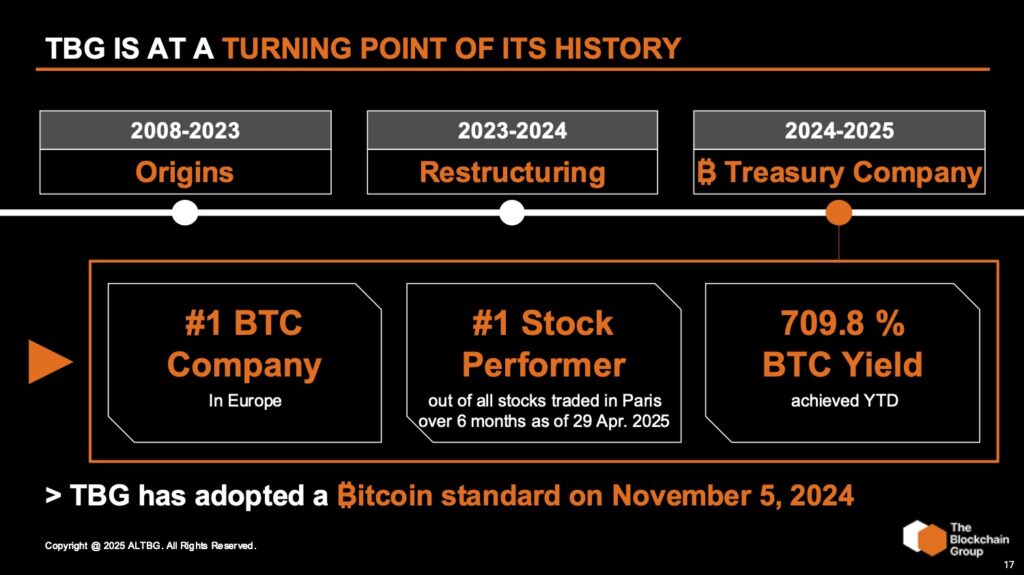

Listed on Euronext Progress Paris, The Blockchain Group has delivered one of the crucial exceptional performances amongst all public Bitcoin corporations since adopting its treasury technique. In simply six months, it has posted a 709.8% BTC Yield, far outpacing Bitcoin’s value efficiency and demonstrating how stability sheet engineering—when executed by way of the Bitcoin lens—can drive exponential shareholder worth.

This isn’t a narrative about using Bitcoin’s value motion. It’s about manufacturing Bitcoin per share by way of disciplined capital technique.

A Strategic Reset—and a Daring Guess on Bitcoin

The Blockchain Group wasn’t all the time a Bitcoin-first firm. In truth, till late 2023, it was a diversified tech holding firm with pursuits throughout media, consulting, and software program providers. However outcomes have been blended, and profitability remained elusive.

The whole lot modified in December 2023. A brand new board was put in. Legacy subsidiaries have been spun off or liquidated. A leaner, extra targeted entity emerged, anchored by two worthwhile working corporations—Iorga (customized internet and blockchain options) and Trimane (information intelligence and AI consulting). However an important shift wasn’t operational—it was philosophical.

In November 2024, TBG grew to become Europe’s first Bitcoin Treasury Company, formally adopting a long-term technique to accumulate Bitcoin, optimize BTC per share, and deal with Bitcoin not as a speculative asset, however as core working capital in a digitally scarce financial system.

From Restructuring to Refinement

What adopted was a masterclass in capital effectivity. TBG didn’t simply purchase Bitcoin—it refined its stability sheet right into a satoshi-generation engine:

- €1M fairness increase (Nov 2024) at a 70% premium allowed the acquisition of ~15 BTC.

- €2.5M fairness increase (Dec 2024) with Adam Again and TOBAM introduced in one other ~25 BTC.

- €48.6M BTC-denominated convertible bond (Mar 2025) enabled the acquisition of 580 BTC—vaulting the corporate to 620 BTC held.

- Complete share value appreciation over the identical interval: +474%

These weren’t random capital injections. They have been extremely focused refinements, designed to maximise the quantity of Bitcoin acquired per share created.

In Q1 2025 alone, totally diluted shares elevated by 100%, however BTC holdings grew by 1,450%. BTC/share rose from 41 to 332 sats—a 709.8% BTC Yield.

On this mannequin, dilution isn’t a risk—it’s a instrument. The query isn’t “how much are you raising?”—it’s “how many sats per share are you generating?”

