Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is at a crucial juncture after breaking above key resistance however failing to maintain momentum towards the psychological $3,000 stage. The latest surge introduced optimism to the market, but ETH has now pulled again barely, struggling to increase positive factors as world uncertainty weighs on sentiment. With macro pressures mounting and negotiations between the US and China over a possible commerce deal in focus, the broader market seems to be awaiting readability earlier than making its subsequent decisive transfer.

Associated Studying

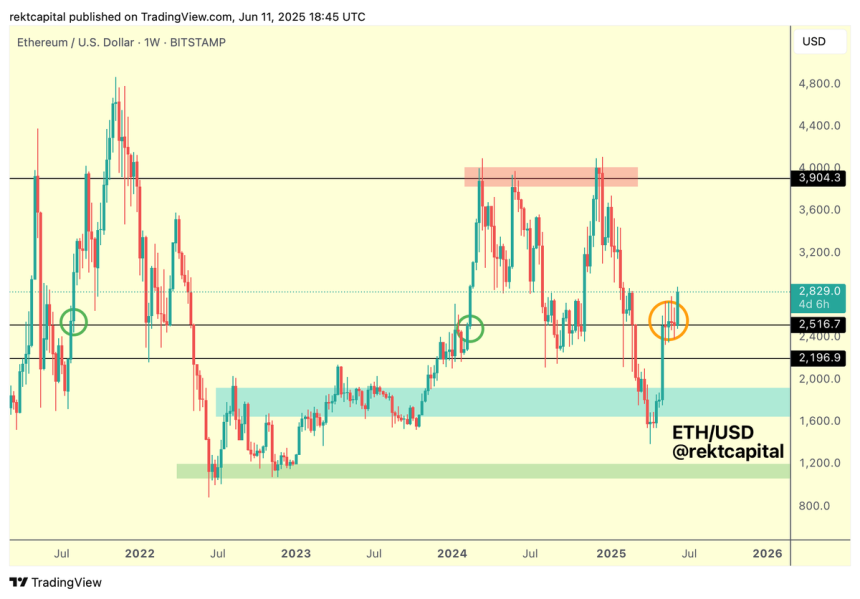

High analyst Rekt Capital provided historic context to Ethereum’s present setup, pointing to 2 earlier cycles the place ETH efficiently retested the $2,500 stage earlier than launching towards $4,000. In August 2021 and once more in early 2024, ETH held $2,500 as sturdy help (inexperienced circles), performing as the muse for a serious breakout rally. This repeating sample has buyers now eyeing the identical stage with rising curiosity.

As Ethereum trades close to $2,750–$2,800, the approaching days might decide whether or not this present setup mirrors previous bullish cycles—or if momentum fades once more. With sturdy help beneath and a transparent historic roadmap above, ETH’s means to reclaim power might set off the subsequent leg in what many consider could be the begin of altseason.

Ethereum Echoes Previous Patterns Ahead Of Potential Breakout

Ethereum has rallied over 100% since its April lows, showcasing highly effective momentum and heightened exercise at present ranges. After briefly tapping an area excessive close to $2,830, ETH has retraced barely however stays firmly above the $2,750 mark—a key space that now acts as short-term help. The power of this rebound is fueling rising hypothesis that Ethereum could not solely be getting ready for one more leg up but additionally setting the tone for a broader altseason.

Analysts throughout the board are intently watching ETH’s present consolidation, with many citing historic patterns as a motive for optimism. Notably, Rekt Capital highlighted a recurring sample that has beforehand led to important rallies. In August 2021, Ethereum efficiently retested the $2,500 stage as help earlier than surging to roughly $4,000. The identical factor occurred in early 2024, when ETH as soon as once more bounced from $2,500 and rallied to the identical zone.

Now, for the previous 5 weeks, Ethereum has repeatedly confirmed the $2,500 stage as stable help, forming what seems to be a textbook basis for one more main transfer. This accumulation part—mirroring previous cycles—has many merchants assured that ETH might quickly reclaim $3,000 and start main altcoins larger.

With macro situations nonetheless unsure and market contributors in search of indicators of power, Ethereum’s conduct at these ranges carries added significance. If ETH can preserve its place above $2,750 and construct momentum by way of $2,830, the market might see an explosive shift in sentiment, doubtlessly triggering the subsequent part of the bull cycle. For now, all eyes stay on Ethereum because it checks the highest of its multi-week vary with bullish conviction.

Associated Studying

ETH Holds Above Breakout Zone After $2,830 Rejection

Ethereum is at the moment buying and selling at $2,749 on the 4-hour chart, holding above a key breakout zone between $2,700 and $2,740 following a quick rejection at $2,830. After breaking above this multi-week resistance final week, ETH surged into larger territory earlier than pulling again in the previous couple of periods. Regardless of this retrace, the worth has thus far maintained help above the earlier resistance space, now performing as a powerful demand zone.

This vary—highlighted by the yellow field on the chart—served as a ceiling for almost a month earlier than being flipped into help through the breakout. Ethereum is now consolidating proper above this space, and so long as it stays above the 50 and 100 easy transferring averages (SMAs), the bullish construction is undamaged. Quantity has began to chill off barely, suggesting that merchants are ready for a decisive transfer—both a bounce towards $2,800–$2,900 or a breakdown again beneath $2,700.

Associated Studying

A profitable maintain of this help zone might verify the retest and construct momentum for one more breakout try. Nevertheless, failure to carry $2,700 might see ETH revisit the 200 SMA round $2,570. For now, Ethereum stays technically sturdy, however merchants are watching intently for affirmation.

Featured picture from Dall-E, chart from TradingView