Buying Bitcoin at considerably increased costs than just some months in the past could be daunting. However, with the correct methods, you should purchase Bitcoin throughout dips with a good risk-to-reward ratio whereas using the bull market.

Confirming Bull Market Situations

Earlier than accumulating, make sure you’re nonetheless in a bull market. The MVRV Z-score helps establish overheated or undervalued situations by analyzing the deviation between market worth and realized worth.

View Dwell Chart 🔍

Keep away from Buying when the Z-score reaches excessive values, similar to above 6.00, which might point out the market is overextended and nearing a possible bearish reversal. If the Z-score is beneath this, dips possible signify alternatives, particularly if different indicators align. Don’t accumulate aggressively throughout a bear market. Focus as a substitute on discovering the macro backside.

Quick-Time period Holders

This chart displays the typical price foundation of recent market contributors, providing a glimpse into the Quick-Time period Holder exercise. Traditionally, throughout bull cycles, every time the value rebounds off the Quick-Time period Holder Realized Value line (or barely dips beneath), it has offered wonderful alternatives for accumulation.

View Dwell Chart 🔍

Gauging Market Sentiment

Although easy, the Concern and Greed Index gives invaluable perception into market feelings. Scores of 25 or beneath usually signify excessive concern, which frequently accompanies irrational sell-offs. These moments supply favorable risk-to-reward situations.

View Dwell Chart 🔍

Recognizing Market Overreaction

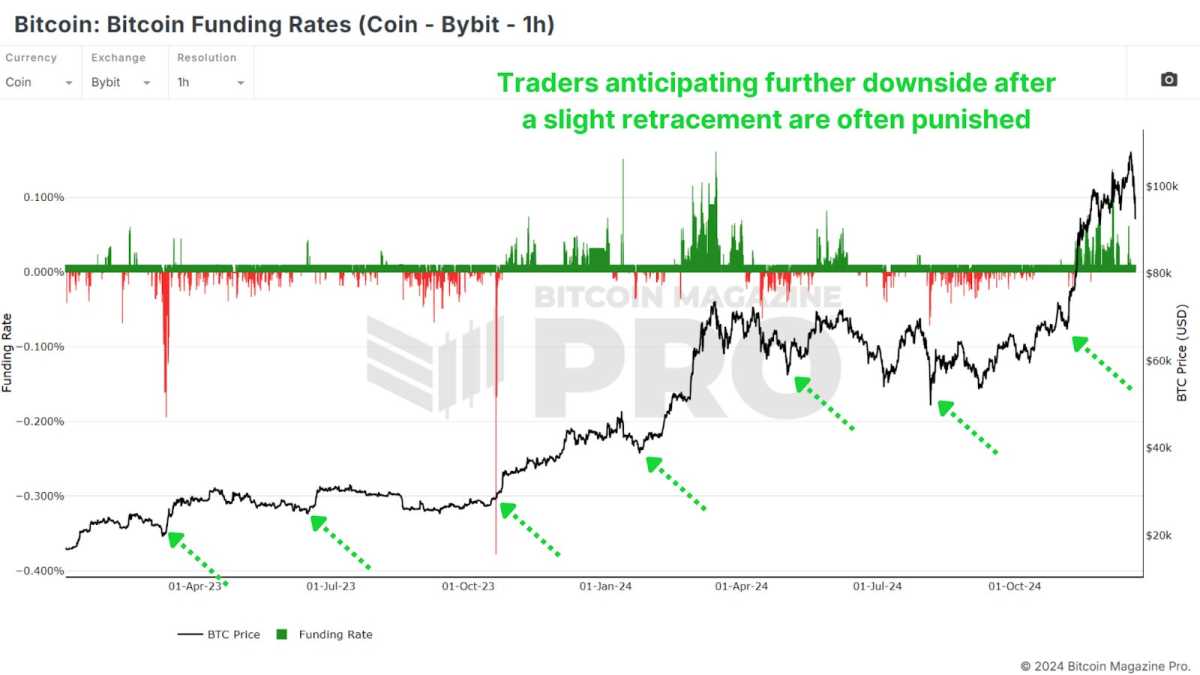

Funding Charges replicate dealer sentiment in futures markets. Destructive Funding throughout bull cycles are significantly telling. Exchanges like Bybit, which magnetize retail traders, present that unfavorable Charges are a robust sign for accumulation throughout dips.

View Dwell Chart 🔍

When merchants use BTC as collateral, unfavorable charges usually point out wonderful shopping for alternatives, as these shorting with Bitcoin are typically extra cautious and deliberate. That is why I want specializing in Coin-Denominated Funding Charges versus common USD Charges.

Energetic Handle Sentiment Indicator

This instrument measures the divergence between Bitcoin’s value and community exercise, after we see a divergence within the Energetic Handle Sentiment Indicator (AASI) it signifies that there’s overly bearish value motion given how robust the underlying community utilization is.

View Dwell Chart 🔍

My most popular technique of utilization is to attend till the 28-day proportion value change dips beneath the decrease commonplace deviation band of the 28-day proportion change in energetic addresses and crosses again above. This purchase sign confirms community energy and sometimes indicators a reversal.

Conclusion

Accumulating throughout bull market dips includes managing danger relatively than chasing bottoms. Buying barely increased however in oversold situations reduces the chance of experiencing a 20%-40% drawdown in comparison with buying throughout a pointy rally.

Affirm we’re nonetheless in a bull market and dips are for purchasing, then establish favorable shopping for zones utilizing a number of metrics for confluence, similar to Quick-Time period Holder Realized Value, Concern & Greed Index, Funding Charges, and AASI. Prioritize small, incremental purchases (dollar-cost averaging) over going all-in and deal with risk-to-reward ratios relatively than absolute greenback quantities.

By combining these methods, you can also make knowledgeable selections and capitalize on the distinctive alternatives offered by bull market dips. For a extra in-depth look into this matter, try a current YouTube video right here: How To Accumulate Bitcoin Bull Market Dips

For extra detailed Bitcoin evaluation and to entry superior options like reside charts, personalised indicator alerts, and in-depth business studies, try Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding selections.