In the world of decentralized networks, the battle traces are drawn not simply between totally different blockchains however throughout the communities they spawn. Bitcoin, having weathered its personal civil battle, has emerged stronger, proving its resilience and dedication to the ideas of decentralization, freedom, and Reality. Ethereum, however, is at present embroiled in inner strife, revealing a stark distinction in neighborhood ethos and management philosophy.

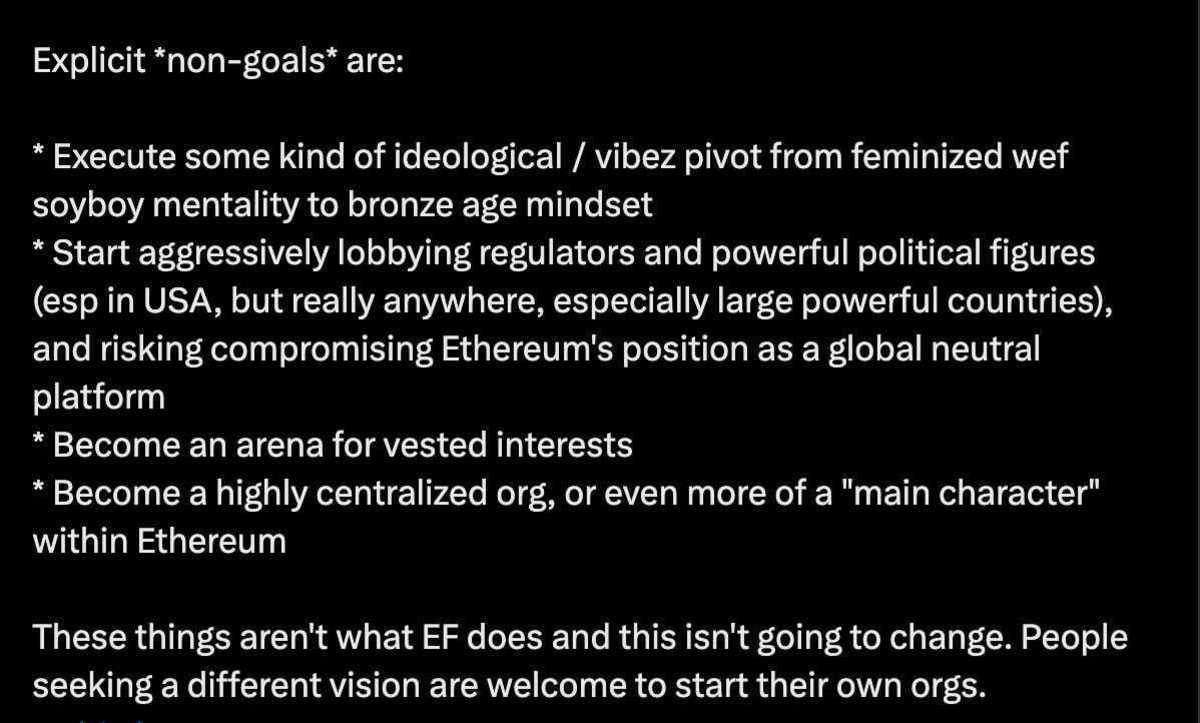

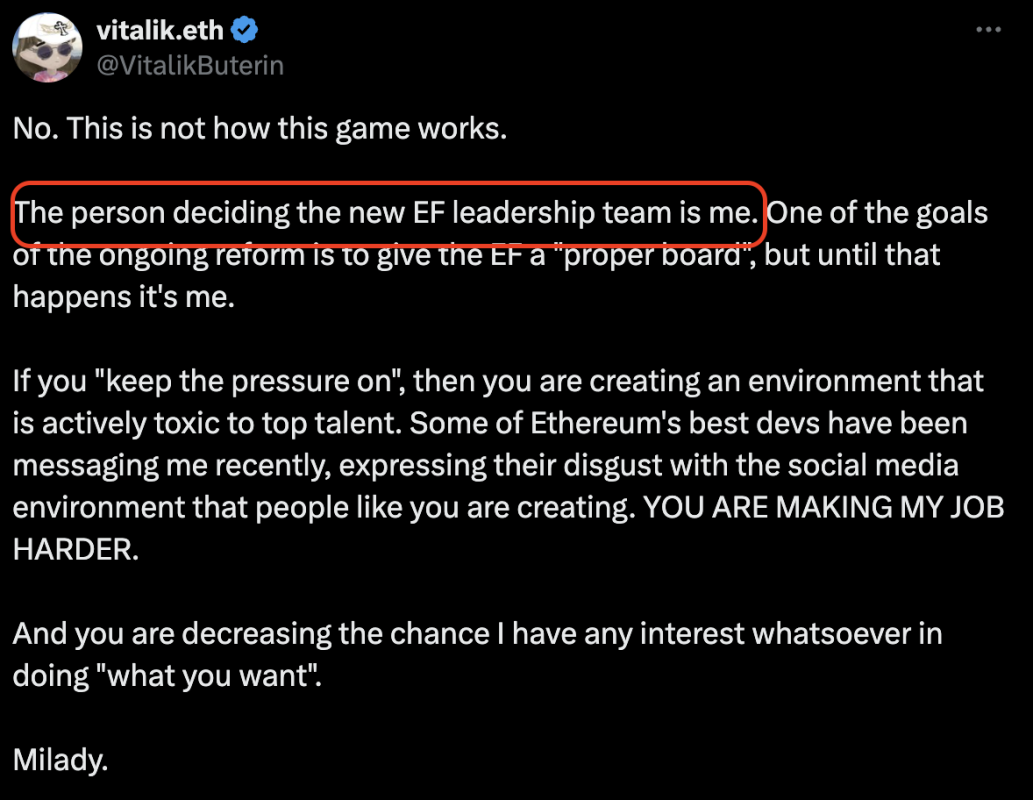

Vitalik Buterin’s current tweets regarding the Ethereum Basis drama are a testomony to this. They expose a neighborhood that appears to prioritize PERCEPTION over substance, an indicator of the bureaucratic and “woke” tradition that has infiltrated society at massive. Ethereum’s strategy, underneath Buterin’s steering, displays a refusal to undertake the “bronze age mindset” that has been pivotal in Bitcoin’s success. This mentality, typically derided as “toxic maximalism” by outsiders (the time period “maximalism” was coined by Vitalik himself, by the best way), champions unapologetic truths and a fierce protection of core values like decentralization and safety.

Toxicity, on this context, turns into a advantage. It favors these keen to talk uncomfortable truths and preserve the integrity of the blockchain’s unique imaginative and prescient. Selecting the trail of bureaucratic, HR-friendly discussions results in a panorama the place managing perceptions overshadows attaining precise outcomes. Ethereum’s present predicament isn’t just a very long time coming however maybe a obligatory wake-up name for individuals who have strayed from the trail of what blockchain expertise was meant to attain.

