Bitcoin is dealing with a vital take a look at as value motion compresses between two key ranges: the $112,000 all-time excessive and the $105,000 help zone. Bulls are trying to reclaim momentum and push BTC into value discovery, whereas bears are working to invalidate latest positive aspects and set off a deeper correction. Nevertheless, the present panorama is dominated by uncertainty. Volatility has surged, but there’s no decisive development in play, making a tense atmosphere crammed with indecision on either side of the market.

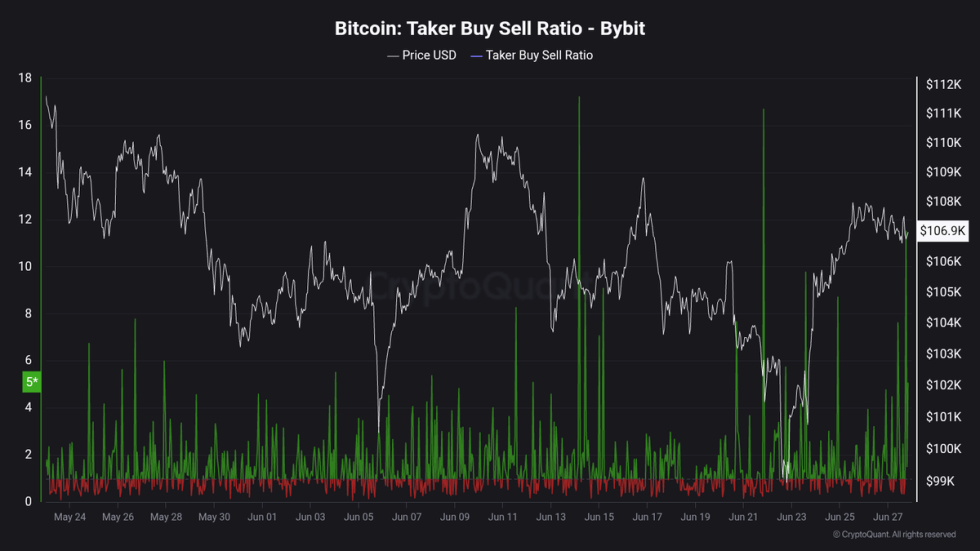

Fueling the hypothesis is contemporary knowledge from CryptoQuant, which reveals excessive Buy-Aspect Aggression on Bybit. Bitcoin’s Taker Buy/Sell Ratio on the trade has spiked to 11.5, an unusually excessive studying that signifies merchants are closely favoring lengthy positions. This surge in aggressive shopping for suggests rising confidence amongst bulls, who consider a breakout is imminent. Nevertheless, it additionally introduces threat. When positioning turns into this one-sided, the market typically punishes late entrants with sudden reversals.

With liquidity clustered close to each the $112K resistance and the $105K help, Bitcoin seems coiled for a risky transfer. Whether or not BTC breaks increased or loses key help will rely on how the broader market reacts to this lopsided positioning—and the way lengthy bulls can maintain the strain with out affirmation.

Bitcoin Breakout Hopes Develop Amid Heavy Lengthy Positioning

Bitcoin has climbed 9% since final Sunday, pushing the value towards key resistance ranges and reigniting hopes of a breakout above its all-time excessive. After weeks of consolidation and uneven motion, the latest surge suggests {that a} decisive transfer might be on the horizon. Momentum is clearly constructing, and plenty of analysts are rising assured that Bitcoin is making ready to problem its $112,000 peak. If bulls handle to interrupt by way of, BTC may enter value discovery and set off a wave of contemporary inflows.

Regardless of the optimism, dangers stay elevated. The broader macroeconomic backdrop continues to be tight, with rate of interest uncertainty, geopolitical tensions, and unstable international liquidity pressuring all threat belongings. Bitcoin could also be exhibiting power, nevertheless it’s doing so in an atmosphere that would rapidly shift towards risk-on positioning. This has led some merchants to stay cautious, whilst technicals present upside potential.

Top analyst Maartunn added gas to the dialog by highlighting alarming knowledge from CryptoQuant. Bitcoin’s Taker Buy/Sell Ratio on Bybit has skyrocketed to 11.5, indicating excessive Buy-Aspect Aggression. This implies market individuals on Bybit—also known as “Bybit Apes”—are opening heavy lengthy positions and aggressively urgent for upside. Whereas this displays robust conviction, such one-sided positioning can backfire if momentum stalls or reverses.

BTC Consolidates After Sharp Rebound

Bitcoin is at present buying and selling at $107,168 after gaining robust upward momentum from the $103,600 help degree. The 8-hour chart reveals a transparent restoration following the June 24 bounce off the 200-day easy shifting common (SMA), marked in purple, which acted as a dynamic help. Value has since climbed above the 50 SMA (blue) and 100 SMA (inexperienced), signaling renewed short-term bullish momentum.

Nevertheless, BTC is now dealing with resistance close to $109,300, slightly below the vital $110,000 zone. This space has beforehand triggered a number of rejections, making it a major short-term barrier. A confirmed breakout above this zone may open the door for a retest of the all-time excessive at $112,000.

Quantity has barely decreased throughout the latest consolidation part, which suggests indecision. Whereas shifting averages have aligned in bullish sequence (value > 50 SMA > 100 SMA > 200 SMA), Bitcoin should keep this construction and break above $109,300 with robust quantity to validate continuation.

If bulls fail to interrupt resistance, the $105,300–$103,600 zone might be essential to observe for potential help. A drop under that would sign renewed draw back strain. For now, BTC stays in a bullish posture however faces a key take a look at simply forward.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.