BlackRock has reportedly elevated its share within the IBIT spot Bitcoin ETF, pushing holdings to $314 million. Why is BlackRock shopping for Bitcoin? Will BTCUSDT break $100,000?

A crypto wave is sweeping by means of the retail and company world. Yesterday, New Hampshire turned the primary state to enact Bitcoin reserve laws. Technique, previously MicroStrategy, is actively shopping for Bitcoin, just lately scooping up over $1 billion of the coin. In the meantime, establishments are actively accumulating and scrambling for the digital gold in Could 2025.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

BlackRock Reportedly Will increase Stake in IBIT

Information that BlackRock, one of many world’s largest asset managers, is reportedly growing its stake in IBIT, its flagship spot Bitcoin ETF, pushing holdings to $314 million, a 124% improve from November, is a large sentiment enhance for holders.

BlackRock will increase its place within the iShares Bitcoin ETF by 124%, bringing its whole holdings to $314 million. pic.twitter.com/VV0paTSRCi

— Dealer T (@thepfund) Could 6, 2025

This strategic allocation, more likely to two of its mannequin portfolios, the Goal Allocation with Alternate options and the Goal Allocation with Alternate options Tax-Conscious portfolios, may encourage different corporations to comply with swimsuit.

Even so, regardless of relentless shopping for and “endorsement” from main gamers, the Bitcoin value stays under $100,000, throttling capital circulate to a number of the greatest ICOs to put money into.

One query looms giant: What does BlackRock know that the remainder of us don’t? Why are they growing their Bitcoin allocation as a substitute of shopping for Ethereum or different cash that analysts take into account among the many greatest to purchase in 2025?

DISCOVER: 11 Finest Crypto Presales to Spend money on Could 2025 – High Token Presale

The Bitcoin Guess: What Does BlackRock Know?

The speedy improve in publicity by BlackRock suggests a deliberate technique. In any case, their lively pursuit of BTC publicity through spot Bitcoin ETFs shouldn’t be new.

By September 2024, their Strategic Earnings Alternatives fund (BSIIX) added over 2 million shares of IBIT, bringing its whole to 2.1 million shares. In the meantime, the Strategic International Bond fund (MAWIX) elevated its IBIT holdings by 24,000 to 40,682 shares.

In a portfolio submitting as we speak with the SEC, BlackRock disclosed proudly owning 2,140,095 shares of IBIT in its Strategic Earnings Alternatives Portfolio as of September 30, valued at $77.3 million.

That’s a rise from 88,000 shares beforehand reported as of June 30.

In case you’ve been…

— MacroScope (@MacroScope17) November 26, 2024

In a word to buyers, Michael Gates, a lead portfolio supervisor for the Goal Allocation ETF mannequin portfolio suite, revealed the rationale behind their help for Bitcoin–one of many greatest cryptos to think about shopping for in 2025.

Gates mentioned they’re including a Bitcoin place, funded from equities, as an “additional alternative asset”, pointing to its mounted provide. Together with the asset of their portfolio permits them to diversify sources of danger and return.

He additional emphasised that they might HODL Bitcoin, because it offers “unique and additive sources of diversification” to portfolios.

Establishments clearly see the worth in holding Bitcoin. As of Could 2026, IBIT managed over $58 billion from buyers shopping for shares from BlackRock.

(Supply)

Prior to now 24 hours, over $36 million in shares had been bought. IBIT ranks among the many prime 5 ETFs by inflows, trailing solely the Vanguard S&P 500 ETF.

Why Is the BTCUSDT Worth Caught?

Regardless of regular inflows and aggressive shopping for from establishments, together with Technique, costs stay under $100,000.

Earlier as we speak, costs rallied to as excessive as $97,700 earlier than retracing from the resistance degree.

(BTCUSDT)

On X, one analyst questions the ” provide ” supply that retains costs low.

You are not allowed to ask the place the Bitcoin “supply” is coming from.

BTC cleared $100k a number of instances. Now for the final 2 weeks It is caught at $94k with M2 exploding, shares up and gold up.$4 billion of ETF buys, $1 billion of Saylor buys.

