Solana’s community continues to draw sturdy engagement, with greater than $1 billion in app income.

Solana (SOL)continues to see sturdy consumer engagement. On Friday, the Solana Basis revealed its Solana Community Well being Report, showcasing its efficiency in Q2 of 2025. Notably, the app income on the community exceeded $1 billion for the second quarter in a row.

In Q2, Solana’s app income rose in comparison with Q1—at the same time as utility income on different main networks declined. The truth is, Solana’s app income now surpasses the mixed whole of all different blockchain networks.

This exercise additionally contributed to a pointy rise in validator earnings, which reached a mean quarterly degree of $800 million. The height occurred on Jan. 19, with $56.9 million earned in a single day. On the identical time, validator prices have dropped dramatically.

Notably, the breakeven SOL stake required for validators to cowl their prices has fallen considerably. Validators now require simply 16,000 SOL to interrupt even, down from 50,000 SOL in 2022. In line with the Solana Basis, this displays substantial enhancements in community effectivity.

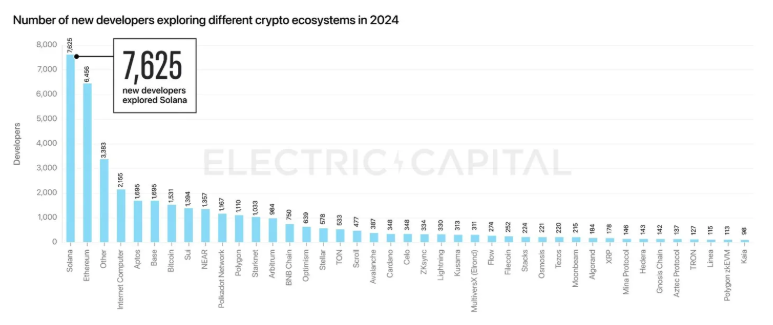

Solana has additionally topped the charts in attracting new builders. In 2024, the community drew 7,625 builders, greater than every other blockchain, together with Ethereum.

Solana Basis showcases decentralization features

In line with the Solana Basis, the community has made important features in decentralization. The Nakamoto Coefficient, used to measure how decentralized a community is, reached 20 by June. This places Solana forward of Ethereum, Sui, and Sei, which have coefficients of 6, 18, and seven, respectively.

Solana validators are additionally geographically distributed, with no single nation or information heart controlling greater than 33% of the whole stake. Germany leads with 23.55%, adopted by the U.S. at 17.37%, and the Netherlands at 14.36%.