Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The Bitcoin worth has simply printed a significant bullish sign, formally confirming a powerful native backside and sparking renewed sentiment amongst analysts. This bullish shift comes after April closed within the inexperienced, reclaiming technical ranges and signaling the potential for a big transfer towards the six-figure worth territory.

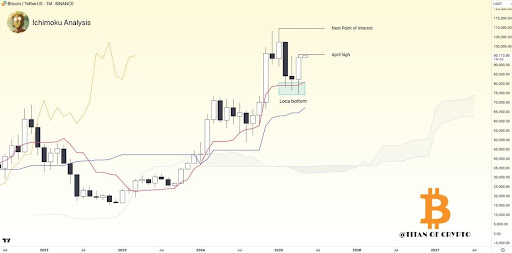

Market knowledgeable Titan Of Crypto has introduced on X (previously Twitter) that Bitcoin has formally hit a neighborhood backside. The analyst shared a chart showcasing that Bitcoin is flashing one of many strongest bullish indicators.

Bitcoin Price Establishes Stable Local Bottom

An in depth above the Tenkan indicators short-term bullish momentum, whereas the Kijun confirms power in a medium-trend. The thick Kimo cloud represents probably the most bullish configuration, indicating clear pattern dominance. Moreover, when Bitcoin closes above all Ichimoku strains, it establishes a dynamic help or resistance zone, validating the general bullish construction.

Including extra weight to this bullish sign, Titan of Crypto revealed that Bitcoin has reclaimed the April excessive, a key resistance degree of round $95,173, which is now appearing as a help space. The oblong zone highlighted as “the local bottom” on the chart displays worth motion between February and April 2025, the place BTC shaped the next low above the Kijun. The bullish April month-to-month candle shut above this zone formally establishes this area as a powerful foundational help, which validates the potential for a neighborhood backside from a technical standpoint.

With the native backside confirmed and momentum on its aspect, Bitcoin might be headed to the following probably resistance space, marked on the chart because the “Next Point of Interest.” This space sits above the $110,000 area, close to $115,000.

For this bullish situation to play out, BTC should keep its place above the April excessive and the Kijun as dynamic help. Bulls might want to defend any retracements towards these zones to protect momentum. Failure to take action might result in a deeper correction, successfully invalidating the bullish outlook.

BTC Price Motion Appears to be like Robust

In a newer X publish, Titan of Crypto introduced that Bitcoin is breaking out of a good vary and its worth motion seems to be sturdy. He shared an Ichimoku Cloud evaluation of the cryptocurrency, exhibiting a possible bullish breakout setup on the 1-day timeframe.

Associated Studying

Trying on the worth chart, Bitcoin has been consolidating between $92,880 and $95,800 over the previous a number of days, however momentum seems to be constructing for a possible breakout. A confirmed shut above $95,800 would validate the breakout and open the door for a bullish continuation, with the worth goal set close to $99,000.

Featured picture from Unsplash, chart from Tradingview.com