Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is buying and selling above the $105,000 stage after a pointy rebound triggered by the announcement of a ceasefire between Israel and Iran. The geopolitical reduction offered a robust tailwind for danger property, and BTC responded with a robust surge, regaining a vital psychological stage that had beforehand flipped into resistance. Now, as bulls regain momentum, Bitcoin is flirting with a possible breakout above the $110,000 mark — a key stage that capped rallies all through June.

Associated Studying

This renewed power comes after a number of days of volatility and worry, the place BTC dipped to as little as $98,200 amid escalating battle within the Center East. Nevertheless, the swift restoration has shifted sentiment again in favor of the bulls. In accordance with on-chain knowledge from CryptoQuant, there was a heavy spike in Taker Buy Volume over the previous 48 hours — a robust sign that aggressive market members are stepping in with conviction.

These buy-side imbalances counsel that institutional and high-conviction merchants are positioning for additional upside. Because the market heats up and danger urge for food grows, a breakout above the $110K resistance might verify the beginning of a brand new bullish impulse. For now, all eyes are on whether or not BTC can maintain and prolong above present ranges.

Bitcoin Faces Uncertainty As Bulls Defend Construction

Bitcoin is at present going through a vital take a look at, buying and selling in a decent vary after failing to interrupt above its all-time excessive. Though bulls have managed to defend the general construction and hold BTC above key shifting averages, the value motion has not offered a transparent directional sign. The asset is roughly 6% down from its $112K peak, and whereas some merchants count on an imminent breakout towards new highs, others warn of a possible retrace under the $100K psychological stage.

This divide amongst analysts stems from ongoing geopolitical instability — significantly within the Center East — and tightening macroeconomic situations. The Fed’s dedication to elevated rates of interest and rising US Treasury yields continues to weigh on danger sentiment, making it tough for BTC to construct sustained momentum. Regardless of the uncertainty, consumers have proven indicators of power, with many trying to verify the current bounce as a stable backside.

High analyst Maartunn highlighted one key bullish sign: heavy spikes in Taker Buy Volume, which point out aggressive market orders being crammed on the purchase aspect. This means that high-conviction consumers are stepping in at present ranges, doubtlessly front-running a bigger transfer to the upside.

Whereas this can be a constructive signal for short-term sentiment, Bitcoin should nonetheless reclaim the $109K–$112K vary to invalidate the chance of a broader correction. Till then, merchants stay cautious. If BTC closes a every day candle under the $103.6K help or loses the $100K stage once more, it might set off a wave of liquidations and ship costs decrease. However, holding above $105K and constructing quantity might set the stage for the following leg up. The approaching days shall be essential in defining Bitcoin’s path ahead.

Associated Studying

BTC Surges Above Key Assist As Buyers Step In

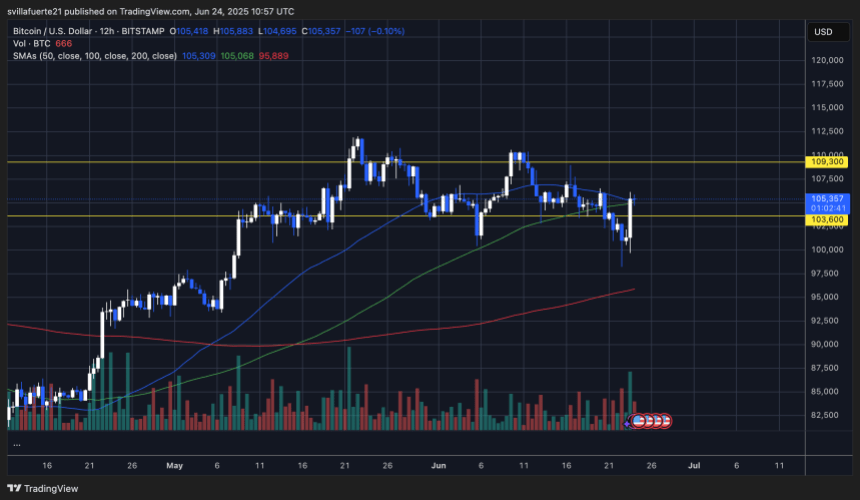

The 12-hour chart for Bitcoin reveals a robust bullish response after a short dip under the $103,600 help stage. The value rebounded sharply, reclaiming each the 100 and 50-period shifting averages (inexperienced and blue strains, respectively), with BTC now buying and selling round $105,357. This transfer confirms the significance of the $103,600 zone as a high-demand space, which has acted as a launchpad a number of instances since early Could.

Volume surged on the current bounce, indicating aggressive shopping for exercise. The spike suggests whales and institutional consumers probably absorbed the panic promoting triggered by geopolitical occasions earlier within the week. Value is now approaching the $109,300 resistance stage, a key ceiling that capped a number of rallies in Could and June.

Associated Studying

The short-term momentum stays constructive so long as BTC holds above the shifting averages. Nevertheless, a rejection close to $109K might verify a broader consolidation vary between $103K and $109K. If bulls handle to flip $109,300 into help, the trail to retest the all-time highs round $112K opens up.

Featured picture from Dall-E, chart from TradingView