Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

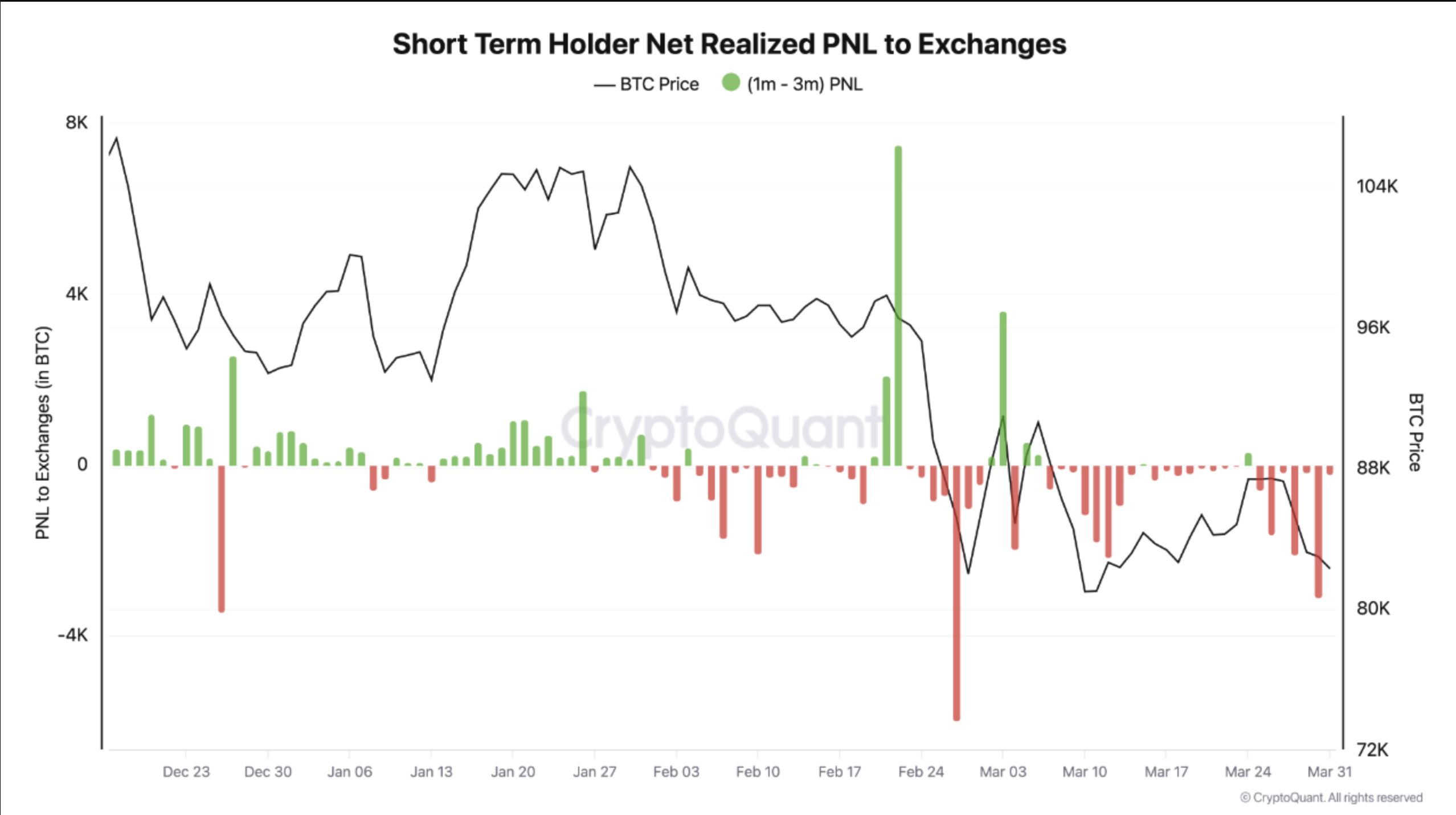

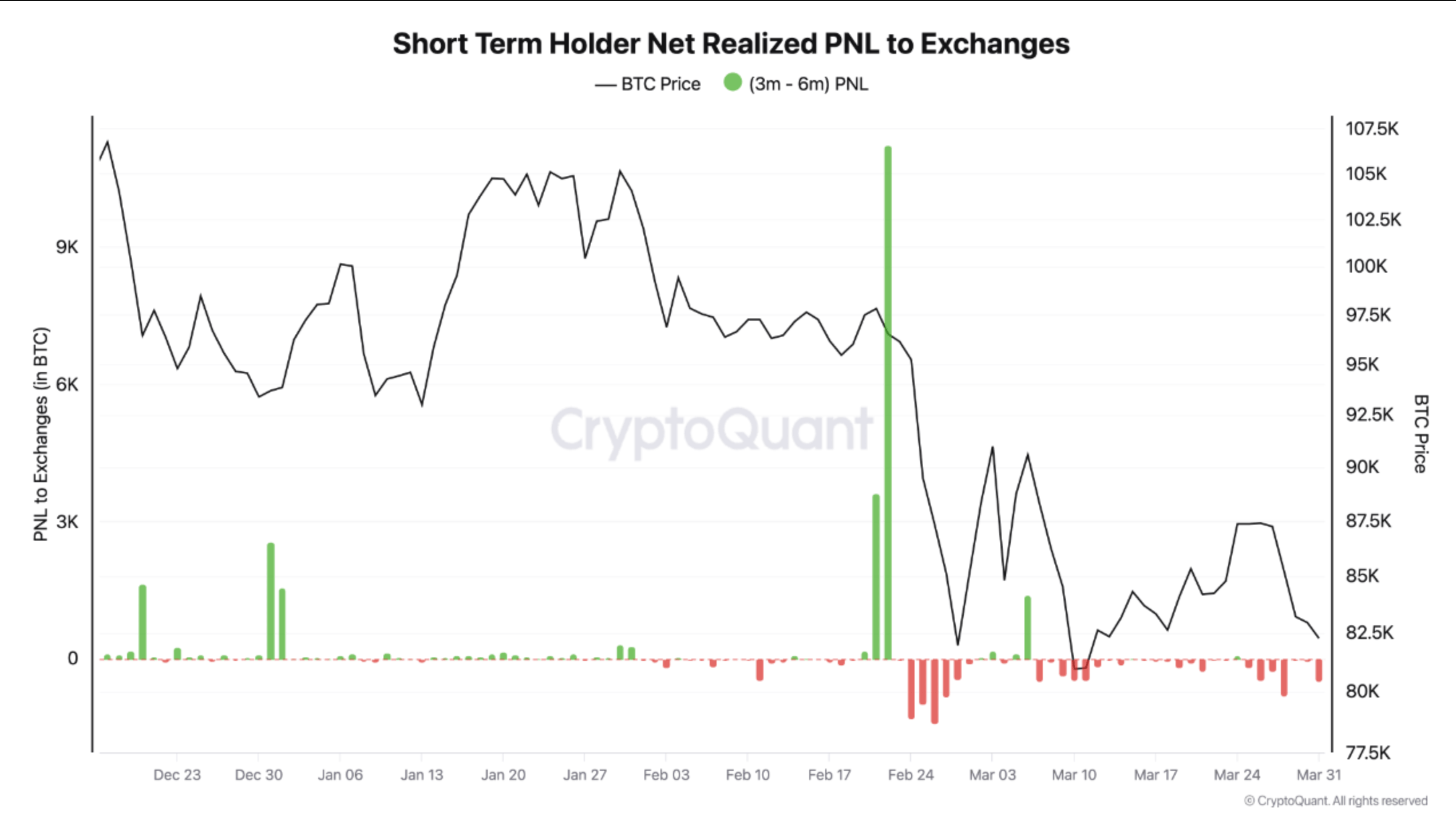

Based on a latest CryptoQuant Quicktake put up, short-term Bitcoin (BTC) holders are selecting to retain their digital property regardless of incurring unrealized losses. CryptoQuant contributor Onchained defined that short-term BTC holders have recorded considerably decrease realized losses in comparison with their unrealized losses.

Short-Term Bitcoin Holders Anticipating A Value Rally?