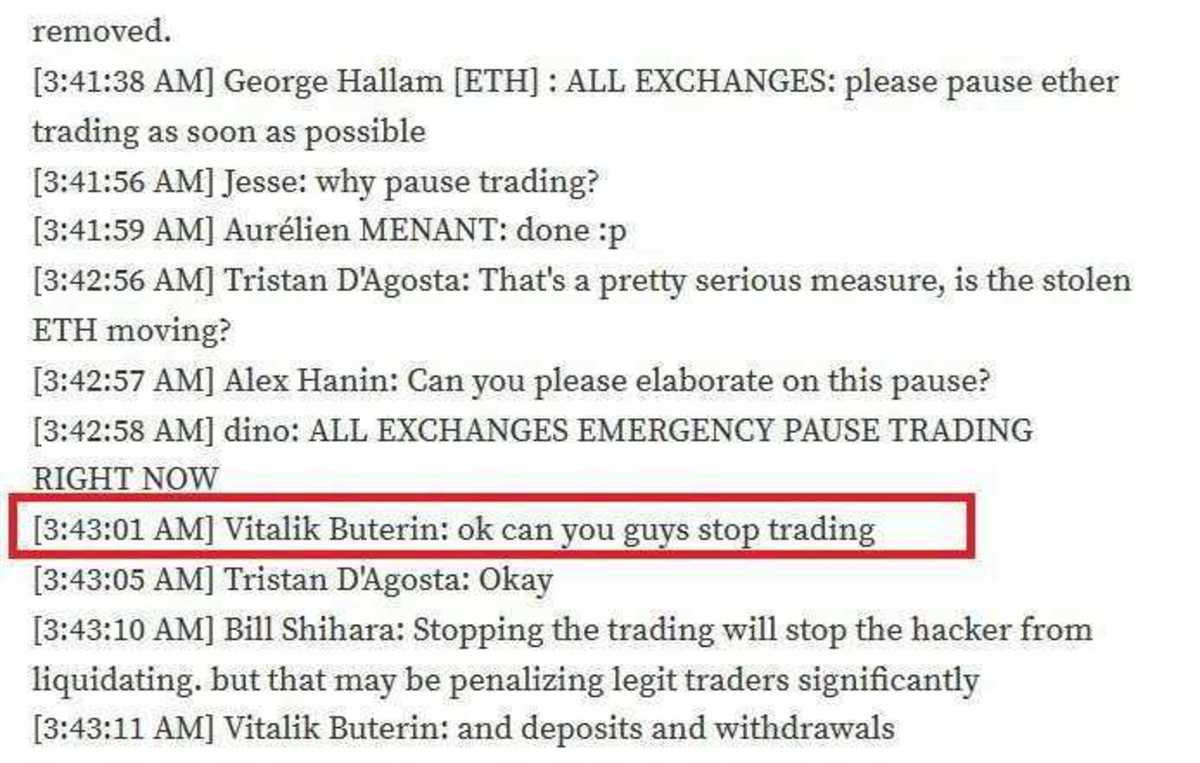

In distinction, Ethereum’s present turmoil showcases a management that’s cracking underneath strain, revealing Buterin’s true colours – not for the primary time.

Bitcoin, in contrast to Ethereum, doesn’t have a Basis, and that is by design. Does this make our governance course of 100 occasions tougher? Completely, and that is exactly the purpose. Though I may not all the time agree with the criticism leveled at Bitcoin Core, I acknowledge the worth in figuring out they are often changed at any given second. The Ethereum Basis has all the time been a magnet for centralized management, and the facility vacuum its collapse would go away will sow chaos. Bitcoin’s governance may be organized chaos, however Ethereum is now dealing with a spell of unorganized chaos that would additional tarnish its popularity. I would like to see Vitalik return to Bitcoin; he is undeniably clever. But, his present function because the “man in control” is precisely why Bitcoin avoids having a public figurehead. The plebs, the node runners – are in management, and that is the higher approach.

The “.ETH” neighborhood’s obvious lack of dedication to those foundational blockchain ideas suggests a future the place Ethereum may not simply undergo drastically from its civil battle however may additionally lose its relevance.

The irony right here is palpable; whereas Ethereum struggles, different platforms like Solana stand to realize.

Nevertheless it looks as if these making this migration don’t be taught from their errors. They acknowledge the ugly facet of Ethereum and Vitalik, however as a substitute of searching for the true axioms of an excellent community, they transfer to an much more centralized different.

Nonetheless, this shift is probably going non permanent. The so-called “On-Chain refugees” fleeing the chaos of Ethereum will ultimately discover their approach again to Bitcoin, the unique and solely cryptocurrency that has constantly delivered on its guarantees with out the drama. They want yet one more rug pull on the Solana facet earlier than they lastly finish their journey, like all of us – Bitcoin solely.

This drama inside Ethereum has been brewing for years, and whereas it may be late in coming, it is not quickly sufficient for Humanity. The time wasted constructing upon what some may argue is a essentially flawed system may have been higher spent advancing applied sciences that genuinely uphold the beliefs of decentralization and freedom.

As Ethereum continues to navigate its inner conflicts, it serves as a cautionary story. It underscores the significance of a neighborhood that values Reality over narrative, freedom over management, and decentralization over centralized decision-making. Bitcoin rising stronger from its civil battle wasn’t nearly survival; it was about proving the soundness of its ideas. Ethereum’s ongoing wrestle may simply be the catalyst wanted for the blockchain neighborhood to return to these roots, recognizing that within the realm of digital currencies, solely these constructed on real, unyielding ideas will stand the check of time.

Bonus Take – PLEASE make this occur Nic: https://x.com/nic__carter/standing/1881029931011903772

This text is a Take. Opinions expressed are totally the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Articles Guillaume writes specifically might talk about matters or corporations which are a part of his agency’s funding portfolio (UTXO Administration). The views expressed are solely his personal and don’t characterize the opinions of his employer or its associates. He’s receiving no monetary compensation for these takes. Readers shouldn’t take into account this content material as monetary recommendation or an endorsement of any specific firm or funding. All the time do your individual analysis earlier than making monetary choices.