Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

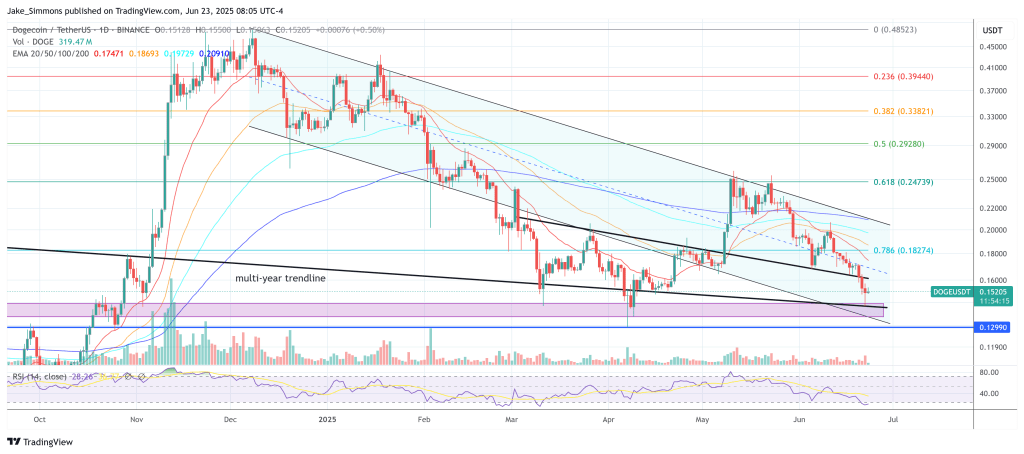

The worth of Dogecoin continues to bleed, and crypto analyst Kevin (@Kev_Capital_TA) warns that the worst should lie forward. Citing an earlier bearish sample, Kevin emphasised over the weekend that Dogecoin’s Head and Shoulders formation—recognized almost two weeks in the past—is quickly approaching its technical “measured move” goal. However he additionally made it clear that the total draw back potential has not but performed out.

Dogecoin Collapse Far From Over?

“I didn’t say we are there now,” Kevin clarified in a follow-up put up, “the orange circle represents a zone of where the measured move could go, with a precise measured move target of the .786 fib at .119.”

This $0.119 stage aligns with a broader confluence of technical helps which might be shortly turning into crucial for DOGE’s construction. “The Head n Shoulders I pointed out on Dogecoin almost a couple of weeks ago is almost at its measured move target range. Certain daily indicators are also starting to enter inciting levels. Watching closely along with BTC and USDT Dominance for further confirmations,” he wrote.

Kevin additionally highlighted the significance of the weekly 200 Easy Transferring Common (SMA) and Exponential Transferring Common (EMA), together with the macro .382 Fibonacci retracement and a long-term descending trendline.

Associated Studying

Collectively, these ranges type what he described because the “must-hold” zone, particularly between $0.1434 and $0.1265. A sustained breakdown beneath that area would probably affirm a macro bearish shift for the meme asset.

What To Monitor Now

Zooming out, Kevin sees Dogecoin’s destiny as inseparably tied to Bitcoin and the broader altcoin market, which he describes as being in its weakest state in years. “So far 2025 has been more bearish for altcoins than 2024 and 2023,” he famous. “Worst year for Alts since the bear market in 2022.” The overwhelming power of Bitcoin’s dominance has been a key think about that pattern.

That dominance, Kevin argues, isn’t a brief spike. “Fresh highs for BTC Dominance on the back of restrictive monetary policy and an uncertain geopolitical environment,” he wrote, referring to international macro circumstances together with persistent quantitative tightening (QT). He has lengthy warned that with out a pivot in central financial institution coverage, any discuss of a real “altseason” is untimely.

Associated Studying

“Been saying since late 2023, early 2024—when AI coins were running crazy and people were saying it was #Altseason—that until QT ends and the terminal rate comes down, you will not see real sustainable altcoin outperformance. That continues to hold true.”

His warning extends effectively past Dogecoin. In earlier posts, Kevin recognized key hazard zones for Bitcoin and Ethereum, which he argues have to be reclaimed to stop broader market deterioration. “As long as BTC cannot break the $106.8K level and show real follow-through on 3D-1W time frames, then the market is in real danger,” he wrote. “Same for ETH not being able to break the $2700-2800 level.”

For Dogecoin merchants, the message is evident. The meme coin’s destiny rests not simply by itself technical well being, however on a wider macro and intermarket construction that continues to be fragile. So long as Bitcoin struggles to carry above key breakout ranges and US financial circumstances stay tight, the likelihood of a deeper Dogecoin correction stays excessive.

Whether or not DOGE can stabilize above the $0.1265 stage can be intently watched by merchants within the days and weeks forward. A lack of that zone, particularly at the side of renewed Bitcoin weak spot, might mark the start of a deeper and extra painful section for the once-beloved meme coin.

At press time, DOGE traded at $0.152.

Featured picture created with DALL.E, chart from TradingView.com