Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst Cyclop has made a probably vital assertion, claiming that the continuing disaster between Israel and Iran might inadvertently enhance the efficiency of digital belongings.

Regardless of current volatility, which noticed a sell-off of roughly $140 billion within the crypto market, Cyclop’s long-term evaluation reveals a extra optimistic outlook for the broader digital asset trade.

Analyst Predicts Bullish Traits For Crypto Amid Conflicts

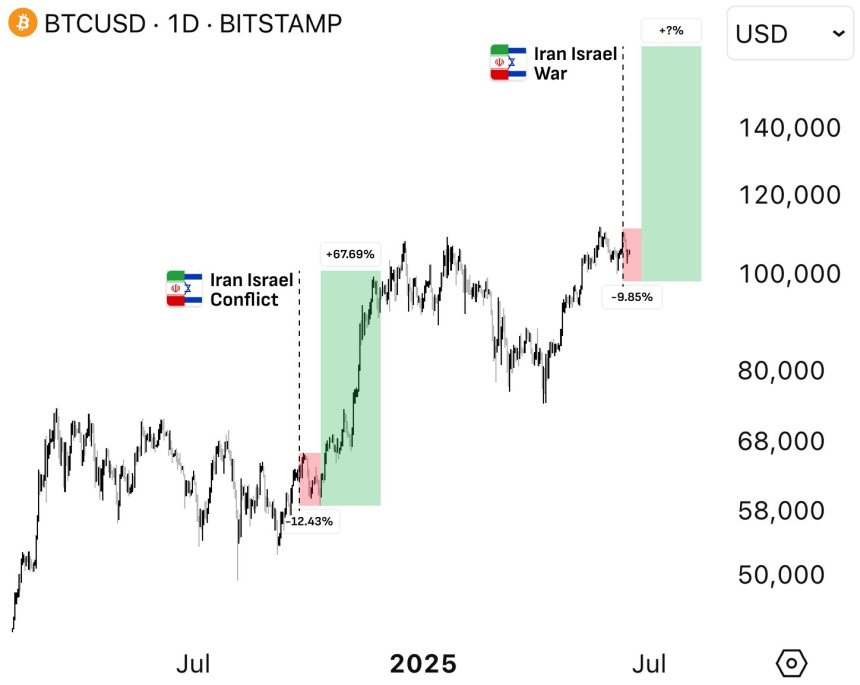

In a current publish on X (previously Twitter), Cyclop pointed to historic patterns that recommend geopolitical tensions usually result in bullish developments in cryptocurrency.

Citing particular situations from April and October 2024, he famous that Bitcoin (BTC) skilled an preliminary decline of 18% and 10% respectively throughout these conflicts, solely to rebound with spectacular features of 28% and 62% shortly thereafter.

This pattern, he argues, signifies a recurring cycle the place war-related dips in crypto costs finally rework into vital development, as may be depicted within the chart under shared by Cyclop.

Associated Studying

The analyst explains that whereas such conflicts can set off short-term bearish actions, the overarching affect tends to be favorable for cryptocurrencies.

As wars ignite fears of inflation and instability, Cyclop has famous that many traders for the standard finance enviornment flip to crypto as a hedge towards weakening fiat currencies.

Not like conventional financial institution accounts, cryptocurrencies are usually not topic to freezing, he stated, making them interesting throughout instances of geopolitical unrest. More and more, digital currencies are being seen as a type of “digital gold,” a secure haven in tumultuous instances.

Favorable Macroeconomic Components

The present market dynamics echo earlier occasions, such because the Russia-Ukraine battle and US-Iran tensions in 2020, which equally resulted in short-term dips adopted by recoveries. Cyclop stays assured that the current state of affairs will yield comparable outcomes, regardless of the standard summer season slowdown that usually impacts market exercise.

Supporting this bullish sentiment are favorable macroeconomic components. Latest developments point out that the US and China have reached a compromise, easing tariffs and aiming to stabilize world provide chains. This transfer is anticipated to assist cool inflation and restore investor confidence.

Furthermore, President Donald Trump’s resolution to delay new tariffs has contributed to a extra risk-friendly atmosphere, permitting liquidity to stream again into crypto markets.

Associated Studying

Additional aiding this constructive outlook is the most recent Client Value Index (CPI) report, which confirmed a modest improve of simply 0.1% month-over-month, barely under forecasts.

With year-over-year inflation at 2.4%—down from an anticipated 2.5%—the Federal Reserve (Fed) is now anticipated to chop rates of interest twice by the top of the yr. Traditionally, such price cuts have been bullish for cryptocurrencies, as they usually result in elevated liquidity within the markets.

Whereas the fast aftermath of the Israel-Iran battle might current challenges, historic knowledge means that cryptocurrencies have the potential to thrive in such environments.

Featured picture from DALL-E, chart from TradingView.com