Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

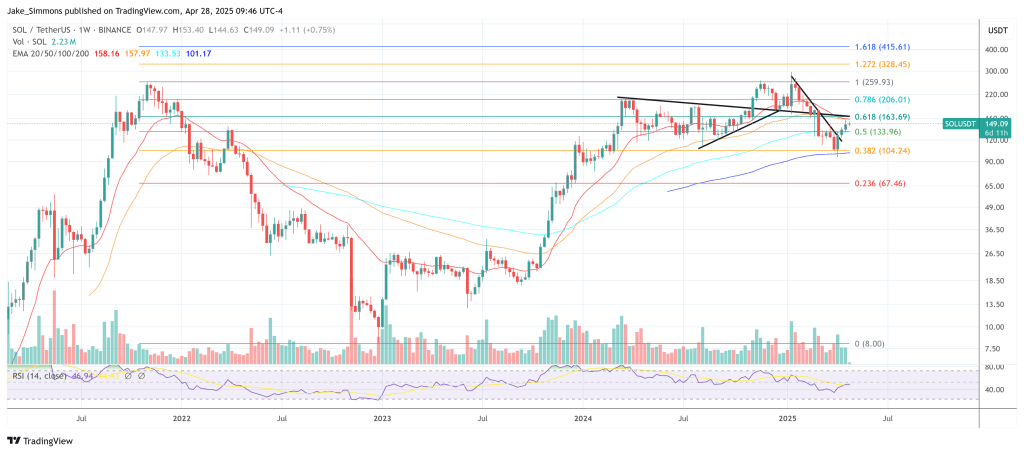

Each day worth motion within the SOL/BTC pair is starting to color a sharply totally different image from the one which dominated the primary quarter, in keeping with a chart shared on Sunday by veteran dealer Josh Olszewicz.

The one-day chart units out a textbook inverse-head-and-shoulders (iHS) basing sample that has been forming since early March and is now approaching the neckline round 0.00162 BTC. On the time of the screenshot, SOL was quoted at 0.001588 BTC. With bitcoin altering fingers close to $94,765, that locations Solana at roughly $150 per coin.

The anatomy of the sample is difficult to overlook: a March 19 low at 0.00127 BTC ($120) types the top, flanked by increased swing lows on March 11 left shoulder). The left shoulders is at present within the technique of forming. The horizontal neckline aligns with the late-December ground that broke down in February, changing sturdy help into equally sturdy resistance. Measured from the top to the neckline, the amplitude is roughly 0.00033 BTC; a clear breakout would suggest a technical goal close to 0.00195 BTC—conveniently the decrease boundary of the Kumo cloud’s far edge.

Solana Bulls Have A Goal

The chart is overlaid with a long-look Ichimoku configuration (20/60/120/30). On the newest shut the Tenkan-sen sat at 0.00150 BTC, the Kijun-sen precisely on the neckline at 0.00162 BTC, and Senkou Span A printed 0.001742 BTC whereas Span B held increased at 0.002159 BTC. The cloud itself stays bearish—thick, crimson and overhead—but the span differential is starting to compress, signalling waning downward momentum. A decisive push into the Kumo would set off the basic Ichimoku edge-to-edge commerce, focusing on Span B at roughly 0.00216 BTC (about $205).

Associated Studying

The bullish setup is going on solely two months after the market accomplished the mirror picture of the identical sample. From mid-December to early-February, SOL/BTC carved out a distinguished head-and-shoulders, misplaced the neckline in early February and cascaded on to March’s iHs. That down-and-up symmetry offers additional weight to the present formation by demonstrating how faithfully the pair has revered classical geometry in the course of the previous half-year.

“1D SOL/BTC – iHS + E2E at some point but not soon, probably late May,” Olszewicz wrote on X. The analyst’s warning displays the truth that worth remains to be beneath each the neckline and the Kijun-sen, and the Kumo doesn’t skinny materially till the ultimate week of Could. A untimely break try dangers rejection right into a remaining right-shoulder retest close to 0.00151 BTC ($143), which can also be the place the Tenkan-sen at present resides.

Notably, the Chikou Span (lagging line) stays under worth and cloud, emphasising that development affirmation is pending; each Ichimoku purists and sample merchants might due to this fact agree that 0.00162 BTC is the road Solana bulls should flip decisively.

Associated Studying

If the edge-to-edge goal is achieved, SOL would add roughly 26 % towards Bitcoin from current ranges and reclaim floor final seen in early February. Ought to the neckline reject but once more, draw back safety is skinny till the dual shoulders at 0.00145–0.00148 BTC; a break of that shelf would invalidate the bullish thesis and reopen the March trough.

For now, the market is content material to coil beneath resistance whereas the clock ticks towards the cloud’s inflection. Whether or not Olszewicz’s late-Could timetable proves prescient will rely upon Bitcoin’s personal trajectory and the broader danger surroundings, however the worth construction on the Solana/Bitcoin chart is obvious: after a bruising winter, the bulls lastly have a sample price defending.

At press time, SOL traded at $149.

Featured picture created with DALL.E, chart from TradingView.com