Bitcoin is dealing with a vital take a look at because it consolidates just under all-time highs, teasing a breakout into worth discovery. After briefly tagging the $112,000 mark, BTC pulled again barely, and volatility has surged, leaving buyers unsure in regards to the subsequent path. Whereas some concern a possible correction, many analysts stay assured that the uptrend remains to be intact, pointing to sturdy help ranges and on-chain indicators backing the bullish case.

Regardless of latest fluctuations, Bitcoin continues to carry above the $105,000 stage, sustaining a bullish construction and protecting market sentiment cautiously optimistic. Merchants at the moment are waiting for a decisive transfer that might both affirm a breakout above resistance or sweep liquidity under earlier than the subsequent leg greater.

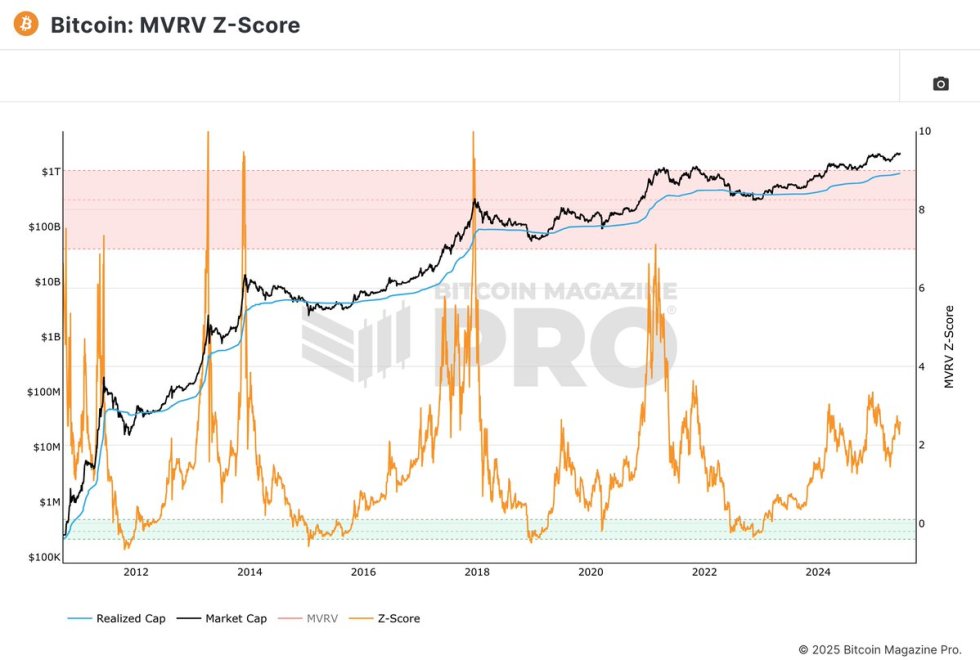

Top analyst Jelle shared on-chain information highlighting the present place of the MVRV Z-Score—a key metric used to gauge whether or not Bitcoin is overvalued or undervalued relative to historic norms. In line with Jelle, the MVRV Z-Score remains to be removed from the pink zone ranges usually related to cycle tops, suggesting there may be nonetheless loads of room for the market to develop. As BTC holds agency and macro situations evolve, the approaching periods may form the subsequent explosive section within the ongoing bull cycle.

Bitcoin Hovers Close to All-Time Excessive As Market Awaits Breakout Affirmation

Bitcoin is buying and selling above important ranges, holding sturdy above $105,000 and sustaining momentum close to its $112,000 all-time excessive. After weeks of climbing and absorbing macroeconomic uncertainty, BTC now faces one among its most vital resistance ranges. A clear breakout from this zone may very well be the set off for a full-blown growth into worth discovery, signaling the subsequent explosive leg of the bull market.

This week may show decisive. Bitcoin’s construction stays bullish, with a sequence of upper lows and regular quantity supporting the uptrend. Nevertheless, volatility has elevated in latest days, suggesting that whereas bulls are in management, the market remains to be weighing its subsequent transfer. A failed breakout may lead to a retracement towards decrease help, with key demand zones resting round $103,600 and $100,000.

Still, on-chain indicators proceed to lean bullish. Jelle highlighted the relevance of the MVRV Z-Score, a historic indicator that measures Bitcoin’s market worth relative to its realized worth. The metric has traditionally flashed pink as worth peaks method—but in keeping with Jelle, the MVRV Z-Score is “not even close to flashing a signal at the moment,” suggesting there’s nonetheless loads of room for upside.

This mixture of worth stability above help, technical resistance overhead, and a wholesome on-chain backdrop places Bitcoin in a pivotal place. A breakout above $112,000 may ignite worth discovery and speed up the uptrend throughout the market. However so long as BTC stays range-bound, merchants should stay cautious and put together for short-term volatility. The path Bitcoin takes from right here will seemingly outline the tone of the market heading into the second half of 2025.

BTC Rejected At $109K Degree

Bitcoin is at the moment buying and selling at $107,044 on the 4-hour chart after dealing with rejection on the $109,300 resistance stage—a key space that has capped upside momentum a number of occasions up to now two weeks. Following a short push above $109K, BTC failed to carry the breakout and has since retraced, now testing the mid-range help zone aligned with the 50, 100, and 200 easy transferring averages (SMAs), that are all clustered between $106,000 and $106,400.

This cluster of transferring averages now serves as quick help and will act as a pivot level for a bounce. If this space holds, bulls may try one other run on the $109K stage. Nevertheless, a breakdown under these SMAs opens the door for a transfer right down to the $103,600 demand zone, the place Bitcoin beforehand discovered sturdy shopping for curiosity earlier this month.

Quantity has been rising barely throughout the retrace, suggesting merchants are cautious and defending beneficial properties after final week’s rally. Till BTC cleanly breaks above $109,300 with quantity, the market is more likely to stay in consolidation mode. All eyes at the moment are on whether or not BTC can defend this help cluster or threat deeper draw back within the quick time period.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.