However you are not allowed to query it.— WhalePanda (@WhalePanda) Could 6, 2025

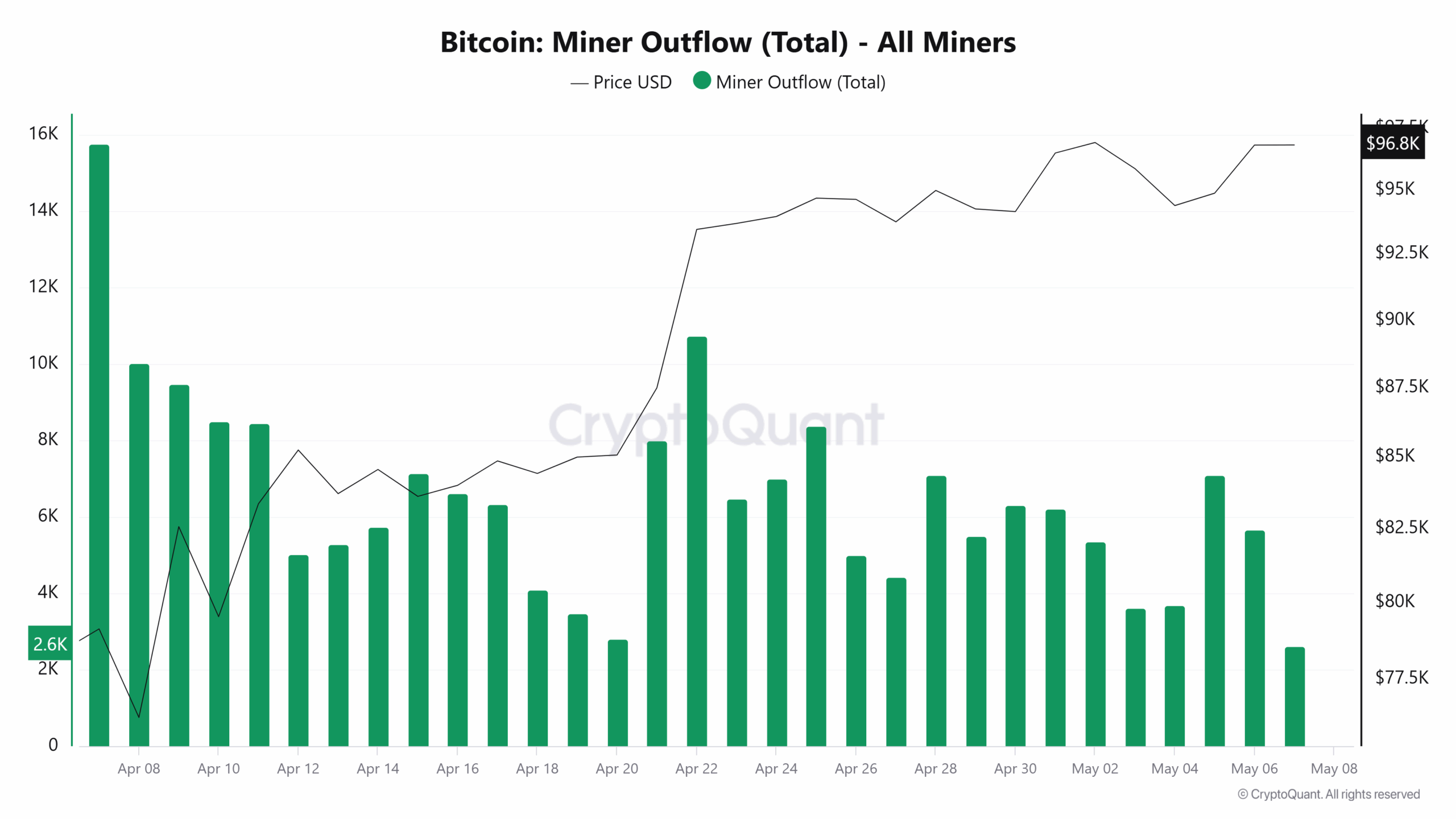

Bitcoin miners, who are inclined to promote when costs are excessive, have slowed their liquidation over the previous month. In accordance with CryptoQuant, solely 5,678 BTC had been offered on Could 6, in comparison with 15,767 BTC offered on April 7.

(Supply)

With miners holding and establishments shopping for, Bitcoin is more likely to break above $100,000 in a purchase pattern continuation formation.

DISCOVER: Subsequent 1000x Crypto – 12 Cash That Might 1000x in 2025

BlackRock Boosts Bitcoin ETF Stake: Why Is BTC Worth Caught Beneath $100K?

- BlackRock has reportedly elevated its stake in IBIT, shopping for extra shares

- Establishments are actively shopping for Bitcoin, following Technique’s methods?

- Miners are usually not promoting and HODL, as CryptoQuant traits present

- Why is the Bitcoin value caught under $100,000?

The submit BlackRock is Still Buying Bitcoin: What Do They Know That We Don’t? appeared first on 99Bitcoins.