Knowledge exhibits the Bitcoin Open Interest has seen a pointy drop not too long ago. Right here’s what this might result in, based on historic development.

Bitcoin Open Interest Has Dropped 17% In Final Week

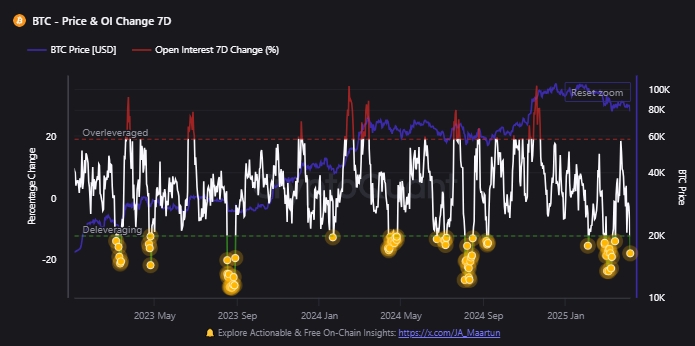

As defined by CryptoQuant neighborhood analyst Maartunn in a brand new publish on X, the 7-day change within the Open Interest has been considerably adverse. The “Open Interest” right here refers to an indicator that measures the overall quantity of positions associated to Bitcoin which can be at the moment open on all derivatives exchanges.

When the worth of this metric rises, it means the buyers are opening up contemporary positions in the marketplace. Usually, new positions accompany extra leverage, so the asset’s value can are likely to grow to be extra unstable when this type of development develops.

However, the indicator happening suggests the derivatives holders are both closing up positions of their very own volition or getting liquidated by their platform. Such a development can result in calmer value motion.

Now, right here is the chart shared by the analyst that exhibits the development within the 7-day change of the Bitcoin Open Interest over the past couple of years:

The worth of the metric seems to have plunged in latest days | Supply: @JA_Maartun on X

As is seen within the above graph, the 7-day common of the Bitcoin Open Interest has dived into the adverse zone not too long ago, implying a considerable amount of positions have disappeared from the market previously week.

Extra particularly, the indicator has taken successful of round 17.8% on this window. This huge drawdown within the metric has come as BTC’s latest volatility has triggered massive liquidations available in the market.

Within the chart, Maartunn has highlighted the situations the place the sector noticed deleveraging of an identical scale through the previous two years. It will seem that many of those occurrences coincided with some type of backside for Bitcoin.

Given this sample, it’s doable that the newest crash within the 7-day change of the Open Interest might additionally grow to be a shopping for alternative for the cryptocurrency.

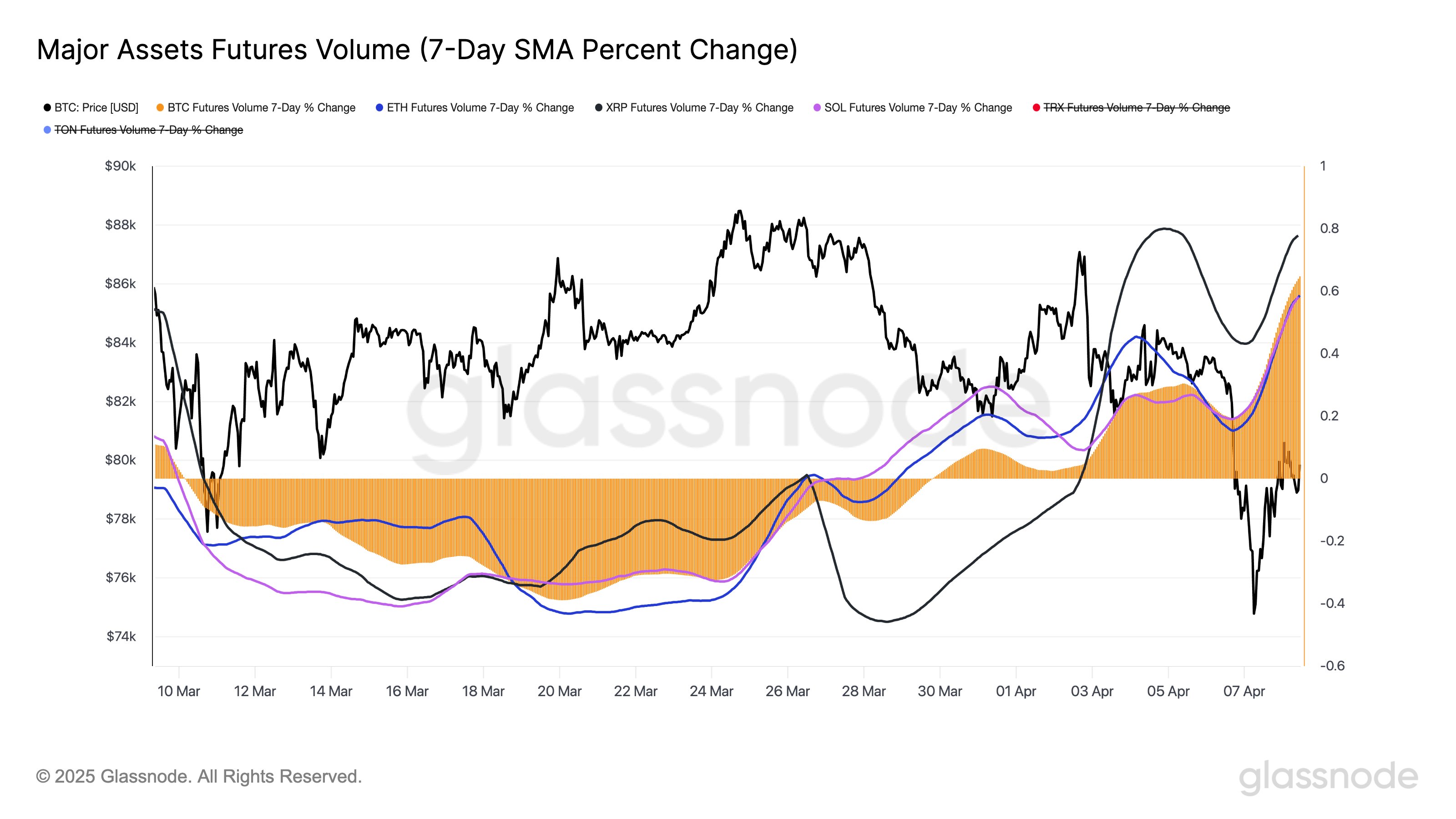

Talking of the futures market, the analytics agency Glassnode has shared in an X publish how the futures quantity has modified not too long ago for main digital property.

The development within the 7-day share change of the futures quantity of main cryptocurrencies | Supply: Glassnode on X

From the chart, it’s obvious that the futures quantity was on the decline for Bitcoin, Ethereum, XRP, and Solana final month, however not too long ago, the metric has reversed its trajectory.

Throughout the previous week, quantity on derivatives exchanges rose for BTC, ETH, XRP, and SOL by 64%, 58%, 78%, and 58%, respectively. This can be a important worth and suggests a return of speculative curiosity round these cryptocurrencies.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $77,900, up virtually 5% previously day.

The development within the BTC value over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.