Solana’s dApp ecosystem is outearning the competitors, with extra income than all different chains mixed.

Within the final 12 months, Solana (SOL) dApps generated extra income than dApps on all different chains mixed. Based on a report by Syndica, printed on April 18, Solana dApps earned $2.8 billion in income. That’s 47% greater than the dApp income on all different chains mixed.

Solana’s dApp earnings started outpacing all different chains in October of final 12 months. Since then, the hole has solely continued to widen. These figures present that Solana’s ecosystem stays extremely enticing to each customers and builders. Its low charges and give attention to person expertise enchantment to finish customers, whereas builders profit from the community’s accessible and developer-friendly infrastructure.

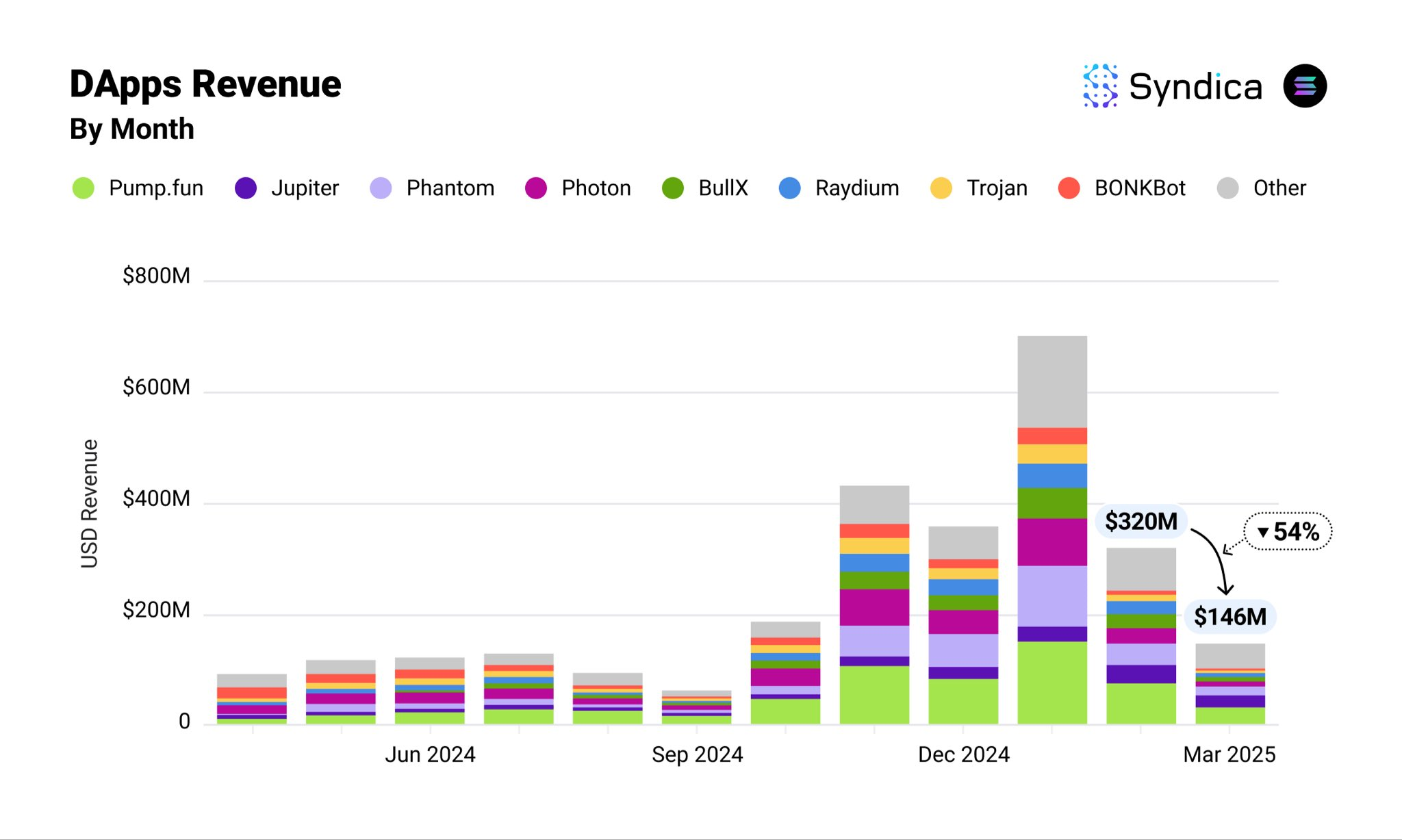

Nonetheless, Solana’s dApp income is essentially pushed by crypto buying and selling functions, which makes earnings extremely risky. For instance, income peaked in January at $701 million, coinciding with Solana’s all-time excessive of $294.33.

