Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin has entered an necessary zone in latest days, with the $94,500 value space standing out as an more and more necessary battleground for its short-term trajectory. Though the main cryptocurrency has made a number of makes an attempt to clear this area throughout its newest rally, it has confronted repeated rejections, highlighting the presence of sturdy resistance.

Regardless of these setbacks, on-chain knowledge signifies vital whale accumulation famous on crypto exchanges, hinting that the bullish undercurrent continues to be sturdy as Bitcoin seems to finish April 2025 on a postive shut.

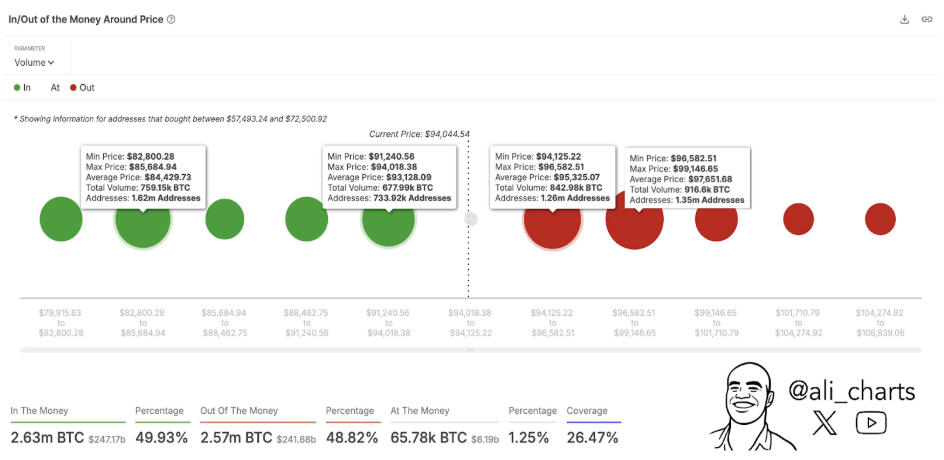

Heavy Resistance Cluster Between $94,125 And $99,150

In response to crypto analyst Ali Martinez, who shared insights from on-chain analytics platform IntoTheBlock, Bitcoin is encountering heavy resistance between the $94,125 and $99,150 value vary.

Associated Studying

Notably, his publish on social media platform X exhibits that roughly 2.61 million pockets addresses have gathered about 1.76 million BTC inside this zone, making it one of many densest provide limitations Bitcoin has confronted in its present market cycle.

As proven within the chart under, about 1.26 million addresses maintain near 843,000 BTC between $94,125 and $96,582, whereas one other 1.35 million addresses are clustered between $96,582 and $99,146, holding roughly 917,000 BTC. This focus of holders creates a formidable wall that Bitcoin should breach decisively whether it is to proceed its upward march into the following month.

A powerful and decisive every day or weekly shut above $96,600 might invalidate the overhead resistance right here, putting the following goal zone at $99,150. In the end, the shopping for momentum right here would clear the trail for the Bitcoin value to lastly goal $100,000 and past once more.

Conversely, repeated failures at this zone might trigger a retest of decrease assist ranges round $93,000 and $84,000, which even have vital volumes of 678,000 BTC and 759,150 BTC, respectively.

Picture From X: ali_charts

Bitcoin’s Bullish Construction Nonetheless Intact

Even because the $94,000 to $99,000 resistance zone poses a near-term problem, technical patterns counsel that Bitcoin’s rally is simply starting. One other distinguished crypto analyst, often called Titan of Crypto, reaffirmed that Bitcoin’s long-term value goal of round $125,000 continues to be legitimate.

This goal is derived from an enormous Inverse Head and Shoulders (H&S) sample recognized on the Bitcoin month-to-month candlestick chart.

Picture From X: Titan of Crypto

The chart exhibits a transparent breakout above the neckline of the Inverse H&S formation earlier this 12 months when Bitcoin pushed to its present all-time excessive round $108,790. Since then, the worth motion has been adopted by a retest that’s holding agency above a assist trendline on the month-to-month timeframe.

Associated Studying

In response to the analyst, this technical construction exhibits that Bitcoin is well-positioned to rebound and attain a brand new all-time excessive of $125,000 very quickly. After all, this timeline can even depend upon whether or not the present assist zone round $85,000 to $87,000 holds regular.

On the time of writing, Bitcoin is buying and selling at $94,147

Featured picture from Unsplash, chart from TradingView