Este artículo también está disponible en español.

Prior to now few days, Bitcoin (BTC) has withstood two key developments that might have derailed the cryptocurrency’s bullish momentum. Given Bitcoin’s resilience, analysts are actually predicting a brand new BTC all-time excessive (ATH) within the coming weeks.

Bitcoin Defies DeepSeek Promote-Off, FOMC Uncertainty

Earlier this week, US shares took a success after Chinese language AI agency DeepSeek unveiled its open-source LLM, elevating issues over the excessive market valuation of its American counterparts. Because of this, the S&P 500 noticed a powerful sell-off, with NVIDIA main the losses, dropping 16% in a single day.

Associated Studying

Equally, in its newest assembly, the Federal Open Market Committee (FOMC) left rates of interest unchanged, according to market expectations. Whereas the hawkish stance was anticipated to deal one other blow to crypto markets, BTC remained comparatively unscathed after an preliminary dip.

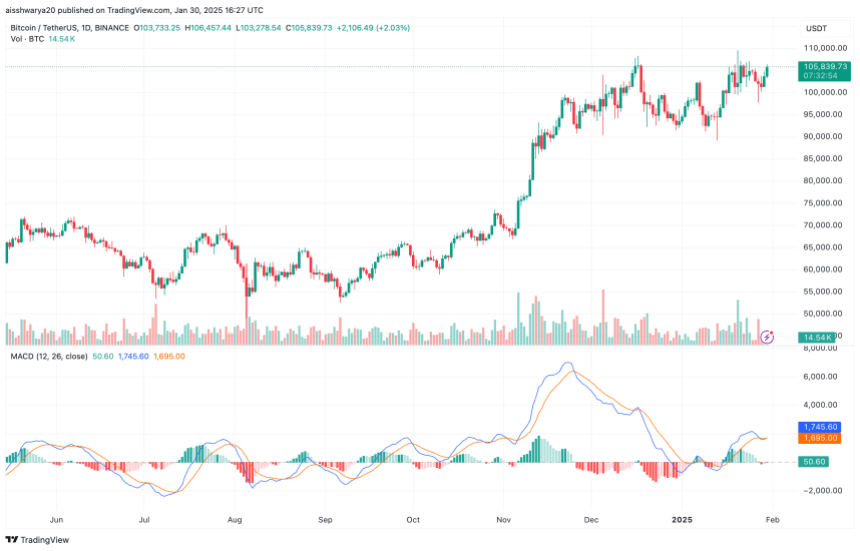

On the time of writing, BTC is buying and selling at $105,839, having primarily recouped all its losses from the DeepSeek-induced market crash. The truth is, BTC has outperformed the S&P 500 over the previous 5 days, surging 1.53%, in comparison with the latter’s 1.25% decline.

New BTC ATH In February?

Seasoned crypto dealer Pentoshi commented on BTC’s power, saying that the digital asset has held up nicely regardless of the turmoil. The dealer added that they see no cause why BTC shouldn’t hit a brand new ATH quickly.

One other Bitcoin fanatic, Castillo Buying and selling, famous that Bitcoin’s value construction “looks flawless.” They added that each lower- and higher-time frames recommend that BTC will probably go greater.

Associated Studying

In the same vein, crypto dealer and entrepreneur Michael van de Poppe mentioned that the market will probably see a brand new BTC ATH within the ‘coming weeks,’ doubtlessly hinting at February because the goal month.

Additional, crypto dealer Roman shared the next chart, commenting that “Stoch & RSI have plenty of room to break $108,000 resistance and head higher.” They added that bullish divergence on BTC can also be taking part in out properly.

For the uninitiated, each Stochastic Oscillator (Stoch) and Relative-Energy Index (RSI) are momentum indicators that assist merchants determine whether or not the underlying asset is oversold or overbought in present market circumstances.

Whereas projections for a brand new BTC ATH could also be centered on the short-term, market cycle peaks are anticipated to happen in the summertime of 2025. As an illustration, a current report by Bitfinex forecasts that BTC might surge to $200,000 by mid-2025, amid shallow value pullbacks.

In the meantime DeepSeek predicts that BTC could high out between $500,000 and $600,000 by Q1 2026. At press time, BTC trades at $105,839, up 3.1% up to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com