Bitcoin continues to impress as among the finest performers among the many large-cap property, with its worth climbing by practically 25% previously month. Extra outstandingly, the Bitcoin worth has managed to remain above the six-figure valuation threshold regardless of the gradual market situations over the previous week.

After a number of weeks of sturdy bullish motion, the flagship cryptocurrency appears to have settled inside the $102,000 – $105,000 consolidation vary. Regardless of market-wide shouts of reclaiming its all-time excessive, the Bitcoin worth appears to be at the moment dealing with a point of indecision amongst buyers.

BTC Price Would possibly Be Getting ready For A Promote-Off

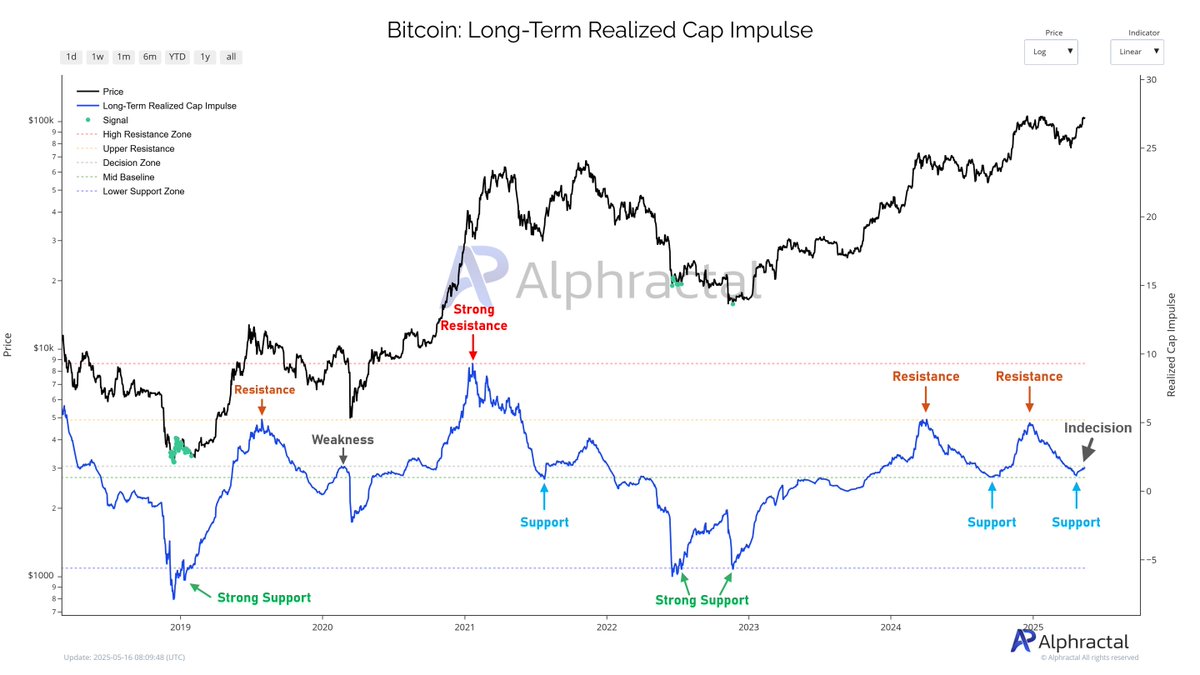

In a Might 16 put up on the social media platform X, on-chain analytics agency Alphractal defined that the Bitcoin worth is at a juncture, which could possibly be essential to its future trajectory. This on-chain analysis relies on the Lengthy-Time period Realized Cap Impulse, a metric that measures the expansion charge of the realized capitalization of long-term holders.

For readability, a constructive worth for the Lengthy-Time period Realized Cap Impulse indicators that long-term buyers are buying extra BTC at a better worth. This development is often indicative of a bullish interval or the beginning of a bull market when long-term holders are in accumulation mode.

However, when the Lengthy-Time period Realized Cap Impulse metric is detrimental, it implies that long-term holders are offloading their cash at costs decrease than their value bases. That is normally seen in late bull cycles and early bear markets, the place long-term buyers are distributing their property.

Moreover, the Lengthy-Time period Realized Cap Impulse indicator gives insights into Bitcoin’s provide and demand dynamics, highlighting main assist and resistance zones. As proven within the chart supplied by Alphractal, the Bitcoin worth is at a essential level marked by a horizontal line referred to as the indecision stage.

Supply: @Alphractal on X

The market intelligence agency famous {that a} breakout of the Lengthy-Time period Realized Cap Impulse metric from this stage might show pivotal to Bitcoin’s long-term well being, signaling continued sturdy demand and potential worth appreciation.

Nevertheless, Alphractal connected a historic relevance to this stage, noting that the Lengthy-Time period Realized Cap Impulse metric was rejected on the indecision zone simply earlier than the COVID-19 dump in March 2020. If historic precedent is something to go by, buyers may wish to be careful for any rejection round this stage, which can set off a major sell-off.

Bitcoin Price At A Look

As of this writing, the value of BTC sits round $103,713, reflecting a mere 0.6% improve previously 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.