Rocket Pool RPL is surging, including 30%. Strengthening Ethereum costs performed a task, however the workforce can be delivery updates forward of the Saturn improve. Rocket Pool TVL is up 43% in a single month. Will RPL break $10?

Yesterday, with none obvious motive or basic set off, UNI, the governance token of the main DEX Uniswap, surged above $7 earlier than cooling off.

In the meantime, prime DeFi tokens like MKR, the governance token of the Sky Protocol (previously Maker), additionally climbed, posting double-digit features.

As these main DeFi tokens rose, consideration shifted to a different key Ethereum participant important to decentralizing the primary sensible contracts platform: Rocket Pool.

DISCOVER: 9+ Greatest Excessive-Threat, Excessive-Reward Crypto to Purchase in Could 2025

RPL Crypto Surges 30%

The native token powering Rocket Pool, RPL, soared almost 30% in 24 hours, extending features from early June and solidifying its place among the many prime 30 largest DeFi protocols by whole worth locked (TVL).

Based on Coingecko knowledge, RPL gained towards the dollar, ETH, BTC, and among the finest cryptos to purchase.

Technically, there’s room for development.

With RPL including almost 30% yesterday, consumers are eyeing resistance ranges at $7 and $10. If this psychological barrier is damaged and RPL reaches new Q2 2025 highs, there’s a excessive chance that the token may double to $20 in late H1 2025 or early H2 2025.

DeFiLlama knowledge exhibits that Rocket Pool is the twenty sixth largest DeFi protocol, managing over $1.7 billion in belongings on Ethereum. With rising costs, its TVL elevated 1% in 24 hours.

(Supply)

Nevertheless, the surge in inflows over the previous month stands out, with the Rocket Pool TVL rising by 45%, outpacing most protocols within the prime 30.

Raydium, the DEX powering Solana token swaps, noticed a 42% TVL enhance within the final month, signaling that merchants could also be returning to commerce among the finest Solana meme cash.

In the meantime, Morpho, EigenLayer, and Pendle additionally drew large inflows, pushing the whole DeFi TVL to $113 billion.

Will ETH Assist Maintain Momentum?

Curiosity in Ethereum staking might clarify this revival.

Notably, the spike within the Rocket Pool TVL coincided with a surge in ETH costs in Could.

The second most beneficial crypto broke above $2,000 earlier than accelerating to just about $2,800. Though costs have stabilized above $2,400, there are hints that consumers are accumulating, and a breakout above $3,000 is inevitable.

