Este artículo también está disponible en español.

Dogecoin (DOGE) holders have been placed on alert by crypto analyst Ali Martinez (@ali_charts), who shared a chart on Monday highlighting a noteworthy technical setup. In accordance with Martinez, the Market Worth to Realized Worth (MVRV) ratio for DOGE simply shaped a “death cross” with its personal 200-day transferring common (MA)—an occasion that beforehand correlated with main value declines.

Dogecoin MVRV Loss of life Cross Warning

Martinez’s chart, sourced from Santiment, plots three key information factors: DOGE/USD Worth (black line), DOGE’s MVRV Ratio (orange line) and DOGE’s 200-day MVRV Ratio MA (crimson line). He commented: “DOGE just saw a death cross between the MVRV Ratio and its 200-day MA. The last two times this happened, prices dropped 26% and 44%.”

The newly printed “death cross” happens the place the orange MVRV ratio line falls under the crimson 200-day MA line. Traditionally, the analyst notes, DOGE’s value skilled two important corrections after this identical crossover: A 26% drop between early September and late October 2023 and a 44% plunge from mid-June to late September 2024.

Associated Studying

Each downturns seem in shaded areas on the chart, labeled accordingly. After every of those drawdowns, Dogecoin’s value finally rebounded, however solely after reaching notably lower cost ranges. Trying nearer on the chart, Dogecoin’s value is proven buying and selling round $0.268. The MVRV ratio (orange line) has climbed close to 91%, whereas the 200-day MVRV Ratio MA (crimson line) hovers round 78.36%.

The MVRV ratio compares Dogecoin’s present market worth to its realized worth (the aggregated value foundation of DOGE final moved on-chain). An MVRV of 91% signifies that market individuals, on common, might be up considerably relative to their buy value—if the ratio stays above 1. Though the precise interpretation relies on how an analyst applies the MVRV scale, a better MVRV ratio typically implies elevated unrealized beneficial properties amongst holders.

Associated Studying

The 200-day MVRV MA is the easy transferring common of the MVRV ratio over the previous 200 days. It supplies a longer-term baseline to gauge how far Dogecoin’s present MVRV stands above or under its historic development. A “death cross” on this context seems when the short-term MVRV ratio (orange line) strikes beneath the 200-day MVRV ratio MA (crimson line), typically signaling a possible shift in sentiment or impending promote strain.

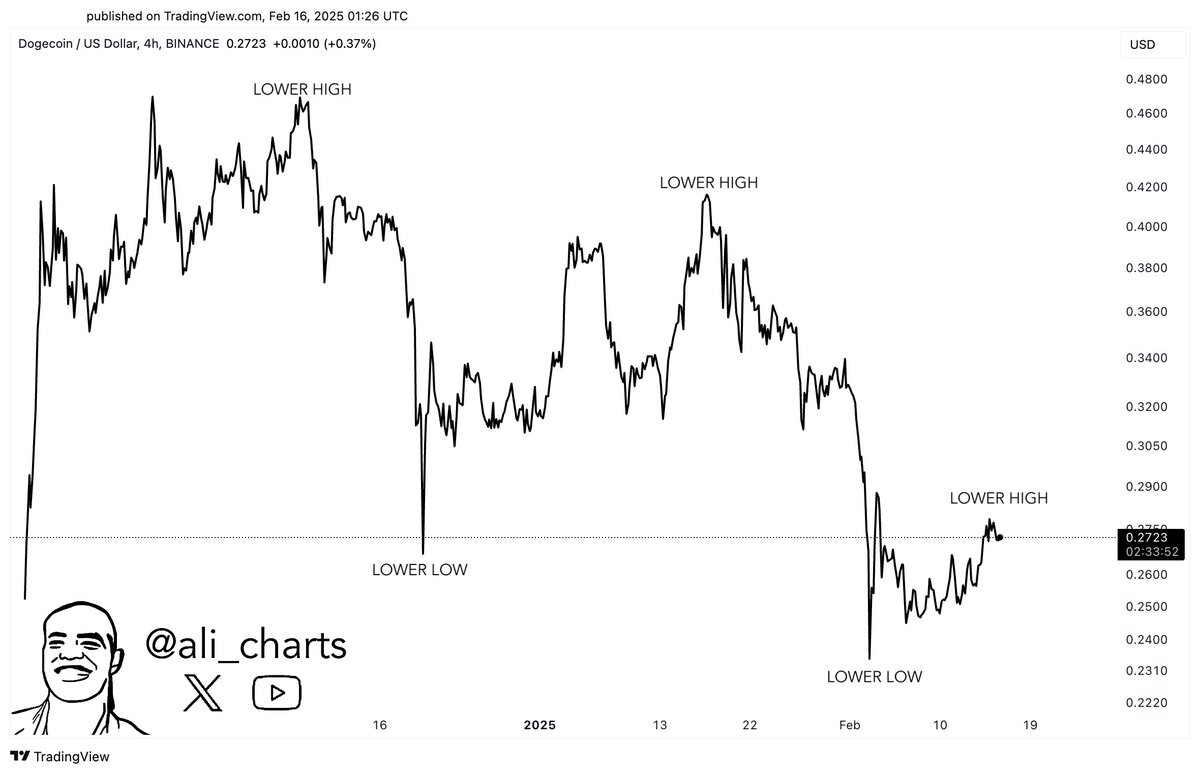

Notably, the Dogecoin value is exhibiting some weak point over the previous couple of weeks. Because the December 8 excessive at $0.4834, DOGE is consistently writing decrease highs and decrease lows, a extremely bearish chart setup. Martinez shared the under chart and said: “DOGE remains in a downtrend, forming lower lows and lower highs. A breakout above key resistance is needed to shift momentum!”

For this to occur, DOGE would want to interrupt above $0.44. Nevertheless, DOGE bulls can anticipate important resistance at $0.31 (0.382 Fibonacci retracement degree), $0.342 (0.5 Fib) and $0.375 (0.618 Fib). At press time, DOGE traded at $0.26.

Featured picture created with DALL.E, chart from TradingView.com