Bitcoin value holds regular above $84,000 as President Trump lambasts the Fed criticism. Although optimism is excessive, merchants urge warning, two key onchain metrics. Stablecoin development is slowing down, which means there may be little capital flowing into crypto. Additionally, the Bitcoin Realized Cap is at an all-time excessive however increasing at a comparatively gradual tempo.

Crypto costs stay regular, holding above the $2.7 trillion mark as buyers carefully monitor Bitcoin. Presently, the Bitcoin value is agency above $84,000, rejecting any makes an attempt by sellers to push the coin under April 2025 lows.

(BTCUSDT)

EXPLORE: Greatest New Cryptocurrencies to Put money into 2025

Bitcoin Agency Above $84,000 as Trump Criticizes the Federal Reserve

At spot charges, the digital gold is up practically 8% prior to now week of buying and selling, inching nearer to $85,000. If patrons press on, any shut above $90,000 within the coming few days might see buyers flip their consideration to a few of the finest 100X cryptos in 2025.

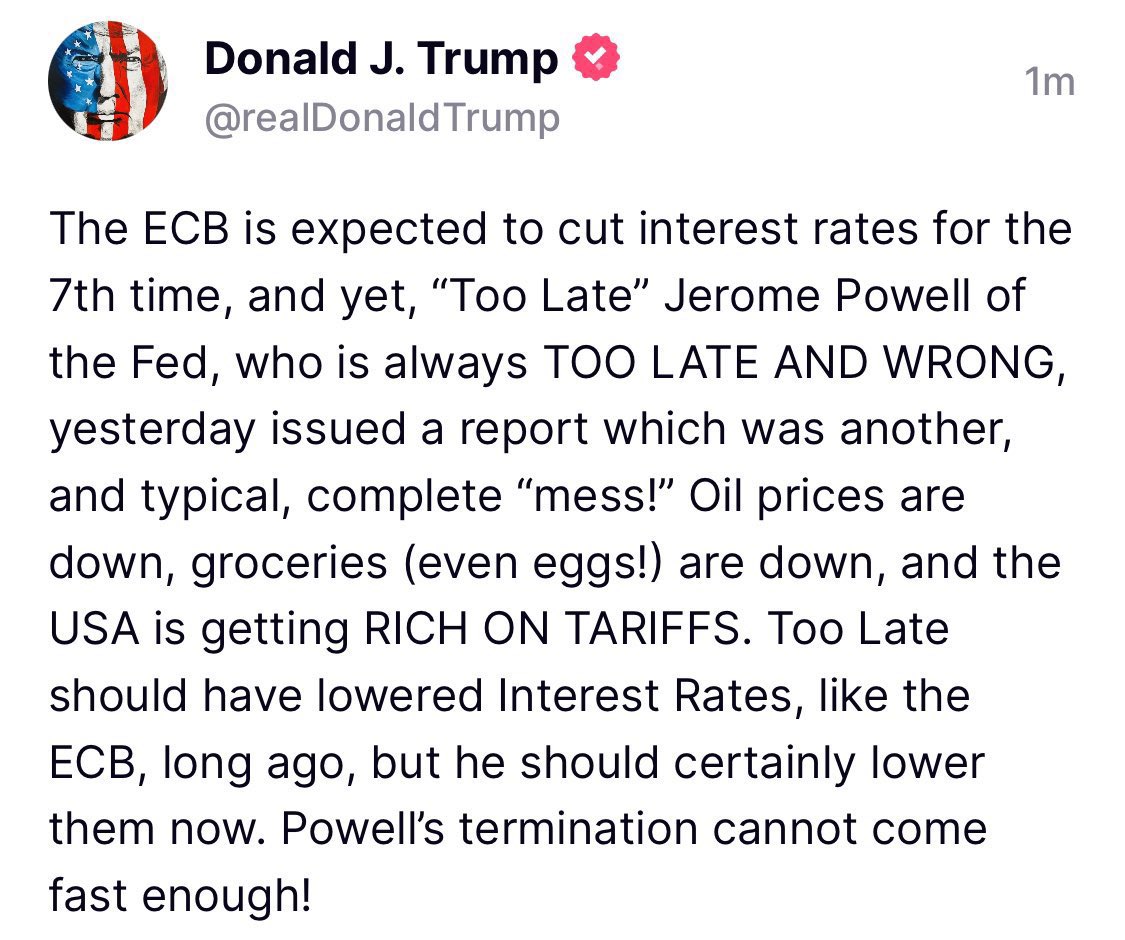

Remarkably, Bitcoin is proving resilient, barely 12 hours after Donald Trump launched a public tirade in opposition to Jerome Powell, the chair of the Federal Reserve. The President has criticized the central financial institution’s stance on rates of interest, demanding they be lowered.

Annoyed by Powell and the Federal Reserve’s gradual response, Trump has known as for his dismissal.

On Wednesday, the chair mentioned Trump’s aggressive tariff insurance policies might negatively affect the economic system, with penalties “larger than anticipated.”

“The level of tariffs increases announced so far is significantly larger than anticipated, and the same is likely to be true for the economic effects, which is higher inflation and slower growth.” – Powell

How a lot clearer might it get?

— Spencer Hakimian (@SpencerHakimian) April 17, 2025

Powell additionally famous that the central financial institution is navigating uncharted financial waters to maintain inflation low and stabilize employment.

If the Federal Reserve slashes charges, Bitcoin, a hedge in opposition to fiat debasement and coverage uncertainty, might soar. In flip, a few of the finest Solana meme cash might additionally profit.

Watch Out for These 2 Key BTCUSDT Metrics

Nonetheless, beneath the present optimism and value stability, Glassnode analysts have recognized two main tendencies that will immediate bulls to reassess their positions.

Of their evaluation on X, they noticed that stablecoin provide development has slowed in latest weeks.

Tokens like USDT, USDC, FUSD, and USDS are primarily used as quote belongings for many crypto pairs on main exchanges. When stablecoin provide grows, it indicators new capital coming into the market, usually boosting Bitcoin and altcoin costs.

(Supply)

Nonetheless, latest information reveals that whereas provide stays regular, development momentum is softening. This improvement signifies a “risk-off” setting, with buyers hesitant to deploy capital aggressively into Bitcoin and even a few of the hottest presales in 2025.

Moreover, the Bitcoin Realized Cap is at an all-time excessive of $872 billion. This metric measures the valuation of all BTC primarily based on the value when it was final moved.

(Supply)

Regardless of the Realized Cap hitting a document excessive, it grew by lower than 1% over the previous month. From this, analysts concluded that capital inflows into BTC are slowing, regardless that spot costs stay regular above $80,000.

The slowdown in Realized Cap momentum indicators that long-term holders, or “diamond hands,” aren’t promoting. Nonetheless, new patrons are much less aggressive, pointing to warning and a “risk-off” sentiment. If this persists, Bitcoin costs are prone to consolidate sideways quite than break greater.

DISCOVER: Greatest New Cryptocurrencies to Put money into 2025 – Prime New Crypto Cash

Bitcoin Regular at $84K: Trump Slams Fed, However 2 Signals Trace at Warning

- Bitcoin agency above $84,000, consolidating above April lows

- Trump criticizes Jerome Powell and Fed, needs charges to be reduce

- USDT, USDC, and stablecoin provide development slowing down, suggesting merchants are cautious

- The Bitcoin Realized Cap hit an all-time excessive, however momentum is fading as diamond arms “HODL”

The publish Bitcoin Holds Above $84,000: What Do These 2 BTCUSDT Signals Say About Sentiment? appeared first on 99Bitcoins.