Ark is a novel off-chain transaction batching mechanism initially proposed by Burak, a younger Turkish developer. There are at the moment two implementations being constructed, one by Ark Labs, and the opposite by Second, neither of which Burak is concerned with.

The unique proposal for Ark was way more sophisticated, and concerned some design targets extra centered round privateness than the implementations at the moment being constructed. It was additionally initially envisioned to require CHECKTEMPLATEVERIFY (CTV) as a way to be constructed.

The protocol is determined by a central coordinating server as a way to operate correctly, however regardless of that is ready to present the identical performance and safety ensures that the Lightning Community does. So long as a consumer stays on-line through the required time interval, always (except they select to belief the operator for brief intervals of time) each consumer is succesful at any time of unilaterally exiting the Ark system at any time and taking again full unilateral management of their funds onchain.

In contrast to Lightning, Ark doesn’t require customers to have pre-allocated liquidity assigned to them as a way to obtain funds. An Ark consumer can merely onboard to a pockets and obtain funds instantly with no liquidity pre-allocation in any respect.

Let’s stroll by means of the totally different constituent items of Ark.

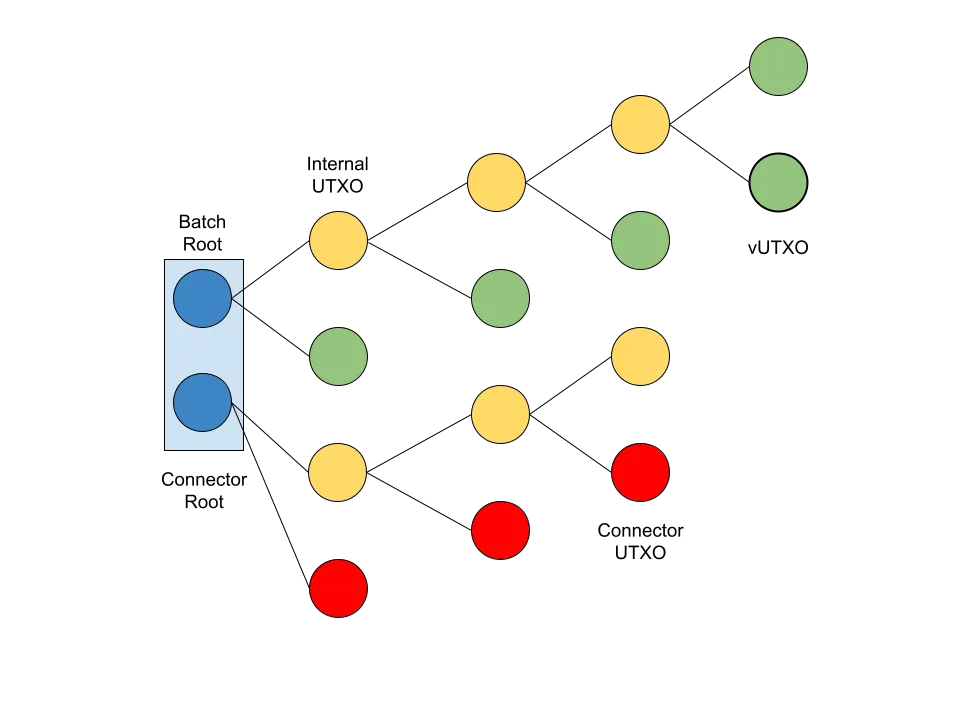

The Ark Tree

Cash held on Ark are referred to as Digital UTXOs (vUTXOs). These are merely pre-signed transactions that assure the creation of an actual UTXO underneath the unilateral management of a consumer as soon as submitted onchain, however are in any other case held offchain.

Each consumer’s vUTXOs are nested inside a tree of pre-signed transactions, or a “batch.” Ark works by having the coordinator server, or Ark Service Supplier (ASP), facilitate the coordination between customers essential to create a batch. At any time when customers are receiving funds, onboarding to Ark, or offboarding, it’s essential to assemble a transaction and the related transaction tree to create a brand new batch.

The tree is constructed to take the one root UTXO confirmed onchain, locked with an n-of-n multisig together with all customers holding vUTXOs within the tree in addition to the ASP, and slowly break up into increasingly more UTXOs till finally reaching the leaves, that are every customers vUTXO. Every vUTXO is assured utilizing a script that needs to be signed by a 2-of-2 multisig, one key held by the consumer, and the opposite by the ASP, or simply the consumer after a timelock.

Every time the tree splits, vUTXOs are created onchain, however so are extra inner UTXOs which have but to truly break up into vUTXOs. Every of those inner UTXOs is locked with an n-of-n multisig composed of the ASP, and all customers who’ve a vUTXO additional down the tree. Through the batch creation course of, customers begin at their respective vUTXOs, and undergo a signing course of all the best way again down the foundation of the tree. This ensures that the foundation won’t ever be signed earlier than every consumer’s declare to a vUTXO is, guaranteeing they all the time have unilateral entry in a worst case state of affairs to their funds.

