Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Solana is at the moment consolidating just under the $180 degree after a powerful rally, dealing with clear resistance as bulls try to take care of momentum. Whereas the general construction stays bullish, upward progress has stalled, and the market is getting into a extra cautious, tense section. Patrons are nonetheless in management, however they’re struggling to push SOL decisively by means of this key barrier, protecting the worth range-bound within the brief time period.

Associated Studying

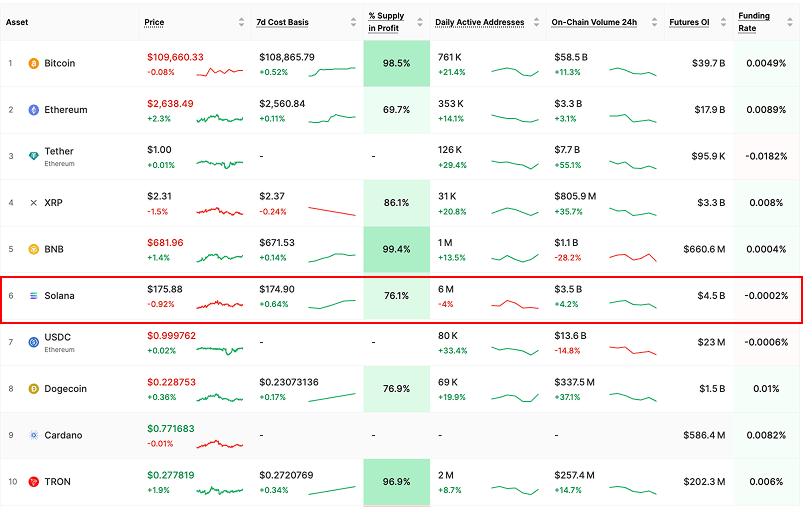

Including to the intrigue, new information from Glassnode reveals that Solana is the one prime 10 cryptocurrency (excluding stablecoins) with a unfavourable funding price. This might sign the early levels of short-side stress constructing within the derivatives market. Negative funding means that merchants are more and more betting towards the asset, whilst spot worth motion holds comparatively agency.

This divergence between worth consolidation and rising bearish positioning might act as a short-term catalyst if bulls regain momentum. Alternatively, it might trace at hesitation from merchants who see restricted upside within the instant time period. With sentiment on edge and key ranges in play, Solana’s subsequent transfer might set the tone for broader market habits within the days forward.

Solana Faces Key Take a look at After Rally

Solana is at a crucial inflection level after gaining greater than 95% in worth since April. The explosive rally has pushed SOL again to a significant resistance zone, the place earlier provide has repeatedly capped upward momentum. Now, bulls should verify the uptrend by pushing above this degree and establishing a brand new increased vary. A profitable breakout right here might solidify Solana’s bullish construction and set the stage for a transfer towards $200 and past.

Nonetheless, dangers stay. Whereas Solana has outperformed most prime belongings in current weeks, some analysts warn that the broader crypto market could also be approaching a short-term correction. With Bitcoin consolidating close to its all-time highs and macroeconomic circumstances tightening, any draw back stress might drag altcoins—together with Solana—decrease earlier than continuation.

Including to the uncertainty, Glassnode shared a notable information level displaying that Solana is at the moment the one prime 10 crypto asset (excluding stablecoins) with a unfavourable funding price. At -0.0002%, it’s a small shift, however one which will sign the early levels of bearish positioning amongst futures merchants. Negative funding implies that brief sellers are paying to carry their positions, doubtlessly indicating rising skepticism about short-term upside.

This divergence between bullish spot efficiency and refined bearish sentiment in derivatives might arrange a high-stakes transfer. If bulls can soak up the stress and flip resistance into assist, Solana might enter a recent worth discovery section. But when promoting intensifies and funding stays unfavourable, a deeper pullback could also be on the horizon. For now, SOL is at a key resolution level—and the following transfer might set the tone for the weeks forward.

Associated Studying

SOL Approaches Resistance As Weekly Construction Turns Bullish

Solana (SOL) is at the moment buying and selling at $175.68 on the weekly chart, consolidating just under the $180 resistance zone. After a powerful rebound from April’s lows close to $90, SOL has gained over 95% and is now approaching a crucial degree that has traditionally acted as a provide zone. The current bullish momentum is notable, with three consecutive inexperienced weekly candles and worth now buying and selling above the 34-week EMA at $164.82—a degree that beforehand capped upside makes an attempt.

The 50-week SMA at $169.48 has additionally been reclaimed, reinforcing the power of the present transfer. Quantity stays regular, suggesting purchaser conviction remains to be intact as SOL pushes into this resistance zone. The subsequent key check lies in whether or not bulls can break and shut above the $180–$185 space, confirming a structural breakout and opening the door for a possible retest of the $200–$220 vary.

Associated Studying

Failure to reclaim this zone might result in short-term consolidation or a light pullback towards the 34 EMA or 50 SMA. Nonetheless, the present pattern favors bulls, with increased lows and stronger weekly closes indicating sustained accumulation. If broader market circumstances stay steady, Solana appears to be like poised to aim a breakout within the coming weeks.

Featured picture from Dall-E, chart from TradingView