Bitcoin is buying and selling under key resistance ranges as bulls proceed to wrestle to ignite a restoration rally. Since peaking in January, BTC has been trapped in a persistent downtrend, shedding over 29% from its all-time excessive. This sustained weak point has sparked rising considerations amongst traders and analysts, with some warning {that a} bear market could also be underway.

Regardless of the cautious sentiment, there’s nonetheless hope amongst market watchers who consider Bitcoin is present process a wholesome correction inside a broader bull cycle. They argue that the current dip may current a long-term shopping for alternative, particularly if key assist ranges maintain and bullish alerts emerge within the coming days.

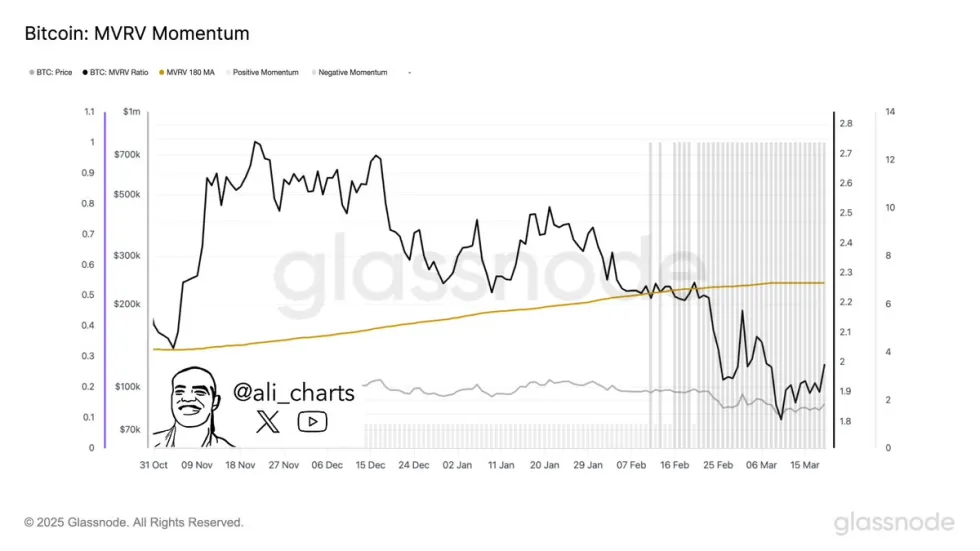

One such sign could come from the MVRV momentum indicator and the 180-day easy transferring common (SMA). Based on knowledge from Glassnode, the 2 metrics are approaching a possible golden cross—an occasion traditionally related to main upward strikes in Bitcoin’s value. If this crossover is confirmed, it may mark a shift in market momentum and sign that BTC is making ready for an additional leg up in its present cycle.

Bitcoin Inches Greater As Analysts Watch For Bullish Signal

Bitcoin is buying and selling above essential demand ranges after a pointy restoration from Tuesday’s $81,000 low. The world’s largest cryptocurrency has bounced over 7% since then, offering a glimmer of hope for bulls after weeks of relentless promoting stress and macro-driven uncertainty. Since its all-time excessive close to $109,000 in January, Bitcoin has misplaced greater than 29% of its worth, triggering debates amongst analysts about whether or not the market remains to be in a bull cycle or initially of a brand new bearish section.

Regardless of the doubts, key technical indicators could recommend a shift in sentiment. Based on high analyst Ali Martinez, the MVRV momentum indicator and the 180-day easy transferring common (SMA) are approaching a golden cross—a traditionally bullish sign that always precedes sturdy upward developments. This crossover, if confirmed, would mark a possible inflection level and reinforce the concept the current correction could also be a part of a broader bull run somewhat than a whole development reversal.

Nonetheless, Bitcoin has work to do. Bulls should maintain present ranges and push above the $88K–$90K zone to verify a restoration and retest the earlier highs. For now, merchants are cautiously optimistic, watching on-chain metrics and technical indicators intently for the subsequent massive transfer.

BTC Value Struggles Under Key Averages Amid Uncertainty

Bitcoin is at present buying and selling at $83,900, persevering with to hover under essential resistance as bulls try to reclaim momentum. The worth has been trapped under the 200-day easy transferring common (SMA) and the 200-day exponential transferring common (EMA), which now act as key technical obstacles close to the $85,500–$86,000 vary. Reclaiming this degree is important for confirming a restoration rally, particularly after Bitcoin’s prolonged downtrend since late January.

Regardless of a 7% bounce from the current low at $81,000, the market stays cautious. A decisive transfer above $86,000 would give bulls the energy wanted to retest larger ranges towards $90K and break the present bearish construction. Nevertheless, and not using a sturdy push above this threshold, Bitcoin dangers shedding its short-term momentum and slipping again towards decrease demand zones.

If the $86K mark continues to reject value motion, a transfer under $81K may observe, probably triggering extra promoting stress and panic amongst retail traders. The approaching days will likely be essential, as bulls should present energy and defend present ranges to keep away from additional draw back. Market contributors are intently monitoring each technical indicators and macroeconomic developments for clues on Bitcoin’s subsequent route.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.