Este artículo también está disponible en español.

Many analysts are ruminating on the subsequent vital milestone, because the outstanding worth improve of Bitcoin has captivated the market’s consideration. A analysis firm, 10x Research, predicts thatthe alpha coin may attain $122,000 by February. Though this may occasionally seem like an bold objective, it’s per the optimistic perspective of quite a few consultants who’ve noticed Bitcoin’s capability to surpass essential worth thresholds for the reason that approval of Bitcoin ETFs.

Associated Studying

Bitcoin: Strong Momentum

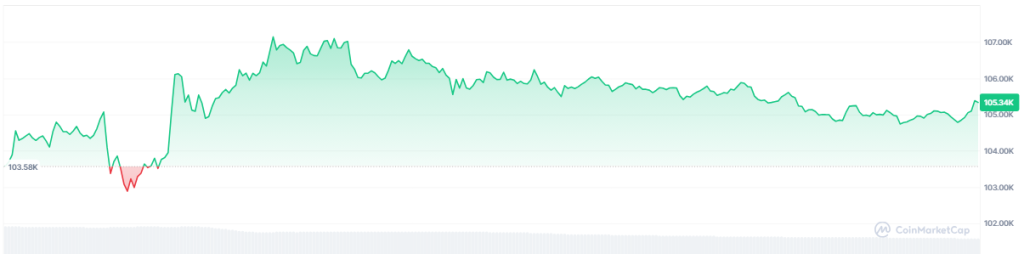

The momentum of Bitcoin is simple. In current months, its worth has fluctuated in a constant method, with periodic will increase which have sometimes occurred throughout the $16,000–$18,000 vary.

Markus Thielen of 10x Research believes that these constant will increase point out a continuation of upward motion, which means that $122,000 is possible within the close to future. Thielen underscores that the crypto asset’s market conduct might expertise a pause upon attaining this goal, regardless of the optimistic outlook.

Thielen believes Bitcoin’s breakout presents a “low-risk, high-reward entry opportunity,” with Bitcoin buying and selling at $105,727. He famous that after Donald Trump’s inauguration, BTC examined the $101,000 resistance, making it a positive time to purchase with stop-losses round $98,000.

Thielen additionally identified that Bitcoin has risen in $16,000–$18,000 increments for the reason that launch of spot Bitcoin ETFs within the US, suggesting it may attain $122,000 by February earlier than coming into one other consolidation section.

Expectation Of Consolidation Following The Surge

A interval of consolidation might ensue following Bitcoin’s potential ascent to $122,000. This section, throughout which its worth stabilizes prior to a different outburst, has been a recurring pattern all through its historical past. Buyers ought to anticipate this era of sideways worth motion, which can current new alternatives for many who are anticipating a extra favorable entry level.

Energy In Relation To The Inventory Market

The optimistic forecast can also be in keeping with the relative power of Bitcoin compared to conventional markets. Regardless of the challenges that equities have encountered, it has demonstrated outstanding resilience.

Because of the rising variety of institutional traders who’re investing in Bitcoin, the worth of this digital asset is turning into much less correlated with the broader monetary market. This sample has the potential to accentuate the upward trajectory towards $12,000.

In the meantime, in response to present worth predictions, the worth of Bitcoin is predicted to rise by 24% and attain $ 130k by February 21, 2025. Technical indicators, in response to CoinCodex, present the present sentiment is Bullish whereas the Worry & Greed Index is exhibiting 84 (Excessive Greed).

Associated Studying

When?

Although historic success of Bitcoin doesn’t guarantee future outcomes, the current circumstances are favorable for extra progress. The cornerstone for any worth will increase is Bitcoin’s skill to revenue on optimistic information, similar to ETF approvals, along with institutional help. The query just isn’t whether or not Bitcoin will hit $122,000; somewhat, when.

Featured picture from Getty Photographs, chart from TradingView