Crypto specialists predict Fantom may probably surge by over 250% after a number of bullish patterns emerged on its charts.

In accordance with analyst CryptoBoss, with over 189k followers on X, Fantom (FTM) may see its subsequent bull run quickly following the anticipated Sonic improve, which is able to transition its community to a extra scalable and environment friendly structure, enhancing transaction pace and lowering charges.

The analyst noticed that FTM had damaged out of a falling wedge sample — a well-liked bullish reversal sample in technical evaluation — on the 4-hour FTM/USDT chart and predicted the altcoin may probably surge 256%, concentrating on round $2 within the quick time period.

Including to the bullish hypothesis, pseudonymous analyst Clifton Fx predicted a fair larger worth goal for FTM, suggesting a possible 400-500% rally from its present worth primarily based on robust technicals.

The skilled famous that this rally may transpire within the coming weeks and push FTM as excessive as $4.16 because the altcoin has damaged above a long-term descending trendline that has been appearing as resistance for practically 4 years.

These bullish predictions align with on-chain metrics exhibiting a surge in dealer exercise and funding because the crypto market regains momentum after a vacation lull. Bitcoin’s rally again above $100,000 has reignited market optimism, setting the stage for altcoins like Fantom to observe swimsuit.

In accordance with information from IntoTheBlock, whale holder netflow surged 540% from an influx of $1.74 million on Jan. 5 to over $11.1 million on Jan. 6. Such a surge in whale accumulation of an asset is usually considered as a powerful bullish sign by retail buyers.

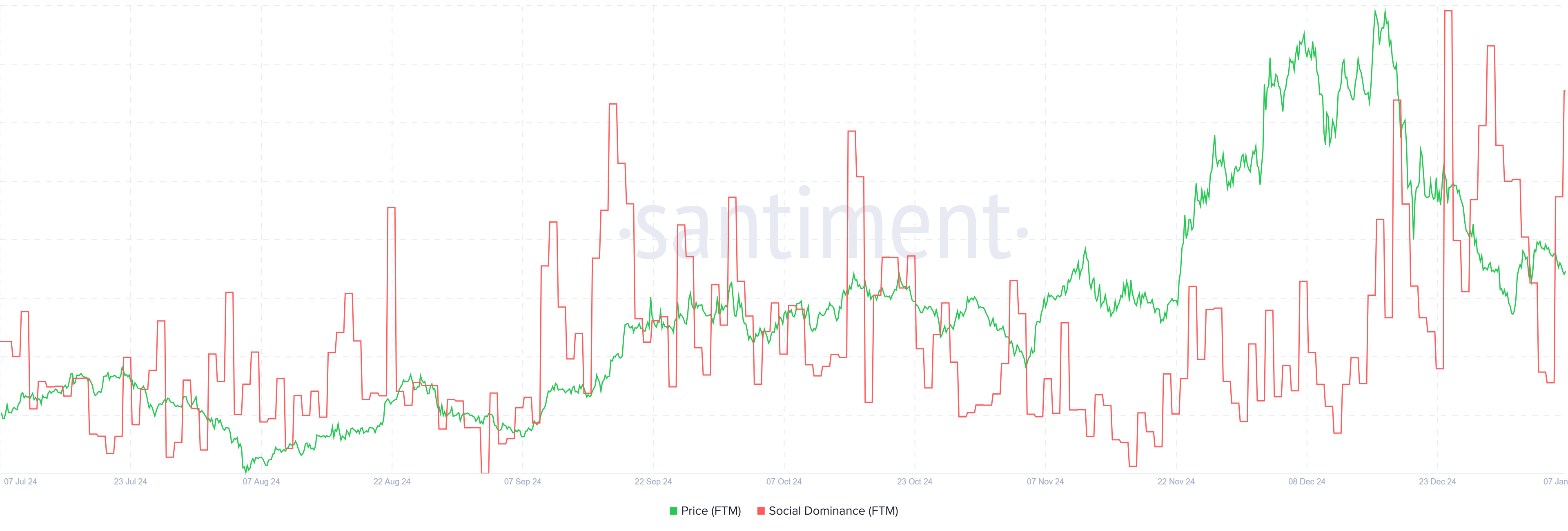

Additional, information from Santiment reveals that the weighted social sentiment surrounding the altcoin appears to have improved over the previous six days. Its weighted social sentiment has elevated from -1.64 in the beginning of January to -0.0427 at press time, suggesting that merchants have gotten more and more optimistic in regards to the mission.

FTM will transition to S

This bullish outlook for FTM comes forward of layer-1 blockchain Fantom Opera Community’s rebranding to Sonic Chain, a brand new layer-1 blockchain designed for sooner transactions.

Alongside this, Sonic Labs will launch its native S token, which can be used for transaction charges, staking, validation, and governance. Present FTM holders can swap their tokens for S tokens at a 1:1 ratio as soon as the blockchain goes dwell.

Binance, the world’s largest crypto alternate, has already revealed its assist for rebranding and swapping FTM-to-Sonic tokens. By Jan. 13, 2025, Binance will delist all FTM buying and selling pairs and cease processing FTM deposits and withdrawals.

Different crypto exchanges, corresponding to Crypto.com and Bybit, have additionally adopted swimsuit with related FTM token swap plans.

Whereas there may be rising neighborhood pleasure, the value of FTM has but to make any notable strikes this season and is down over 40% up to now month. Nevertheless, technicals counsel an impending reversal from the present bearish pattern.

On the 1-day FTM/USDT chart, the Shifting Common Convergence Divergence indicator reveals the MACD line (blue) is about to cross above the sign line (orange), a sign for bullish reversal suggesting that bulls are selecting up power.

The Common Directional Line at 26.8 additionally leans in the direction of a excessive probability of pattern reversal probably resulting in a rally within the altcoin with the primary goal being the psychological resistance stage of $1. A break above $1 may drive the value increased, aiming for final yr’s peak of $1.44.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.