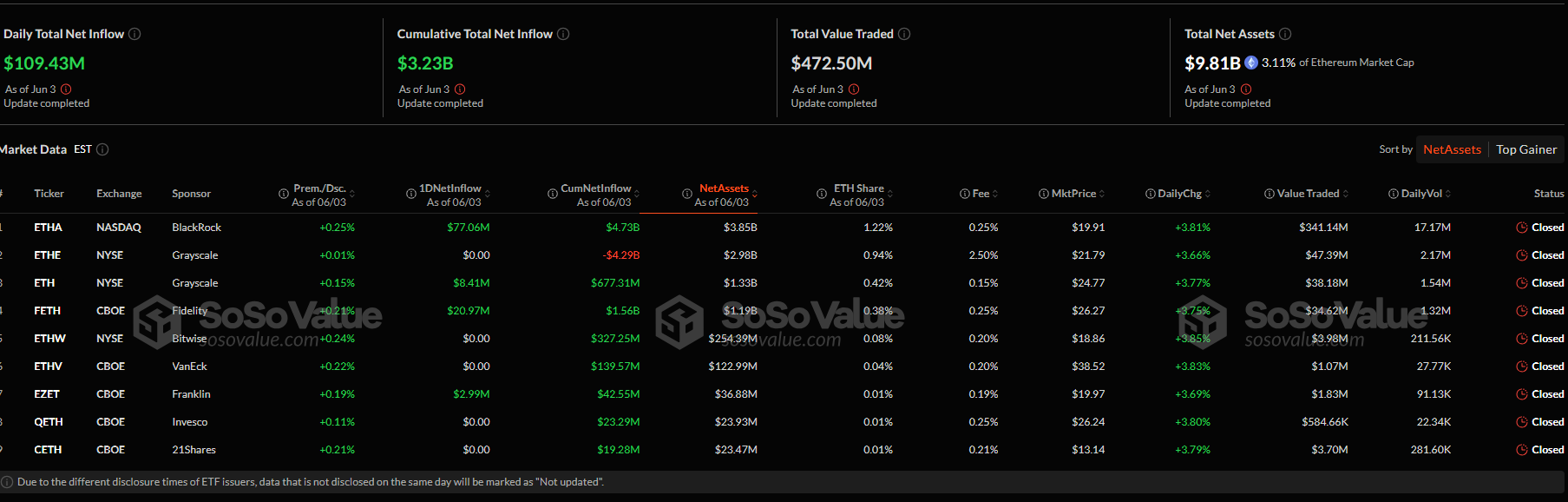

On June 3, establishments in america bought over $109 million price of spot Ethereum ETF shares, growing their holdings to over $9.8 billion, representing roughly 3% of the Ethereum market cap.

(Supply)

If Ethereum costs rise, Rocket Pool’s TVL will probably broaden, boosting RPL demand. This momentum may very well be additional fueled by optimistic ecosystem developments in latest weeks.

Over $14m price of ETH was staked with Rocket Pool yesterday, totally clearing the validator minipool queue!

If you happen to’re occupied with changing into a node operator, now may very well be time to start out – you simply want 8 ETH, with $RPL non-obligatory to earn extra fee pic.twitter.com/UUbOPe72q0

— Rocket Pool (@Rocket_Pool) Could 25, 2025

DISCOVER: Prime 20 Crypto to Purchase in Could 2025

What’s Driving Rocket Pool Demand?

Analysts are intently monitoring progress on the upcoming Saturn Upgrade.

Forward of this key replace, the workforce has launched sensible contracts for Saturn devnet-3 and is engaged on the Sensible Node stack. Moreover, builders are getting ready devnet-4, which, although much less advanced, will play a pivotal foundational position within the launch scheduled for late Q3 2025.

The workforce has additionally accomplished an inner code evaluation for Saturn and is now participating exterior blockchain safety corporations to audit the code completely earlier than the improve.

Safety earlier than deployment is important as a result of Saturn will introduce scaling options, together with “Megapools,” which purpose to enhance validator throughput and dynamic payment splits to boost protocol effectivity and RPL utility.

Past Saturn, Rocket Pool up to date its Smartnode software program in April and Could to make sure compatibility with Ethereum’s Pectra arduous fork. The workforce addressed issues about shopper integration, relay processing, and validator reliability, enabling node operators to proceed staking on Ethereum with minimal disruption.

The growing interoperability with different DeFi protocols may additionally drive RPL costs. With expanded use instances for rETH, holders stand to learn, encouraging extra adoption of Rocket Pool.

rETH <> wETH liquidity pool is LIVE!

Present liquidity, earn rewards

• Get ETH staking yield on Ronin

• Earn boosted rewards within the Ronin Blitz

• Mix rETH with different DeFi primitives

Present rETH liquidity on Katana now

:

Right here’s what’s… pic.twitter.com/UkZe4XVjjK

— Ronin (@Ronin_Network) Could 23, 2025

After becoming a member of the Balancer Alliance Program, which unlocks income sharing for rETH/ETH, Rocket Pool additionally built-in with the Ronin Community, adopting Chainlink’s CCIP.

DISCOVER: 15 Subsequent Crypto to Explode in 2025: Professional Cryptoforex Predictions & Evaluation

Rocket Pool RPL Up 30%, Ethereum Regular: Are DeFi Tokens Back?

- RPL is up 30%; will the token push above $10?

- Rocket Pool DeFi TVL up over 45% in a single month

- Builders delivery updates forward of the Saturn improve

- Ethereum staking growth and rising ETH demand driving DeFi tokens

The put up Rocket Pool RPL Crypto Up 30%: Are DeFi Tokens Back? appeared first on 99Bitcoins.