Bitcoin has made a fast restoration from the weekend sell-off. This sort of BTC USD value stability within the midst of worldwide instability speaks volumes about present demand. The most important crypto asset is being purchased up and stashed as establishments, governments, banks and corporations have joined the aggressive market. Retail patrons don’t wait round are scrambling to get a chunk of the pie.

The Bitcoin steadiness on exchanges has dropped by 800,000 between June 2024 and at present. The estimated quantity of BTC mined for the previous 12 months is round 177,000.

MVRV Z-Rating – in my view a very powerful on-chain metric – tells us the true story of the place we’re within the BTC cycle.

MVRV reveals the distinction between Bitcoin’s market cap and what folks really paid for his or her cash (realized cap). The Z-Rating normalizes this… pic.twitter.com/trwe5AESDG

— Stockmoney Lizards (@StockmoneyL) June 24, 2025

Stockmoney Lizards’ statement that individuals are nonetheless not massively in revenue signifies that promoting strain ought to nonetheless be quite low, in comparison with what it must be on the finish of the bullrun. Nice fundamentals! Now it’s time to maneuver on to technical evaluation.

Is Bitcoin Rush Displayed On the Charts?

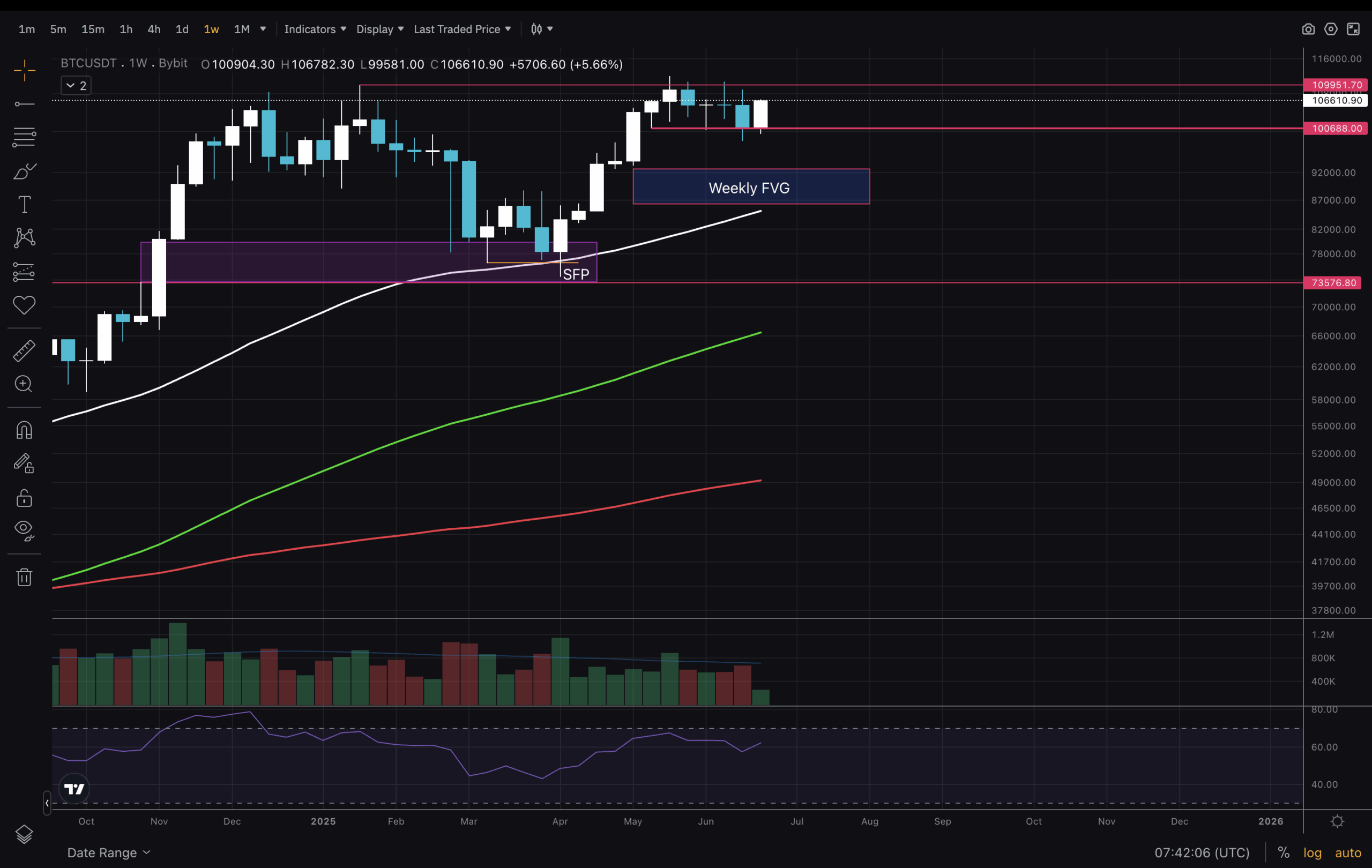

(BTCUSD)

Bitcoin remains to be in an uptrend within the weekly timeframe. Above all, shifting averages are making greater highs and decrease lows. A key degree that must be damaged is at $110,000, which for now proves to be resistance. One potential state of affairs buyers wouldn’t like is the so-called double prime. The FVG hole right here remains to be not stuffed, although we’re witnessing a robust bounce from assist at $100,000.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

BTC USD Forms a Bull Flag on The Every day Chart?

(BTCUSD)

Subsequent in line is the Every day timeframe. Right here we see two FVG gaps. The higher one has been visited a number of occasions, however FVG1 remains to be stuffed. Will it occur? We’ll see later, so preserving it as a believable state of affairs is nice.

Nonetheless, it being beneath the shifting averages, which is the value reclaimed in April, makes it unlikely. One other sample I see here’s a bull flag, which I indicated with orange strains. In uptrends, these formations are often bullish accumulations and break to the upside.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

(BTCUSD)

Let’s end at present’s evaluation with the 4H chart. The 2 fundamental components of this chart we take note of are the second break above MA200, which led to a fast leg up. Now, we would see this repeated. The second bit is that value has moved above the earlier excessive (take a look at of MA200 earlier than the drop to $98,000). I count on $108,000 to be examined once more quickly, and I’ll be watching how merchants reply.

DISCOVER: High 20 Crypto to Purchase in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Bitcoin Rush Of twenty first Century: Individuals Scrambling For Leftovers

- FVG 2 demand must be low now

- Weekly FVG may not be examined, although we hold it as believable

- Price is forming a bull flag.

- MA200 on 4H reclaimed

The publish Bitcoin Price Rush – Biggest This Century? Traders Scramble For Last Minute BTC USD Positions appeared first on 99Bitcoins.