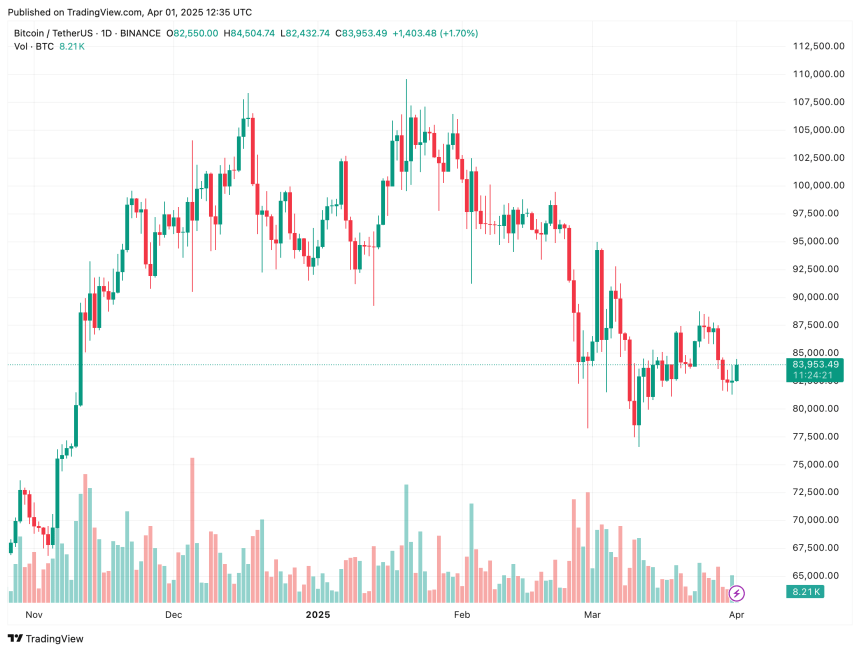

The primary quarter of 2025 has been marked by excessive worth volatility within the cryptocurrency market, together with Bitcoin. BTC has dropped from roughly $97,000 on January 1 to round $83,000 on the time of writing, reflecting a decline of greater than 15%.

Associated Studying

Despite this worth pullback, short-term BTC holders proceed to carry onto their property as an alternative of promoting at a loss. CryptoQuant contributor Onchained analyzed the Short-Term Holder Internet Realized PNL to Exchanges, highlighting a shift in promoting habits.

Based on the analyst, BTC holders who’ve owned their cash for one to a few months have been probably the most energetic sellers in latest days, even at the price of realizing losses. That is uncommon, as short-term buyers holding BTC for lower than per week are sometimes probably the most reactive sellers.

Nevertheless, latest information reveals a big decline in promoting stress to cryptocurrency exchanges. This implies that BTC holders who bought their cash within the final six months are opting to carry onto their property slightly than panic promote.

This shift in promoting habits amongst short-term holders may have a number of implications. A decline in promoting stress could point out a change in investor sentiment, with holders keen to endure short-term losses in anticipation of long-term features.

Whereas the analyst cautioned that this information doesn’t predict future worth actions, it does present precious insights into market psychology. The evaluation states:

Are short-term holders lastly holding the road? If that’s the case, this might scale back draw back volatility and set the stage for stabilization, or perhaps a reversal.

Onchained concluded that short-term holders at the moment management 28% of BTC’s circulating provide. If a good portion of those holdings transitions to long-term holders, it may pave the way in which for Bitcoin’s worth to surge past $150,000.

Is BTC About To Stage A Comeback?

Alongside the decline in short-term BTC promoting stress, a number of different exchange-related metrics counsel the potential of an upcoming worth surge for the world’s largest cryptocurrency by market capitalization.

Associated Studying

Not too long ago, crypto entrepreneur and market commentator Arthur Hayes claimed that BTC “probably” hit this market cycle’s backside throughout its plunge to $77,000 on March 10. Nevertheless, Hayes famous that the inventory market may nonetheless expertise additional pullbacks.

Whereas Bitcoin has been in a downtrend for the previous few months, gold has surged to a number of new all-time highs (ATHs) resulting from ongoing world macroeconomic uncertainty. BTC’s poor efficiency towards the valuable metallic is seemingly to proceed because the US commerce tariff risk looms. At press time, BTC trades at $83,953, up 2.2% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com