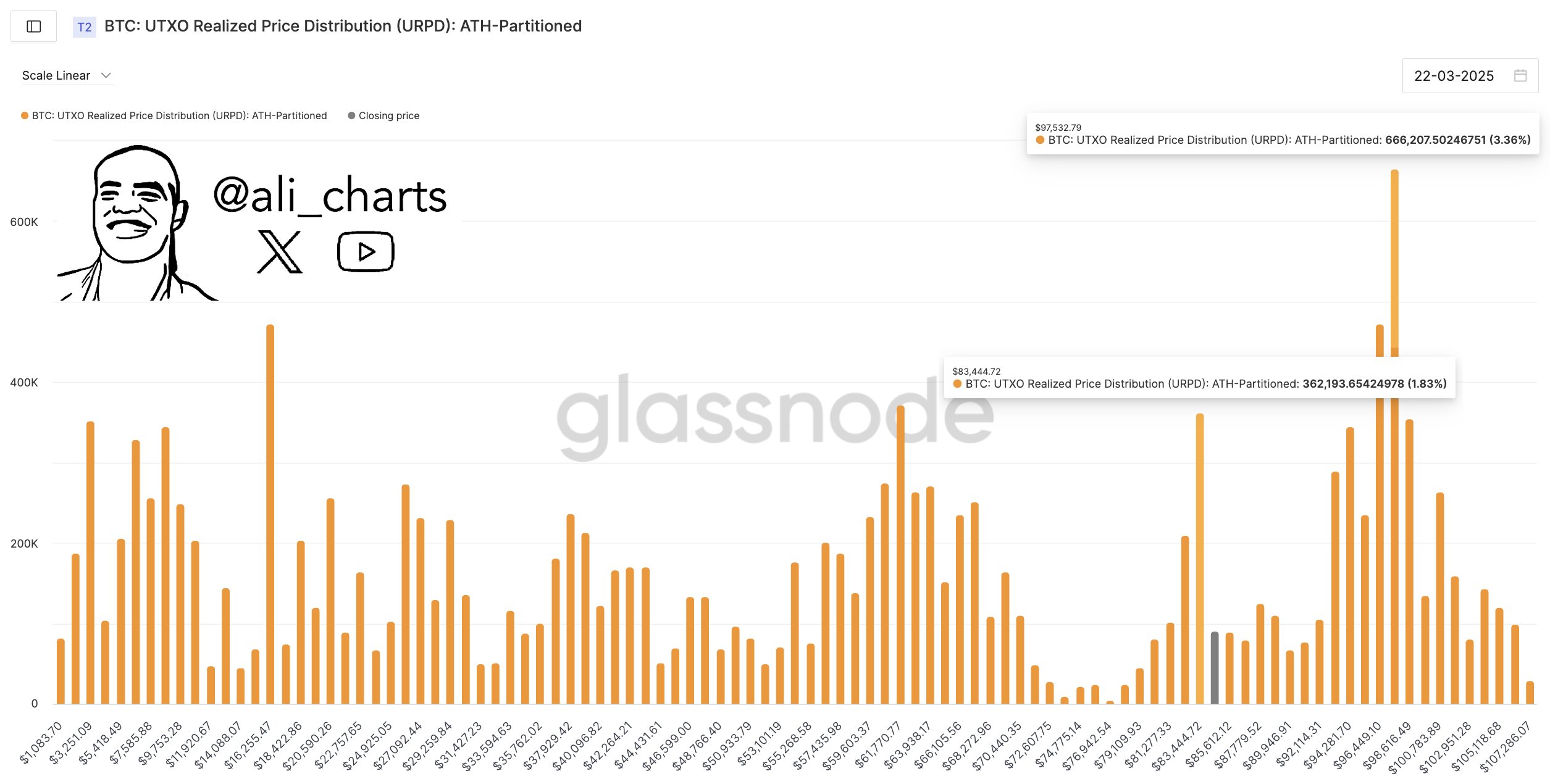

Crypto analyst Ali Martinez has shared some essential insights into the present Bitcoin (BTC) market based mostly on UTXO Realized Worth Distribution (URPD). Utilizing this metric, the famend market professional has highlighted key help and resistance ranges with a probably sturdy impression on BTC’s rapid value motion.

Following one other week of widespread market uncertainty, Bitcoin costs stay in consolidation, failing to make an efficient breakout above $84,380.

Bitcoin Bull Run: $97,532 Holds Key To Renewed Bullish Momentum

In on-chain evaluation, the Unspent Transaction Output (UTXO) represents the rest of Bitcoin after each transaction which can be utilized as enter in a brand new transaction. Subsequently, the UTXO Realized Worth Distribution permits analysts to determine value ranges at which Bitcoin’s present provide was final moved. By highlighting value ranges with excessive concentrations of UTXOs, the URPD is a vital metric in discovering resistance and help ranges.

In an X submit on March 22 by Martinez, information from Glassnode reveals a powerful cluster of UTXOs round $83,444 indicating that many buyers have their price foundation round this degree. At the moment, BTC’s value is effectively above this help degree exhibiting intent of a possible upswing. Nevertheless, Martinez notes {that a} stiff resistance awaits market bulls on the $97,532 value degree which additionally hosts an unlimited quantity of UTXOs.

The analyst explains {that a} profitable clearance of this resistance value degree would sign a renewed bullish momentum in a BTC market that has undergone important correction prior to now few months. In a extremely constructive state of affairs, Bitcoin is more likely to surge in direction of new all-time highs. Nevertheless, failure to maneuver previous $97,532 could pressure BTC to stay in consolidation and even retrace to decrease help ranges.

Bitcoin Rearing To Resume Uptrend?

In different developments, Martinez has urged Bitcoin’s present correction is probably going nonetheless ongoing based mostly on the Bitcoin Sharpe Ratio. For context, the Sharpe Ratio determines whether or not BTC’s returns are presently well worth the degree of danger concerned for the time being.

The analyst explains that finest market entries have occurred when the Bitcoin Sharpe ratio is at low danger, presenting a positive shopping for alternative. Nevertheless, the present Sharpe ratio signifies excessive danger suggesting that potential BTC buyers would possibly have to train persistence.

Martinez mentioned:

We’re not there but, however getting shut would possibly sign a chief shopping for window!

At the time of writing, BTC continues to commerce at $84,075 following a 0.27% value enhance within the final 24 hours. Nevertheless, the asset’s every day buying and selling quantity has crashed by 46.41% as market engagement falls.

Featured picture from MorningStar, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.