Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Based on a latest X put up by crypto analyst Ali Martinez, Ethereum (ETH) is inching nearer to a vital demand zone that has traditionally marked market bottoms. Notably, ETH has declined by greater than 21% over the previous two weeks.

Ethereum About To See Pattern Reversal?

Ethereum could quickly witness a reduction rally, because the second-largest cryptocurrency by market cap nears a key demand zone that has traditionally marked market bottoms and provided robust shopping for alternatives.

Associated Studying

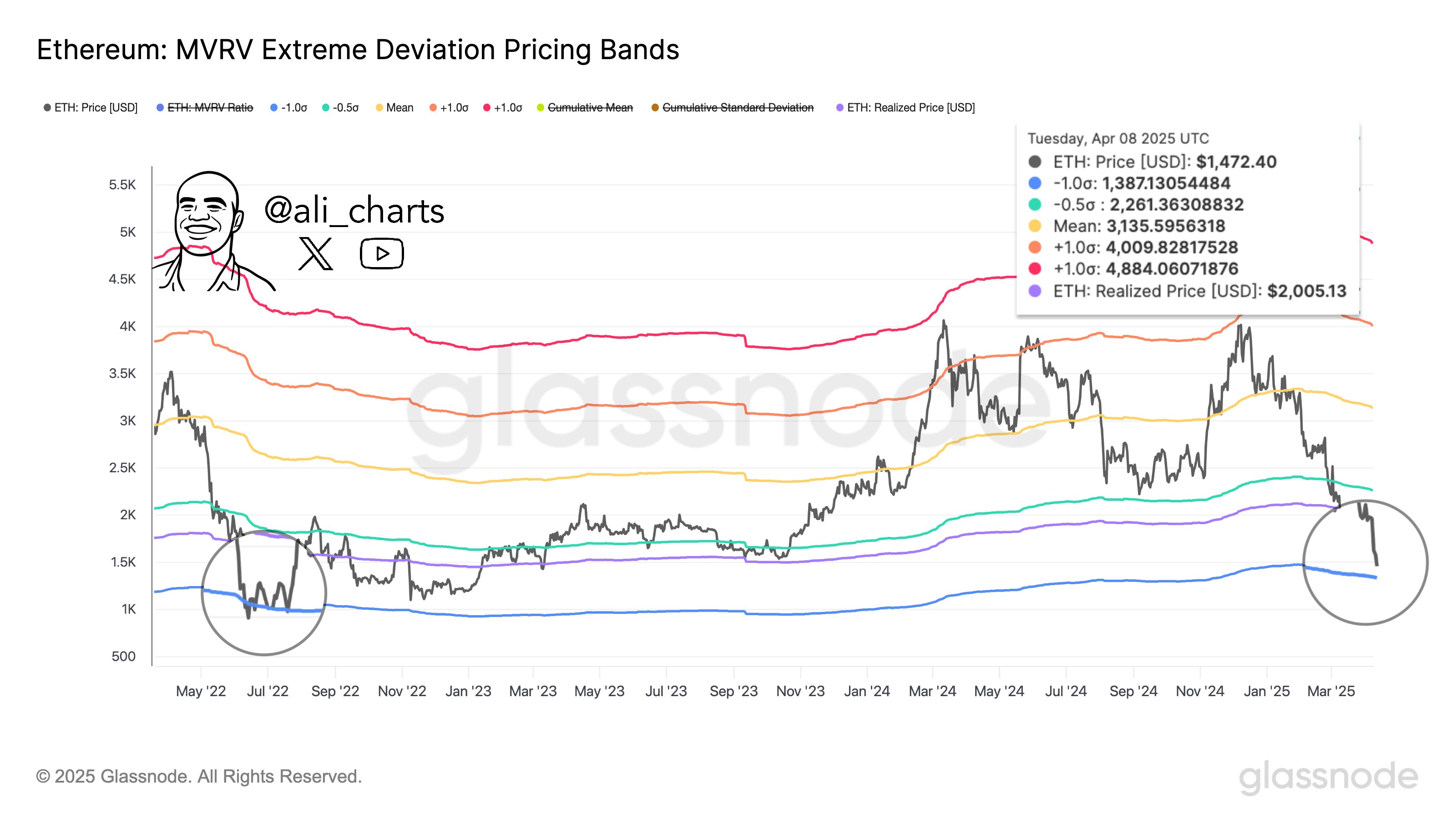

Sharing his evaluation, Martinez posted the next chart, illustrating how ETH is probably going approaching the -1 normal deviation pricing band based mostly on Market Worth to Realized Worth (MVRV) Excessive Deviation Pricing Bands.

Based on the chart, the -1 normal deviation pricing band lies round $1,387, whereas ETH’s realized value hovers round $2,005. The final time ETH touched this band – again in July 2022 – it marked an area market backside.

For the uninitiated, MVRV Excessive Deviation Pricing Bands are on-chain metrics that assist determine potential market tops or bottoms by measuring how far ETH’s present market worth deviates from its realized worth. These bands spotlight traditionally important overvalued or undervalued zones, typically aligning with durations of utmost investor sentiment or value reversals.

As ETH nears the -1 normal deviation pricing band, it suggests the asset could also be considerably undervalued at its present value. Fellow crypto analyst TraderPA seems to help Martinez’s view.

In an X put up, TraderPA shared a weekly Ethereum chart displaying that ETH’s value decline aligns with a low Stochastic Relative Energy Index (RSI) worth – indicating the cryptocurrency could also be oversold following the latest sell-off.

The Stochastic RSI is a momentum indicator that applies the stochastic oscillator system to RSI values relatively than value, making it extra delicate and aware of short-term actions. In contrast to the usual RSI – which ranges from 0 to 100 – the Stochastic RSI ranges between 0 and 1, serving to merchants determine overbought or oversold situations.

Whales Dropping Confidence In ETH

Whereas Martinez and TraderPA’s analyses recommend ETH could also be undervalued, latest whale exercise factors to a attainable lack of confidence. A beforehand dormant ETH whale dumped 10,702 ETH after almost two years of inactivity, signaling weakening conviction amongst massive buyers.

Associated Studying

Apparently, the whale had initially acquired ETH again in 2016, when it was valued at simply $8. Regardless of holding via the 2021 peak close to $4,000, the latest value drop appears to have triggered a big sell-off.

Moreover, Martinez’s newest evaluation suggests that ETH may drop to $1,200, because the asset continues to interrupt beneath a number of key help ranges. At press time, ETH trades at $1,553, up 5.5% up to now 24 hours.

Featured picture from Unsplash, charts from X and TradingView.com