The Bitcoin value has witnessed its justifiable share of corrections in current days after reaching a brand new all-time excessive final week. The premier cryptocurrency’s newest efficiency displays what appears to be an exhaustion of bullish energy, as the overall market fell underneath some downward stress in May’s last week.

With the continued battle between the bulls and bears, there is no such thing as a clear-cut solution to inform what’s subsequent for the Bitcoin value. Nonetheless, a current on-chain remark reveals elevated bullish exercise on a well-liked centralized change, which might provide perception into the short-term motion of the market chief.

‘Decreased Bitfinex Longs May Be Good For BTC’s Momentum’ — Alphractal

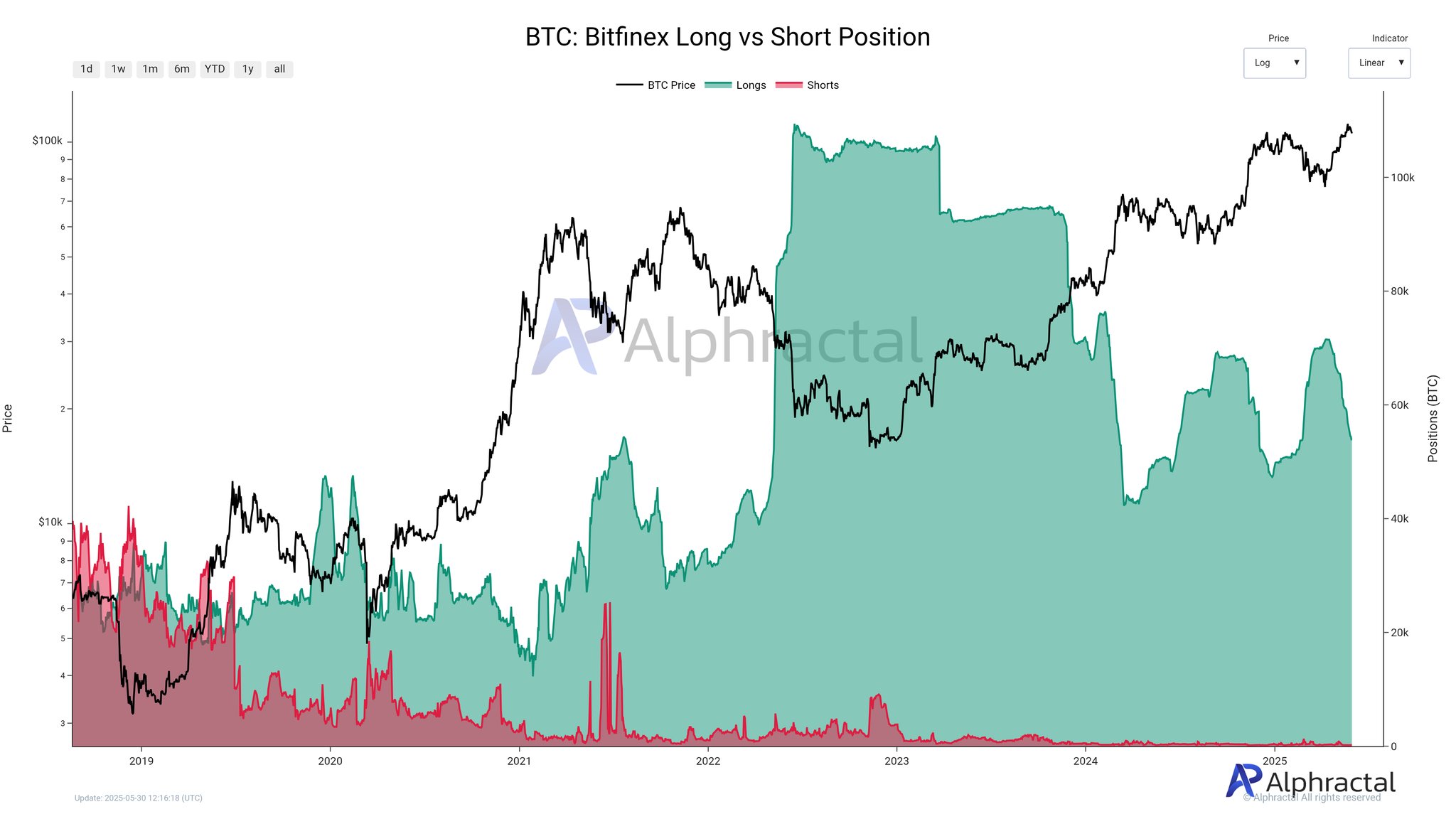

In a May 30 submit on social media platform X, crypto analytics agency Alphractal delved into the connection between leveraged lengthy positions on crypto change Bitfinex and the Bitcoin value path. This evaluation is predicated on the Bitfinex Lengthy Vs. Quick Place metric, which estimates the ratio of buys towards the sells of a cryptocurrency (BTC, on this case).

Based on Alphractal, the connection between BTC’s value trajectory and the leveraged lengthy positions on Bitfinex is inversely proportional. Which means if there are extra lengthy positions on the crypto buying and selling platform, the chance of a value drop will increase. In the meantime, a lower in lengthy positions on the change could possibly be bullish for the Bitcoin value.

The analytics agency attributed this sample to the propensity of merchants to be improper concerning the market’s precise trajectory. Based on Alpractal, these improper value predictions ultimately result in liquidations and compelled place closures, which drive the BTC’s value in the other way.

The chart above reveals a decline in lengthy positions and a low quantity of quick positions | Supply: @Alphractal on X

Within the current submit on X, Alphractal identified that the Bitfinex Lengthy Place is declining, and if this development is sustained, the premier cryptocurrency might resume its upward run. On the flip aspect, if the metric had been to ascend above its present degree, the Bitcoin value could possibly be making ready for a extreme pullback.

Bitcoin Price At A Look

As of press time, Bitcoin trades simply above $104,100, reflecting a greater than 2% decline previously 24 hours. The flagship cryptocurrency’s efficiency is much more disappointing on the weekly timeframe, having misplaced over 4% of its worth previously seven days.

The value of BTC drops beneath the $104,000 degree on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.