Bitcoin and US equities are going through mounting stress as macroeconomic uncertainty and erratic coverage selections from US President Donald Trump proceed to shake investor confidence. With sudden tariff bulletins and unstable international coverage stances dominating headlines, markets have turn out to be more and more unstable. Bitcoin, usually seen as a hedge in opposition to conventional market instability, has entered a consolidation part across the $85,000 stage. After weeks of sharp worth swings, BTC seems to be gathering momentum for its subsequent main transfer—up or down.

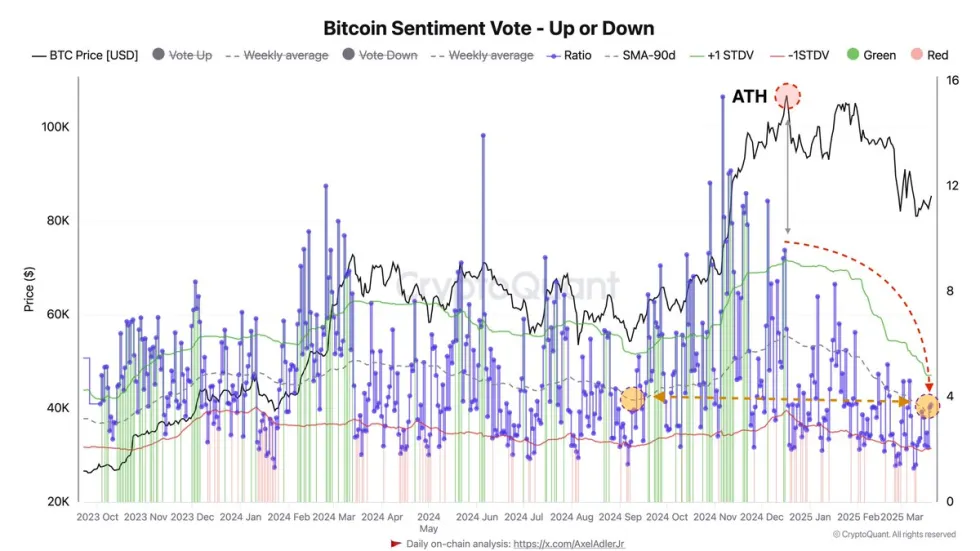

Regardless of hopes for a robust restoration following its all-time excessive earlier this 12 months, sentiment throughout the crypto area has grown more and more bearish. Based on new knowledge from CryptoQuant, investor and dealer outlook on Bitcoin has shifted considerably. The Bitcoin Sentiment Vote – Up or Down chart reveals a transparent transition towards detrimental sentiment, with a majority now betting in opposition to additional short-term positive factors. This development mirrors situations final seen in September 2024, simply earlier than the market’s final main rally.

With sentiment turning bitter and worth motion narrowing, Bitcoin’s present place at $85K has turn out to be a battleground for bulls and bears. Whether or not this era of indecision resolves in a breakout or breakdown could rely closely on broader financial developments and investor response to continued political instability.

Investor Sentiment Hits 6-Month Low As Bitcoin Stalls Beneath $90K

Traders face a vital second as Bitcoin trades in a good vary, struggling to reclaim key resistance ranges whereas holding above important help. Regardless of makes an attempt to provoke a restoration, bulls have been unable to generate sufficient momentum to push costs meaningfully larger, whereas bears have did not pressure a decisive breakdown. This ongoing stalemate has heightened market stress.

The failure to reclaim the $90K stage and maintain above $85K constantly has led some analysts to query whether or not the present cycle continues to be intact. The stress on bulls to show the continuation of the bull run is mounting, as sentiment begins to shift towards a extra cautious—and even bearish—outlook.

Top analyst Axel Adler shared insights on X that paint a sobering image. Based on Adler, after Bitcoin reached its ATH, sentiment took a pointy flip for the more severe. This shift is clearly illustrated within the Bitcoin Sentiment Vote – Up or Down chart. The present quarterly sentiment ratio has dropped to ranges not seen since September 2024, simply earlier than the market’s final main rally.

Whereas it’s attainable that this bearish sentiment may function a contrarian indicator—signaling a backside—many imagine it displays deeper uncertainty. With macroeconomic instability and geopolitical issues on the rise, Bitcoin’s subsequent transfer will probably be essential in figuring out whether or not the broader market sees a renewed uptrend or enters a chronic bearish part. As merchants watch the $85K–$90K zone carefully, the approaching days could also be decisive for BTC’s trajectory in 2024.

Bulls Face Rising Pressure

Bitcoin is presently buying and selling at $84,200, holding slightly below the important $85,000 stage the place each the 200-day transferring common (MA) and exponential transferring common (EMA) converge. This space has turn out to be a big resistance zone, and bulls have struggled to push previous it. To provoke a robust restoration rally, BTC should break above the $88,000 stage—this could verify momentum and will set off a swift transfer again towards the psychological $90,000 mark.

For now, worth motion stays range-bound and unsure, with bearish sentiment nonetheless weighing available on the market. Whereas BTC has managed to carry above short-term help at $82,000, the lack to reclaim the 200-day MA/EMA cluster raises issues about additional draw back stress.

If bulls fail to defend present demand and the worth drops under $82,000, a retest of the $81,000 stage is probably going. Dropping that help may open the door for a deeper correction towards the $78,000–$75,000 vary. This situation would additional shake investor confidence and reinforce the rising narrative that the market is transitioning into an extended consolidation or bearish part.

The approaching days are important, and all eyes stay on BTC’s capacity to flip $85K into help and goal larger resistance zones.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.