Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The story has been considerably the identical for the worth of Bitcoin over the previous week, drifting farther from its recently-notched all-time excessive of $111,814. On Friday, June 6, the premier cryptocurrency fell in the direction of the $101,000 stage, reflecting an uptick out there volatility over the previous few days.

Whereas the Bitcoin worth has shortly recovered from this sudden downturn, there may be nonetheless actual concern concerning the market chief’s efficiency since reaching its record-high worth. Nonetheless, a brand new indicator means that the worth of BTC would possibly nonetheless have a while to run as much as a brand new excessive.

Analyst Predicts 4 Months Of Alternative For BTC

In a latest put up on the X platform, crypto professional Joao Wedson revealed that there would possibly nonetheless be some extent of alternative within the Bitcoin market. This statement relies on a mannequin, which was correct in predicting previous all-time excessive costs for the world’s largest cryptocurrency by market capitalization.

Associated Studying

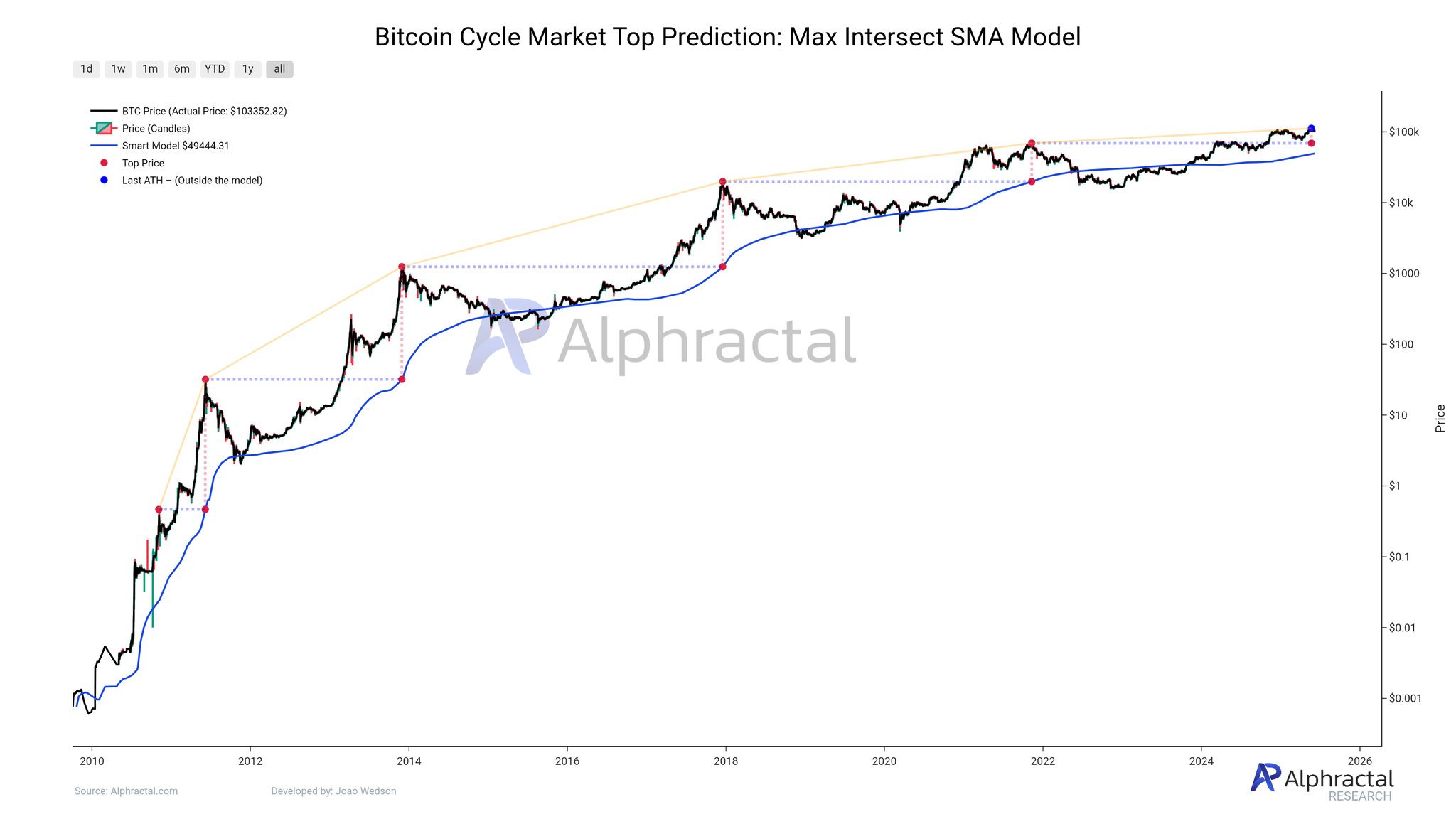

This revelation relies on the Max Intersect SMA Mannequin (the blue line), which has precisely recognized the tops of previous Bitcoin cycles. In keeping with Wedson’s put up, this cycle prime prediction mannequin means that the worth of BTC may nonetheless have round 4 months of upward progress potential — whatever the volatility and market shakeout.

As seen within the chart above, the worth of Bitcoin reaches its present cycle peak each time the Max Intersect SMA (easy transferring common) hits the earlier cycle prime. Within the 2021 cycle, the highest prediction mannequin hit the 2018 excessive of round $19,000 in November 2021, culminating in a then-all-time excessive of $69,000.

Therefore, when this Max Intersect SMA hits precisely $69,000 — the worth prime within the final cycle, that can characterize the height of this present cycle. Wedson additionally asserted that this mannequin is fairly dependable, as it’s backed by 200 examined algorithms.

With this prime prediction mannequin nonetheless a bit off $69,000, the Bitcoin worth would possibly nonetheless be some months away from its peak.

Bitcoin Worth At A Look

As talked about earlier, the worth of BTC appears to be struggling after not too long ago hitting its present all-time excessive above the $110,000 mark. This week’s efficiency will need to have examined buyers’ persistence because the flagship cryptocurrency principally traded inside a consolidation vary.

Associated Studying

In keeping with knowledge from CoinGecko, the BTC worth is up by a mere 0.2% within the final seven days. As of this writing, Bitcoin is valued at round $104,400, reflecting an over 2% worth enhance prior to now 24 hours.

Featured picture from iStock, chart from TradingView