Yesterday, IOTA crypto launched its Starfish, a brand new Byzantine Fault Tolerant (BFT) consensus mechanism to reinforce DAG-based distributed ledgers. It comes with modern strategies to enhance scalability, safety, and effectivity. However, what’s IOTA?

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

Value

Quantity in 24h

<!–

?

–>

Value 7d

is a distributed ledger know-how tailor-made for the Web of Issues (IoT), utilizing a Directed Acyclic Graph (DAG) referred to as Tangle as an alternative of a standard blockchain. This construction permits for prime scalability and feeless transactions, making it splendid for microtransactions in IoT ecosystems.

The IOTA crypto objective is to allow safe, decentralized knowledge and worth transfers throughout linked gadgets with Starfish, which addresses limitations like excessive charges and vitality use in blockchain techniques.

We’re excited to share our new whitepaper on #IOTA Starfish – our next-gen Byzantine Fault Tolerant consensus mannequin for DAG-based protocols.

That is our newest work to extend the scalability and resiliency of blockchain networks.

1/10 pic.twitter.com/ZNBO3NCG0Y

— IOTA (@iota) April 17, 2025

EXPLORE: Dave Portnoy’s New Meme Coin Went 100,000% However What Is The Greatest Meme Coin to Purchase?

IOTA Crypto Launched Its New Starfish Whitepaper: What to Know

The newly launched Starfish’s consensus mannequin mixes the safety of licensed DAGs with the effectivity of uncertified ones. It operates underneath partial synchrony, decreasing trade-offs between security and velocity.

This synchrony ensures the protocol stays safe in opposition to Byzantine faults whereas sustaining excessive efficiency in any circumstances. The mannequin helps constant operation throughout networks with 10 to 100 validators, delivering dependable transaction processing.

IOTA Starfish – our next-gen Byzantine Fault Tolerant consensus mannequin for DAG-based protocols.

Starfish: A excessive throughput BFT protocol on uncertified DAG with linear amortized communication complexity— Carlos R. Ferreira (@carlosrof) April 17, 2025

Starfish Key Characteristic:

- Modern Consensus Mannequin: Starfish is {a partially} synchronous DAG-based BFT protocol that mixes the safety of licensed DAGs with the effectivity of uncertified DAGs, decreasing trade-offs between safety and efficiency.

- Encoded Cordial Dissemination: This mechanism permits validators to broadcast full transaction knowledge for their very own blocks whereas sharing encoded shards for others’ blocks, enabling environment friendly and safe knowledge reconstruction with minimal communication.

- Excessive Efficiency: Starfish achieves sub-second latency with as much as 150,000 transactions per second (TPS) and maintains constant efficiency throughout 10–100 validators, even underneath adversarial circumstances.

- Low Communication Complexity: It presents linear amortized communication complexity (O(n) per transaction byte), making it bandwidth-efficient and splendid for large-scale DLT networks.

- Knowledge Availability Verification: Starfish makes use of dedicated chief blocks as Knowledge Availability Certificates (DACs), making certain knowledge availability for giant transactions whereas protecting communication prices low.

DISCOVER: Greatest Meme Coin ICOs to Put money into 2025

Execs and Cons

Safety is IOTA Starfish energy, it presents strong Byzantine fault tolerance. It maintains community integrity and efficiency even underneath malicious assaults, matching the ability of licensed DAG protocols. This reliability is vital for trust-sensitive functions, making certain knowledge and transactions stay safe in decentralized environments.

Starfish’s environment friendly useful resource use its low communication complexity. Decreasing bandwidth necessities permits validators to function successfully in massive networks. This effectivity lowers operational prices and helps adoption in IoT ecosystems.

Nevertheless, implementing Starfish’s mechanisms, reminiscent of Encoded Cordial Dissemination and DACs, introduces complexity. Builders will doubtlessly face challenges integrating these options, which can end in slowing the adoption tempo. The protocol’s superior design requires cautious implementation to make sure compatibility with present techniques.

Consensus is just not the one part we’re researching and bettering. The IOTA Rebased launch is only the start. And sure, Starfish is just not a part of the Mainnet launch, so no delays right here to fret about. Keep tuned for some information very quickly…

— Alexander Sporn (@alexsporn) April 17, 2025

As a whitepaper-stage protocol, Starfish continues to be in early improvement. It wants rigorous testing earlier than mainnet integration, and unexpected points can come up. This stage introduces dangers, as real-world efficiency could differ from theoretical projections till totally validated.

Starfish’s efficiency is optimized for 10 to 100 validators, however bigger or smaller networks would require changes. This dependence on validator rely may restrict flexibility in sure deployments, necessitating additional tuning to take care of effectivity throughout various community sizes.

