Polygon plans to pivot, specializing in the PoS and AggLayer with management from CEO Sandeep Nailwal. POL has been dragging decrease as Ethereum layer-2 options like Base and Arbitrum enhance in TVL.

Ethereum is inherently much less scalable, making it inconceivable to run a Fb-like dApp with out customers incurring 1000’s in charges and congesting the community.

Polygon, an Ethereum sidechain, acknowledged this early and constructed a scaling answer for customers and builders searching for low charges and excessive scalability whereas having fun with all that Ethereum needed to provide.

As a sidechain, it’s scalable, interoperable with Ethereum, and safe, working its nodes.

Through the years, the sidechain has attracted billion-dollar dApps in DeFi, NFTs, meme cash, and extra. High DeFi gamers like Uniswap run on the platform

Moreover, Polymarket, a well-liked predictions market platform, is anchored on Polygon and will see additional development after lately partnering with X to turn out to be the social media community’s official predictions market.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in June 2025

Is POL Falling as Polygon Fades?

Regardless of Polygon’s formidable roadmaps and improvement efforts, POL has struggled, trending decrease over current months.

After rebranding from MATIC to POL in early September, with added utilities, the token has failed to achieve all-time highs and stays largely within the crimson.

In response to Binance knowledge, POL is presently buying and selling at $0.19, down practically 50% from its rebranding itemizing value of $0.38.

After peaking at $0.75 in late 2024, POL fell to $0.15 by April 2025, an 80% decline from This fall 2024 highs.

(POLUSDT)

Falling Bitcoin, Ethereum, and Solana costs might have dragged the broader crypto market decrease, impacting POL.

Nevertheless, regardless of their ambition and aggressive improvement, POL seems much less enticing to buyers and merchants.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Sandeep Nailwal Takes Over as CEO of the Polygon Basis

On June 11, 2025, the sidechain made adjustments to interrupt free from stagnation and refocus efforts. Sandeep Nailwal, the co-founder of Polygon, was appointed CEO of the Polygon Basis, signaling a pivot towards pace and focus.

In a submit on X, Nailwal mentioned the platform now wants a “clear direction,” and which means “stepping up.”

BIG replace – As the biggest holder of POL and somebody who devoted his life to improvement and success of @0xPolygon from the very starting, I’ve determined to take full management of Polygon Basis and will likely be its CEO going ahead. Polygon Basis owns and oversees…

— Sandeep | CEO, Polygon Basis (※,※) (@sandeepnailwal) June 11, 2025

With Nailwal on the helm, the purpose is to execute a streamlined roadmap.

To speed up progress, the Polygon Basis will give attention to core initiatives: Polygon PoS and the AggLayer.

Different tasks, together with Polygon zkEVM, will likely be deprecated.

Per the Polygon 2.0 roadmap, the AggLayer facilitates trustless, cross-chain communication throughout protocols. Polygon plans to launch AggLayer v3.0 by the top of June 2025, with extra interoperability options in Q3 2025.

In the meantime, Polygon PoS will likely be upgraded underneath the Gigagas roadmap, focusing on over 1,000 TPS with sub-second finality, with testnet outcomes already displaying promise. The long-term purpose is to realize over 5,000 TPS.

Can The Sidechain Catch Up, or Is It Too Late for POL?

Whereas Polygon’s technique is daring, clearly outlining its worth proposition, the query stays: Are these adjustments too late?

Polygon was as soon as Ethereum’s main scaling platform, however it has misplaced floor.

Within the layer-2 wars, Base and Arbitrum have taken the lead. Their structure, which routes transactions off-chain, aligns extra intently with Ethereum 2.0’s imaginative and prescient.

With Vitalik Buterin emphasizing the significance of layer-2s for Ethereum’s scalability, these platforms are attracting extra liquidity and builders, particularly after the Dencun improve, which focused layer-2 enhancements.