A Capital Refinery in Movement

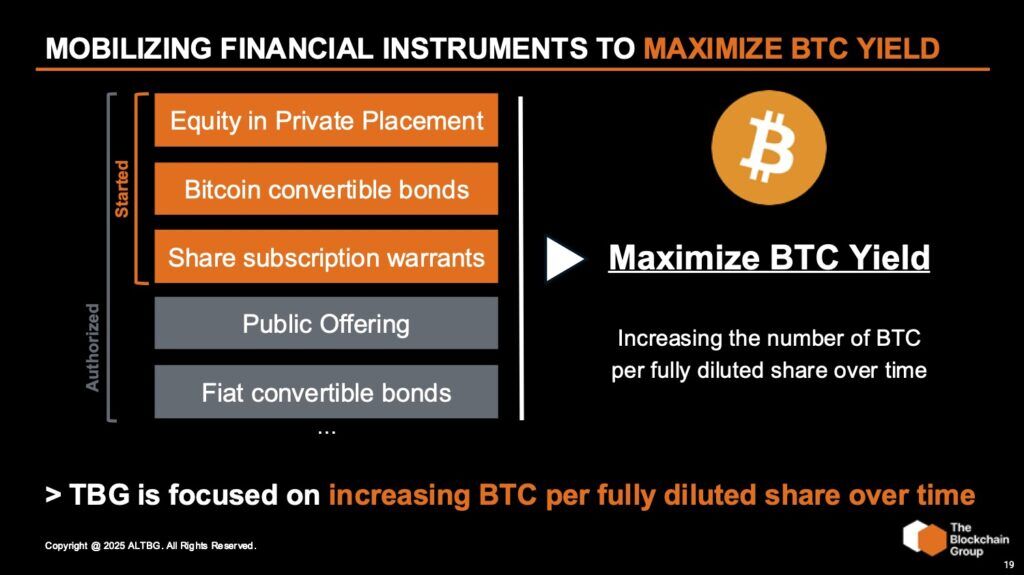

TBG’s rise isn’t an accident—it’s the product of a deliberate, multi-instrument capital technique modeled after Technique’s “Bitcoin refinery” playbook:

- Fairness placements have been executed at premiums to market, avoiding worth leakage.

- Bitcoin-denominated convertible bonds aligned liabilities with asset publicity, minimizing credit score threat.

- Shareholder warrants have been launched to provide all traders entry to upside.

- €300M in capital increase authorization was authorised to fund future BTC acquisitions.

These instruments enable TBG to supply capital from a number of channels whereas retaining one purpose: maximize BTC per share over time. The extra devices at its disposal, the extra agility it has in optimizing capital flows—with out ever needing to promote Bitcoin.

Each funding occasion is a conversion: capital in, sats out. That’s the refinery at work.

International Backing, Native Execution

If the technique appears daring, the traders backing it counsel confidence.

- Adam Again, CEO of Blockstream and cited within the Bitcoin white paper, participated instantly in TBG’s December increase.

- Fulgur Ventures, UTXO Administration, and TOBAM have joined the cap desk, offering international legitimacy and deep Bitcoin-native perception.

- TOBAM, particularly, authored a broadly shared mathematical paper modeling how BTC Treasury Corporations can outperform Bitcoin itself when BTC Yield is maximized.

This alignment between operational execution and long-term capital companions provides TBG a powerful basis to broaden past France—and deep credibility amongst establishments eyeing Bitcoin-native capital methods.

TBG Outlines Their 8-Yr Roadmap

The roadmap forward is much more bold.

- By 2029, TBG goals to carry 21,000–42,000 BTC.

- By 2033, that concentrate on grows to 170,000–260,000 BTC—slightly below 1% of Bitcoin’s fastened provide.

- All with out promoting a single satoshi.

To fund that development, the corporate plans to broaden its capital elevating capability from €300M this 12 months to over €100B by the early 2030s. If Bitcoin reaches €1–2 million per BTC, as projected by some, TBG’s BTC holdings might signify a €210–420 billion NAV—positioning it to change into Europe’s most precious public firm.

These aren’t moonshot projections. They’re mathematical extrapolations primarily based on a capital mannequin already proving itself.

Why It Issues

TBG’s success doesn’t simply validate the Bitcoin Treasury mannequin—it globalizes it. Now not confined to U.S. equities or Asia’s frontier performs, Bitcoin-native treasury technique is now anchored in European capital markets.

This sends a powerful message to European CFOs and capital allocators:

Bitcoin isn’t a speculative hedge. It’s a superior capital basis.

And for corporations keen to measure success in BTC/share—not simply euros earned—the upside is exponential.

TBG isn’t simply holding Bitcoin. It’s optimizing for it. And in doing so, it’s reshaping what shareholder worth can seem like in a world of finite cash.

Disclaimer: This content material was written on behalf of Bitcoin For Firms. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy, or subscribe for securities. For full transparency, please word that UTXO Administration, a subsidiary of BTC Inc., holds a stake in The Blockchain Group.