Every batch additionally has an expiry time (which can make sense within the subsequent part). This expiry spend path, which exists as an alternate spending situation for the foundation UTXO onchain in addition to each inner UTXO, permits the ASP to unilaterally spend all funds by itself.

Transactions, Preconfirmation, and Connector Inputs

With regards to transacting on Ark, there are two doable mechanisms which can be doable, each with their very own prices and implications by way of safety mannequin. There are out-of-round transfers, or preconfirmed transactions, and there are in-round transfers, or really confirmed transactions.

To conduct an out-of-round switch is a quite simple course of. If one consumer (Alice) desires to pay one other (Bob), they merely contact the ASP and have them co-sign a transaction spending the vUTXO to Bob. Bob is then provided that pre-signed transaction, in addition to all the opposite ones previous it again to the batch root onchain. Bob is now able to unilaterally exiting the Ark with this transaction, however, he should belief the ASP to not collude with Alice to doublespend it. These out-of-round transactions may even be chained a number of instances earlier than lastly confirming them.

To finalize an Ark transaction, customers have to have interaction in a “batch swap.” Customers can’t really trustlessly affirm a switch inside a single batch, they need to atomically swap a vUTXO in an current batch with a contemporary vUTXO created in a brand new batch. That is achieved utilizing the ASP as a facilitator of the swap, and with assistance from what known as a “connector input.”

When a consumer goes to finalize an Ark transaction with a batch swap, they relinquish management of the vUTXO to the ASP. This may very well be problematic, what’s to cease the ASP from merely maintaining it and never giving them a confirmed vUTXO in a brand new batch? The connector enter.

When a brand new batch is created, a second output is created within the transaction that’s confirmed on chain instantiating a brand new tree composed of connector UTXOs. When Bob goes to signal over a forfeit transaction to the ASP to conduct the batch swap, the transaction contains as an enter one of many connector UTXOs from the brand new batch.

This creates an atomic assure. Bob’s confirmed vUTXO is included in a batch in the identical transaction the connector enter is created in that’s vital for his forfeit transaction to be legitimate. If that batch isn’t created onchain, i.e. Bob by no means really receives the brand new confirmed vUTXO, then the forfeit transaction he signed for the ASP won’t ever be legitimate and confirmable onchain.

Liquidity Dynamics and Blockspace

All the liquidity essential to create new batches as a way to facilitate transfers between customers is supplied by the ASP. They’re required to have sufficient liquidity to create new batches for customers till outdated ones have expired and the ASP can unilaterally sweep them to reclaim outdated liquidity beforehand locked as much as create vUTXOs for customers.

That is the core of the liquidity dynamic on the middle of the Ark protocol. Whereas in a single sense this can be a huge effectivity win, not requiring liquidity suppliers to evaluate customers and primarily guess which of them will really obtain giant volumes of funds earlier than they’ll obtain any funds, in one other it’s an effectivity loss because the ASP will need to have sufficient liquidity to proceed creating new batches for customers for nonetheless lengthy they configure the expiry time to be they usually can begin reclaiming allotted liquidity.

This may be mitigated to a good diploma by how usually an ASP gives to create new batches to finalize pending transactions. Within the occasion of an ASP making an attempt to create new batches in actual time as transactions are coming in, the liquidity necessities could be exorbitantly excessive. Nevertheless, an ASP can decrease the frequency at which they create new batches and drastically decrease their liquidity necessities.

This dynamic additionally has implications for blockspace use. In contrast to Lightning, which might present sturdy affirmation ensures fully offchain, to ensure that an Ark transaction to have an equal trustless diploma of finality a brand new batch has to be created onchain. Because of this in contrast to Lightning, the place transaction quantity doesn’t replicate itself onchain, the speed of Ark transactions inherently requires a proportional quantity of blockspace use, albeit in a really compressed and environment friendly method. This creates a theoretical higher restrict of what number of Ark batches will be created throughout any given time interval (though Ark bushes will be smaller or bigger relying on this dynamic).

Wrapping Up

Ark presents in some ways an virtually reverse set of tradeoffs to the Lightning Community. It’s a huge blockspace effectivity enchancment for offchain transactions, and does away with the issue of liquidity allocation on the Lightning Community, however it does have a a lot nearer tied throughput restrict that’s correlated with the blockchains throughput restrict.

This dynamic of virtually reverse tradeoffs makes it a really complementary system to the Lightning Community. It may additionally interoperate with it, i.e. vUTXOs will be swapped atomically in transactions coming into or exiting the Lightning Community.

In the end the way it matches into the broader Bitcoin ecosystem is but to be seen, however it’s an undoubtedly useful protocol stack that can discover some useful area of interest, even whether it is totally different than initially meant.