Este artículo también está disponible en español.

Bitcoin has confronted intense promoting stress since Tuesday, following a powerful breakout above the $100K mark. The rally, which many buyers hoped would solidify Bitcoin’s bullish construction, shortly reversed, driving the worth all the way down to a low of $92,500. The sudden downturn has rattled market sentiment, leaving buyers cautious concerning the instant path of the crypto market chief.

Associated Studying

Prime analyst Axel Adler has shared essential information on X, highlighting Bitcoin’s nearest assist ranges. In accordance with Adler, the important thing ranges to observe are between $86.8K and $89.7K, representing the short-term holders’ realized worth. These metrics counsel that Bitcoin is approaching a major demand zone, the place accumulation may happen if the promoting stress eases.

As Bitcoin consolidates close to these ranges, the market waits for indicators of stabilization. Whether or not Bitcoin can get better from this setback or lengthen its correction stays unsure. Nonetheless, the present assist ranges may function a turning level, providing a basis for bulls to regain momentum.

Bitcoin Consolidates Between Key Levels

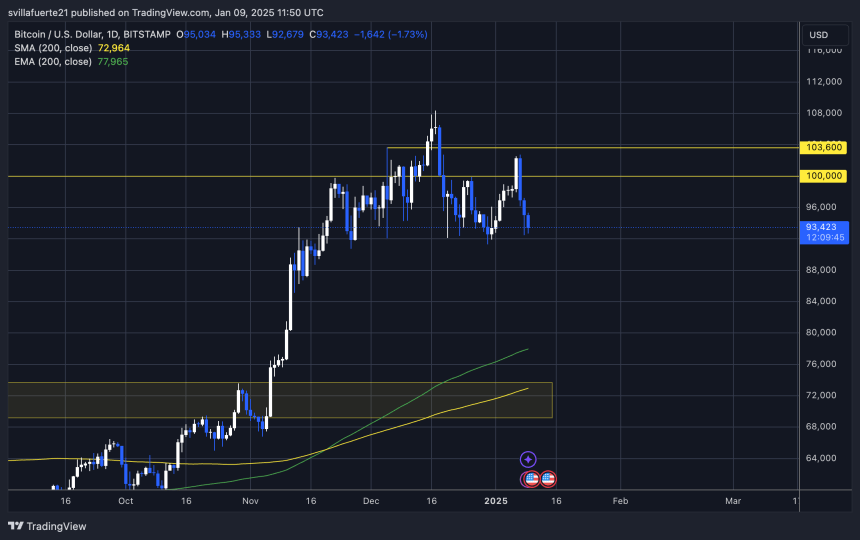

Bitcoin is navigating a essential consolidation section, with the worth fluctuating between $100K and $92K. Whereas there have been transient deviations above the $100K mark, the market chief has struggled to keep up momentum, elevating considerations a few potential drop to decrease demand zones. Buyers and analysts alike are intently monitoring this vary, with expectations of Bitcoin discovering stronger footing beneath the $90K space.

Prime analyst Axel Adler just lately shared insights on X, shedding mild on Bitcoin’s nearest assist ranges. In accordance with Adler, the Brief-Time period Holders 1M-3M Realized Value is at the moment $89.7K, whereas the broader Brief-Time period Holders Realized Value sits at $86.8K.

These ranges signify key demand zones that would present Bitcoin with the gas wanted for its subsequent rally. A dip into these areas would seemingly appeal to patrons, setting the stage for a possible reversal.

Associated Studying

This era of consolidation is seen as pivotal for Bitcoin, as holding above or reclaiming key ranges like $92K will decide its trajectory. Whereas the broader market sentiment stays cautious, a drop into these decrease assist zones may provide a major accumulation alternative for long-term buyers. The approaching days can be essential in deciding whether or not Bitcoin can stabilize and put together for a renewed bullish push.

BTC Faces Essential Support Check Under $95,000

Bitcoin is buying and selling at $93,400, navigating a precarious place because it faces growing danger with every second spent beneath the $95,000 mark. After a short surge above $100K earlier this month, the bulls misplaced management, failing to maintain assist above this psychological degree. This decline has left Bitcoin susceptible to additional draw back, with buyers intently watching key assist ranges.

For bulls to regain momentum, reclaiming the $95K degree is essential. Past this, the $98K mark should even be retaken to substantiate a bullish consolidation and sign power out there. Till then, uncertainty looms, with Bitcoin’s present vary reflecting a scarcity of decisive management by both facet.

Associated Studying

The essential $92K assist degree now acts as a short-term security internet. Nonetheless, dropping this degree would expose Bitcoin to decrease demand zones round $85K, a key space that would appeal to patrons and stabilize the worth. The following few days can be pivotal as Bitcoin both levels a restoration or dangers a deeper correction.

Featured picture from Dall-E, chart from TradingView