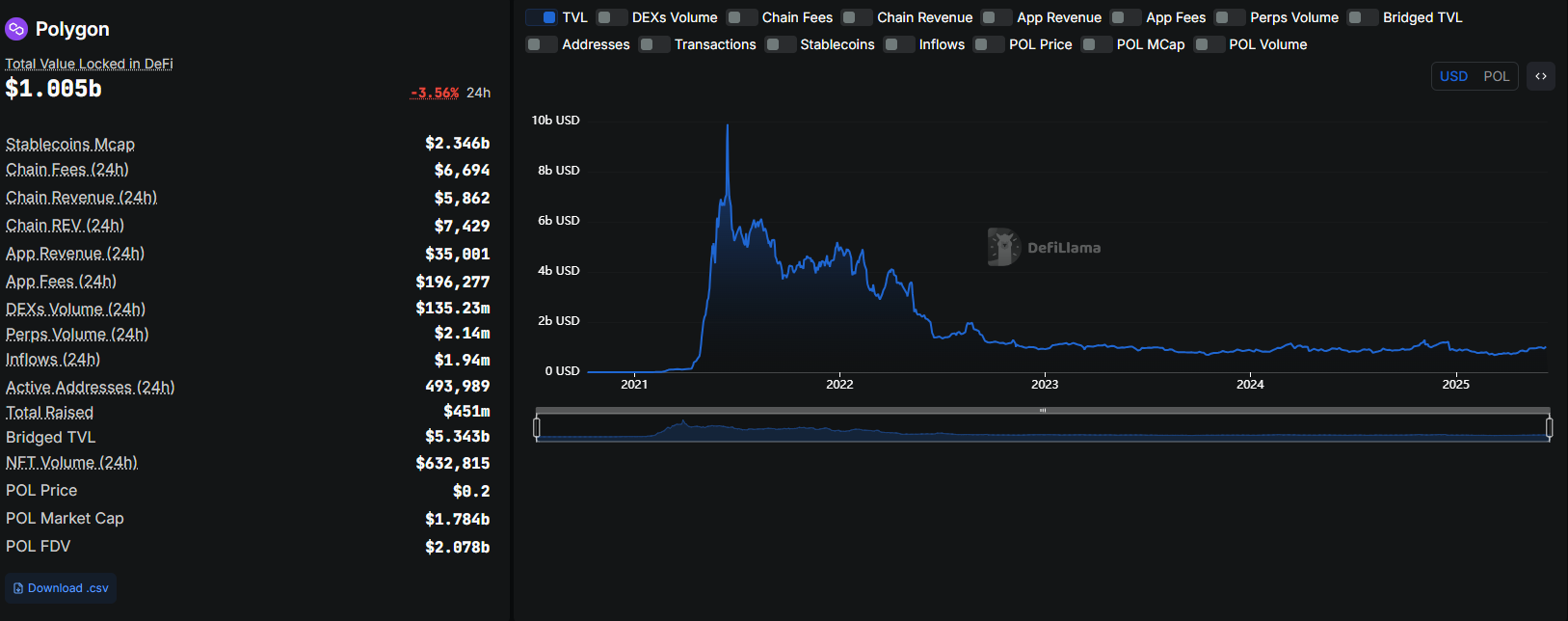

Arbitrum alone boasts a TVL of $13.8 billion, greater than 13X that of Polygon at simply $1 billion.

(Supply)

To reclaim its place, Polygon should make daring adjustments and align extra intently with Ethereum’s evolving ecosystem.

DISCOVER: Finest New Cryptocurrencies to Spend money on 2025 – High New Crypto Cash

Polygon Has A New Plan: Will POL Rise From The Ashes?

- Polygon has been shedding its shine after Ethereum layer-2 turned widespread

- Sandeep Nailwal is taking on because the CEO of the Polygon Basis

- The main focus will likely be on the AggLayer and PoS

- Will POL get better and breach above 2024 highs?

The submit Polygon Has a New Plan: Is It Too Late for POL? appeared first on 99Bitcoins.