Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Dogecoin is now buying and selling at vital ranges after enduring a number of days of sustained promoting strain and failing to interrupt above the $0.18 mark. The favored meme coin is at present down 65% from its multi-year excessive round $0.48, and sentiment round DOGE stays underwhelming. As worth motion continues to weaken, traders are rising cautious, and bulls are struggling to regain management.

Associated Studying

The broader monetary panorama just isn’t serving to. Macroeconomic uncertainty, rising geopolitical tensions, and sweeping commerce tariffs are shaking international markets, pushing risk-on property like cryptocurrencies deeper into correction territory. On this setting, volatility and instability have gotten the norm — significantly for extremely speculative property equivalent to meme cash. Dogecoin, recognized for its price-driven hype cycles, might be particularly susceptible if market circumstances proceed to deteriorate.

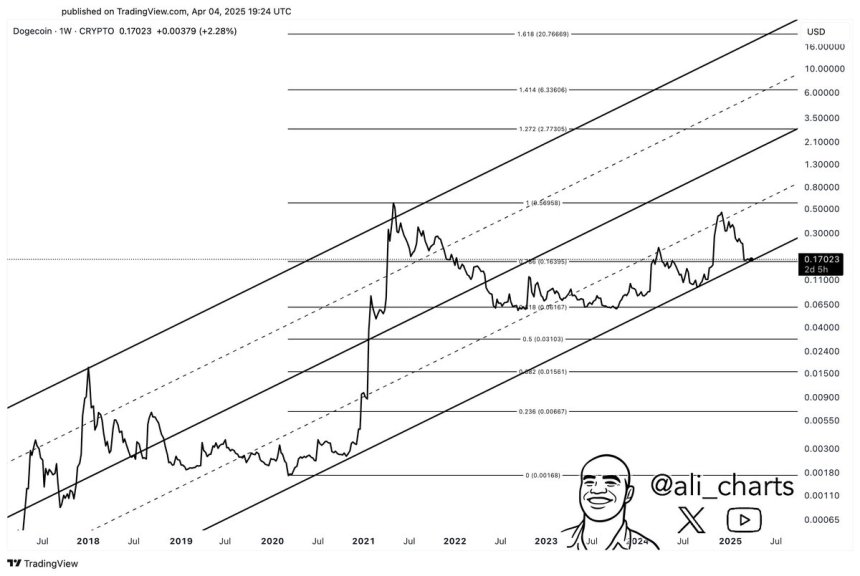

Crypto analyst Ali Martinez shared a technical evaluation on X, revealing that Dogecoin is at present testing a key help degree. In accordance with Martinez, this degree will possible decide the coin’s subsequent massive transfer — both triggering a rebound or opening the door to deeper losses. With sentiment nonetheless fragile and volatility excessive, DOGE’s subsequent steps will likely be carefully watched because it teeters on the sting of additional draw back.

Dogecoin Trades At Make-Or-Break Level As Bears Dominate

Dogecoin is buying and selling at a vital demand zone after enduring weeks of aggressive promoting strain that has dragged the value under key resistance ranges. Amongst all crypto sectors, meme cash have taken the toughest hit in the course of the current market correction, and DOGE isn’t any exception. The asset continues to observe a powerful bearish development, and except bulls can defend the present help, the downtrend may speed up.

At current, Dogecoin is hovering simply above the $0.17 degree — a key threshold that will determine whether or not the coin rebounds or continues to slip. Martinez’s insights spotlight the importance of this zone. In accordance with Martinez, Dogecoin is now at a “make-or-break” degree, and the way it behaves right here will form its short-term and probably long-term trajectory.

Martinez identified that DOGE has been buying and selling inside a long-standing bullish channel, and the $0.17 degree sits on the decrease boundary of this construction. A decisive maintain at this degree may act as a launchpad for a big rally, particularly if broader market sentiment improves. Conversely, if DOGE loses this help, the bullish construction would break down — opening the door to deeper losses.

Associated Studying

With meme cash underperforming and macro uncertainty nonetheless in play, all eyes are on DOGE’s subsequent transfer. If bulls fail to defend the $0.17 mark, Dogecoin may face one other leg decrease. Nonetheless, if this significant help holds, a robust rebound might observe, providing a uncommon window of alternative for affected person traders.

DOGE Trades Under Key Averages As Bulls Defend $0.16 Support

Dogecoin is at present buying and selling at $0.169 after a number of days of struggling to regain momentum under the 4-hour 200 MA and EMA, each hovering close to the $0.18 degree. The current rejection from this technical zone has stored DOGE below strain, with worth motion displaying indicators of continued weak point. Bulls are actually in a decent spot, needing to defend present ranges to keep away from a deeper correction.

To verify a possible restoration rally, DOGE should not solely maintain above the $0.169 mark but additionally break decisively above the $0.205 resistance degree. This space has acted as a key barrier in current weeks, and a breakout would sign a shift in momentum and open the trail towards larger ranges.

Associated Studying

Nonetheless, the draw back dangers stay. If DOGE loses the $0.16 help — a degree that has held by means of earlier dips — it may rapidly fall under the $0.15 mark, deepening the bearish development. With meme cash underperforming throughout the board and general market sentiment nonetheless fragile, Dogecoin’s subsequent transfer will likely be essential. A bounce from right here may mark the start of a restoration part, however failure to reclaim key technical ranges may end in one other leg down.

Featured picture from Dall-E, chart from TradingView