Since that peak, dApp income has declined considerably, dropping to $146 million in March. This highlights how intently dApp earnings correlate with excessive buying and selling volumes and elevated asset costs.

Pump.enjoyable leads in Solana income

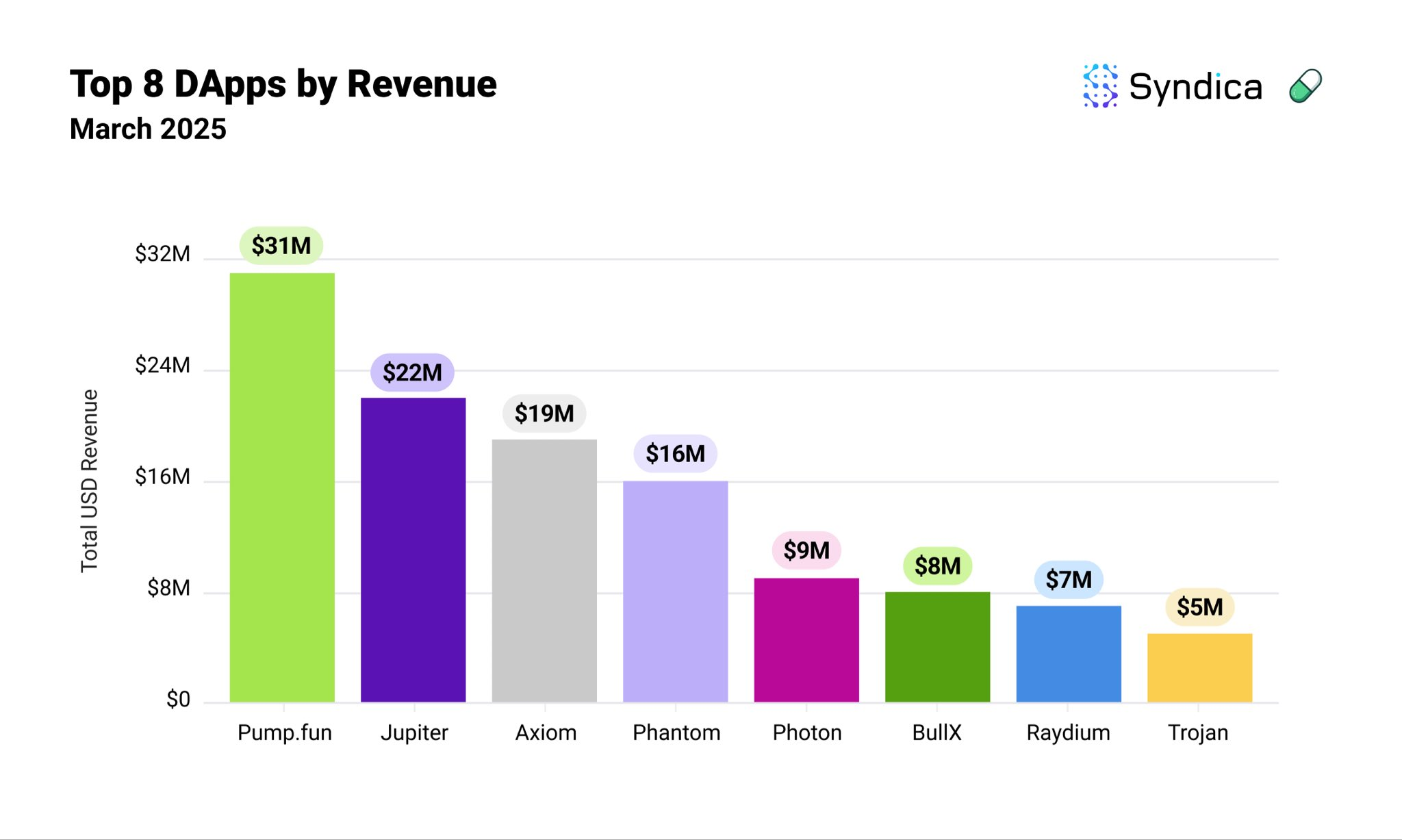

Exchanges, wallets, and different trading-focused platforms dominate Solana’s top-earning dApps. The most important contributor in March was memecoin launchpad Pump.enjoyable, which introduced in $31 million, surpassing platforms like Jupiter and Phantom.

Pump.enjoyable is now going through rising competitors from Axiom, a memecoin launchpad backed by Y Combinator. Axiom has rapidly gained traction, capturing 29% of the memecoin dApp market and producing $19 million in income.

In the meantime, Jupiter stays the dominant power amongst Solana DEXs, incomes 93% of complete DEX income on the community. It maintained robust efficiency in March, bringing in $22 million regardless of the cooling market—alongside constant outcomes from Kamino Finance.