Information reveals Bitcoin sentiment on social media could also be beginning to turn into overheated, an indication that might find yourself being a menace to the worth rally.

Bitcoin Social Media Sentiment Is At present Notably Optimistic

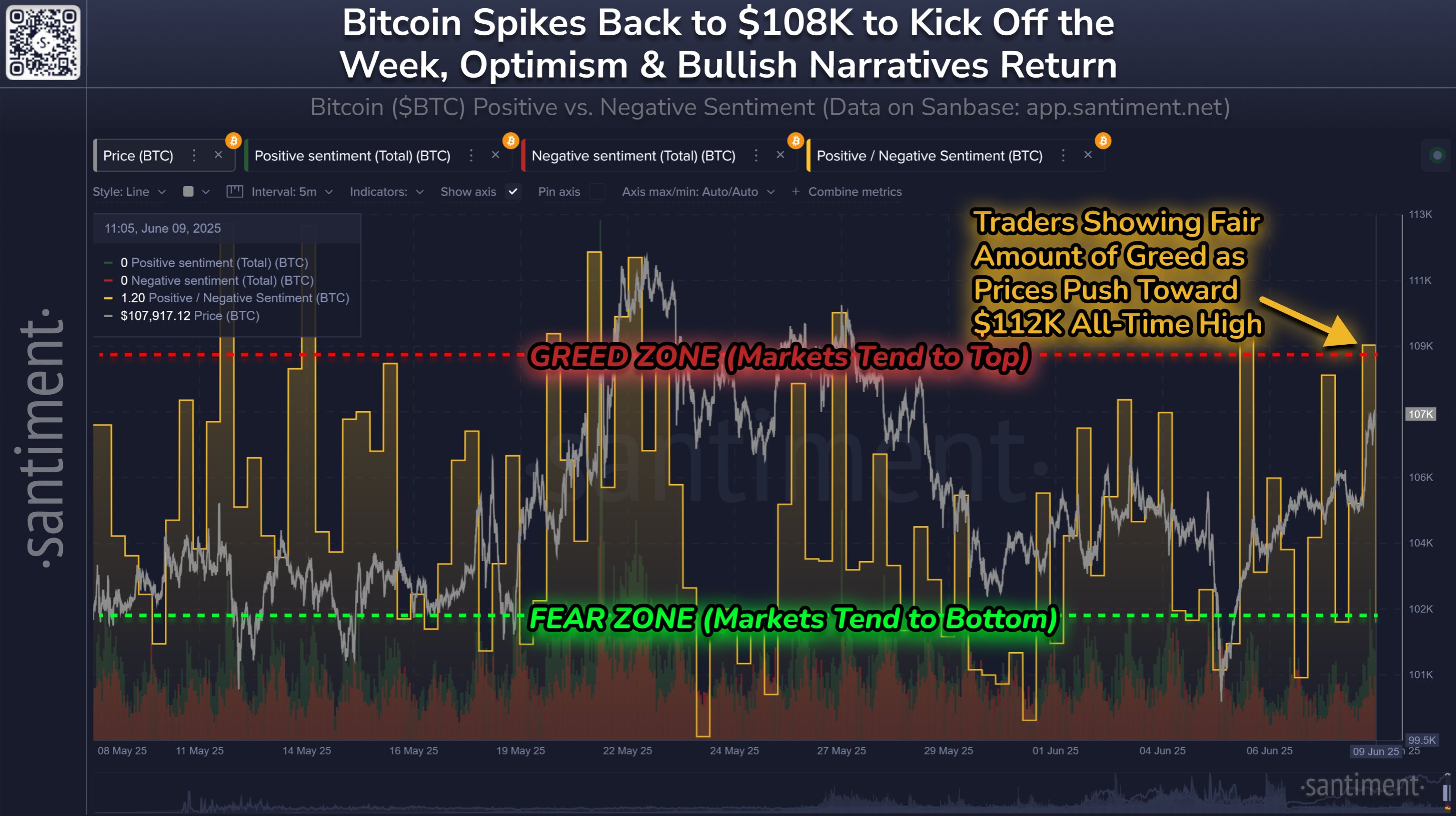

In a brand new publish on X, the analytics agency Santiment has mentioned how sentiment round Bitcoin has modified on the foremost social media platforms after the most recent restoration rally.

The indicator of relevance right here is the “Positive/Negative Sentiment,” which compares the extent of optimistic sentiment to destructive sentiment round a given cryptocurrency on social media.

The metric works by filtering posts/messages/threads containing mentions of the asset and placing them by a machine-learning mannequin that separates between optimistic and destructive feedback. The indicator counts up the variety of each forms of posts and takes their ratio to supply a internet illustration of social media.

Now, right here is the chart shared by Santiment that reveals the pattern within the Optimistic/Destructive Sentiment for Bitcoin over the previous month:

The worth of the metric seems to have spiked in latest days | Supply: Santiment on X

As displayed within the above graph, the Bitcoin Optimistic/Destructive Sentiment has seen a spike within the zone above the 1.0 mark, which suggests a flood of optimistic posts associated to the asset have hit social media platforms. This flip towards a major optimistic sentiment has come because the cryptocurrency’s worth has been going by a restoration surge.

This isn’t a very uncommon pattern, as pleasure tends to rise amongst merchants every time bullish worth motion takes place. Within the context of the most recent surge, particularly, an uplift of sentiment isn’t shocking, because it has introduced the worth near the all-time excessive (ATH).

Whereas some hype is to be anticipated, an extra of it may be one thing to be careful for. The rationale behind that is the truth that Bitcoin and different cryptocurrencies have traditionally tended to maneuver within the course that goes opposite to the gang’s opinion.

Because of this a surge of greed available in the market is one thing that may result in a high for the asset’s worth. Equally, a cooldown in sentiment can indicate a bullish reversal as an alternative.

From the chart, it’s obvious that the Optimistic/Destructive Sentiment declined to a comparatively low stage a couple of days in the past when Bitcoin noticed a drawdown towards $100,000. This concern amongst social media customers could have helped the coin attain a backside.

After the most recent spike within the indicator, the scenario is now the alternative, with Worry Of Lacking Out (FOMO) doubtlessly growing among the many buyers. It now stays to be seen whether or not this overexcitement would supply impedance to the worth rally or not.

BTC Worth

Bitcoin briefly broke above $110,000 through the previous day, however the asset has since seen a minor pullback because it’s now again at $109,500.

The pattern within the BTC worth during the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from iStock.com, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.