After a torrid begin to the week, the value of Bitcoin seems to be lastly stabilizing and constructing some bullish momentum. On Friday, March 14, the flagship cryptocurrency demonstrated this rising momentum, because it steadily climbed the charts and briefly crossed the $85,000 mark to shut the week.

Interestingly, the BTC open curiosity (OI) has additionally been transferring in an identical route as the value over the previous few days. With the rising open curiosity, the urgent query that calls for a fast reply is — is the Bitcoin bull run again on monitor?

BTC Open Interest Jumps To $27.9 Billion — What Does It Imply?

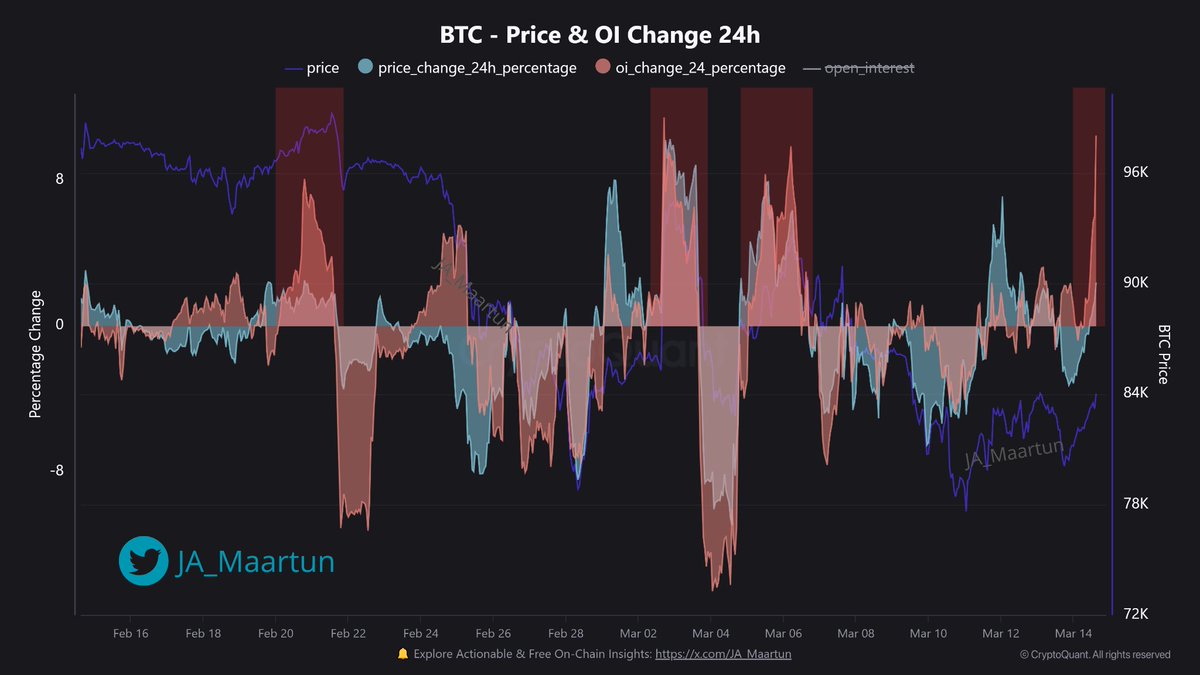

In a brand new put up on the X platform, a CryptoQuant group analyst with the pseudonym Maartunn revealed that the Bitcoin open curiosity is on the rise. For context, the open curiosity metric tracks the entire amount of cash poured into BTC derivatives at any given time.

In accordance with information from CryptoQuant, the Bitcoin OI witnessed a notable upswing on Friday, rising to $27.9 billion. Maartunn famous that this vital transfer marked an over 13% soar (greater than $3.3 billion) from the metric’s most up-to-date low.

Supply: @JA_Maartun

Sometimes, a rise within the Bitcoin open curiosity means that buyers are opening up new positions within the futures and choices market. It implies that buyers are pouring cash into BTC derivatives on the time. Conversely, a falling OI worth signifies that derivatives merchants are leaving their positions or getting liquidated available in the market.

A rising open curiosity could possibly be a wholesome bullish signal for the premier cryptocurrency — particularly if historic priority is something to go by. The inflow of contemporary capital into the market suggests surging investor sentiment (sometimes confidence) or hypothesis on the Bitcoin value trajectory.

As extra buyers flood the derivatives market and proceed to wager on BTC’s value, the rising open curiosity might additional heighten volatility within the Bitcoin market. Elevated volatility indicators that the flagship cryptocurrency might probably expertise massive value actions quickly.

What Subsequent For Bitcoin Value?

BTC’s value does look like gearing for a big transfer to the upside. Chartered Market Technician Tony Severino shared on the X platform that the market chief might make a run to round $95,000 over the subsequent few days.

Supply: @tonythebullBTC

The crypto professional famous that this projection hinges on the Bitcoin value reclaiming the 200-day transferring common (MA). If the value of BTC decisively closes above this MA, it might run to the 50-day MA across the mid-$90,000 area.

As of this writing, the value of Bitcoin stands at round $84,500, reflecting an nearly 5% improve previously 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by DALL-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.