DISCOVER: 9+ Greatest Excessive-Threat, Excessive-Reward Crypto to Purchase in 2025

Why IOTA Pumps? Can IOTA Crypto Bypass SUI with Its Starfish?

IOTA and its Starfish know-how mix scalability, safety, and effectivity, which pulls curiosity from crypto builders and traders. Its energy to beat DAG-based DLT challenges additionally generates enthusiasm that drives engagement. The facility itself aligns with IOTA’s imaginative and prescient for superior decentralized techniques.

The Starfish whitepaper launch shows IOTA’s ongoing innovation, bumping traders’ confidence in its roadmap. This progress encourages holding and group involvement.

Beneath the identical targets, Starfish’s DAG-based BFT protocol outshines

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

Value

Quantity in 24h

<!–

?

–>

Value 7d

blockchain strategy in scalability and effectivity. Whereas SUI achieves excessive TPS with its Narwhal-Tusk consensus, Starfish’s knowledge propagation presents superior bandwidth effectivity and strong safety. These make IOTA a extra versatile resolution than SUI for decentralized, high-throughput functions.

(supply)

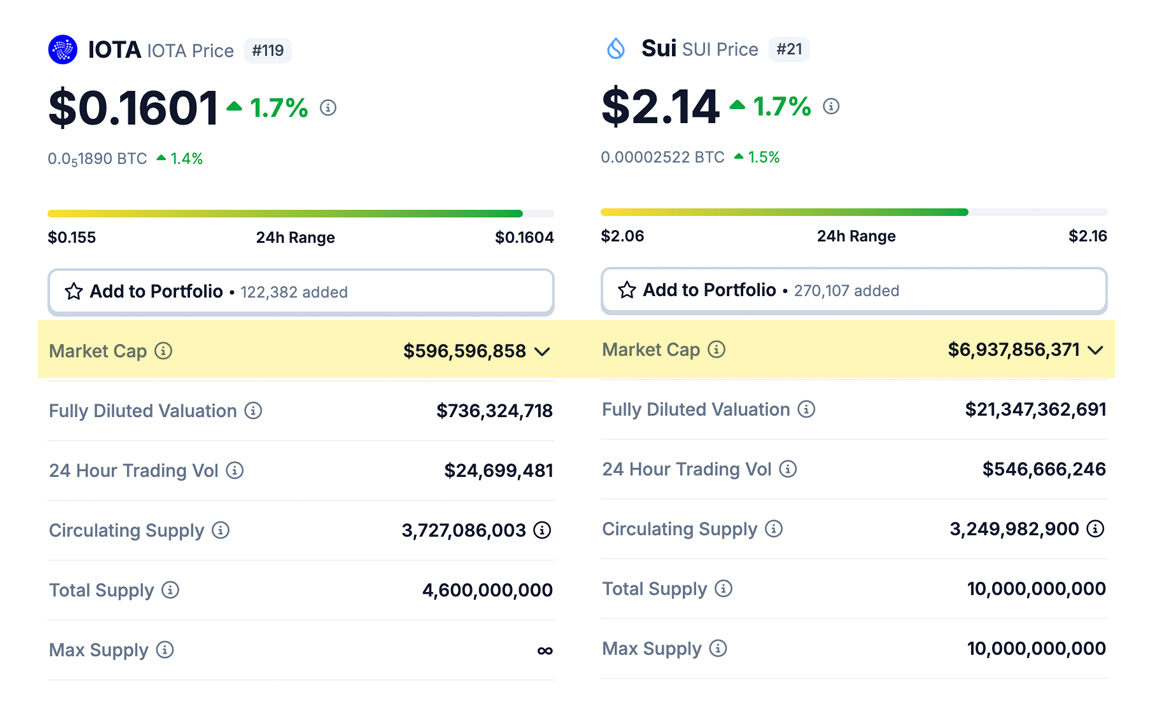

Priced at roughly $0.15, IOTA’s market cap nonetheless stands at underneath $600 million. Forecasts counsel IOTA can attain $1.00 by 2025, coming from its IoT adoption and Starfish’s scalable consensus. At $2.11 with a $6.68 billion market cap, SUI faces steeper corrections, with predictions starting from $4.19 to $9.20.

IOTA’s stability, pushed by its feeless Tangle and Starfish’s scalable consensus, helps regular development, making it a lower-risk funding.

For now, stakeholders are anticipating future integrations like mainnet deployment, which can elevate curiosity in IOTA’s ecosystem.

EXPLORE: Dave Portnoy’s New Meme Coin Went 100,000% However What Is The Greatest Meme Coin to Purchase?

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

- What’s IOTA crypto and its starfish?

- IOTA execs and cons.

- What fueled the IOTA current pump and its various?

The publish Why is IOTA Crypto Up? Everything To Know About IOTA Starfish appeared first on 99Bitcoins.