Bitcoin is holding above key help ranges because it continues to consolidate slightly below the $112,000 all-time excessive. Regardless of bullish momentum constructing throughout the broader crypto market, BTC has struggled to reclaim this crucial resistance stage, conserving merchants on edge. Analysts agree {that a} decisive breakout is required to verify the uptrend and sign the beginning of a brand new enlargement part.

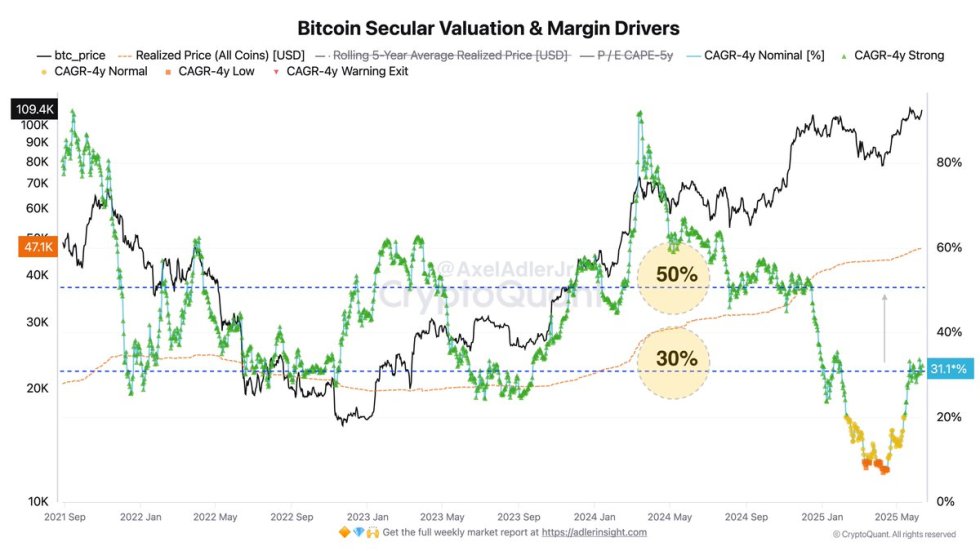

In keeping with on-chain information from CryptoQuant, the latest restoration in Bitcoin’s 4-year Compound Annual Progress Fee (CAGR) highlights a shift in long-term market sentiment. After plunging to only 7% in April—reflecting compressed margins and cycle exhaustion—the CAGR has now rebounded to round 31%, which falls into what analysts contemplate the “strong zone.” This resurgence got here as BTC’s value rallied again towards $110,000 by Could–June 2025, reviving hopes for a sustained bullish pattern.

Though the present progress charge stays under historic cycle peaks of fifty–80%, the market’s construction and on-chain dynamics recommend there’s nonetheless loads of room for upside. As Bitcoin holds its floor and market situations stabilize, the stage could also be set for a decisive breakout—one that would affirm the uptrend and drive BTC into value discovery as soon as once more.

Bitcoin Gears Up For Value Discovery As Fundamentals Strengthen

Bitcoin is on the verge of coming into value discovery, with the asset buying and selling slightly below its all-time excessive close to $112,000. After weeks of consolidation and regular increased lows, this week may show decisive for your complete crypto market. A breakout above resistance would sign the beginning of a brand new, explosive part, whereas a pullback to brush liquidity under stays a sound threat if momentum stalls. Both method, the market is making ready for a big transfer.

This crucial second comes amid rising macroeconomic uncertainty. The U.S. economic system continues to point out indicators of systemic stress, pushed by elevated Treasury yields, sticky inflation, and geopolitical tensions. Regardless of these headwinds, Bitcoin’s construction stays robust, underpinned by enhancing long-term fundamentals.

Top analyst Axel Adler shared insights from CryptoQuant, pointing to the rebound in Bitcoin’s 4-year Compound Annual Progress Fee (CAGR). After falling to only 7% in April—signaling a severely compressed market—the CAGR has recovered to 31% by June 2025, coming into what Adler calls the “strong zone.” This rebound coincided with Bitcoin’s climb again towards $110,000, reinforcing bullish sentiment.

Whereas 31% stays under historic peak CAGRs of fifty–80%, Adler notes that the backdrop is favorable. If futures market momentum and leverage proceed to construct, he tasks that Bitcoin may attain $168,000 as early as October 2025. For now, all eyes are on BTC’s subsequent transfer as a result of whichever path it breaks, it’ll possible set the tone for the remainder of the 12 months.

BTC Consolidates Beneath ATH: Market Awaits Subsequent Transfer

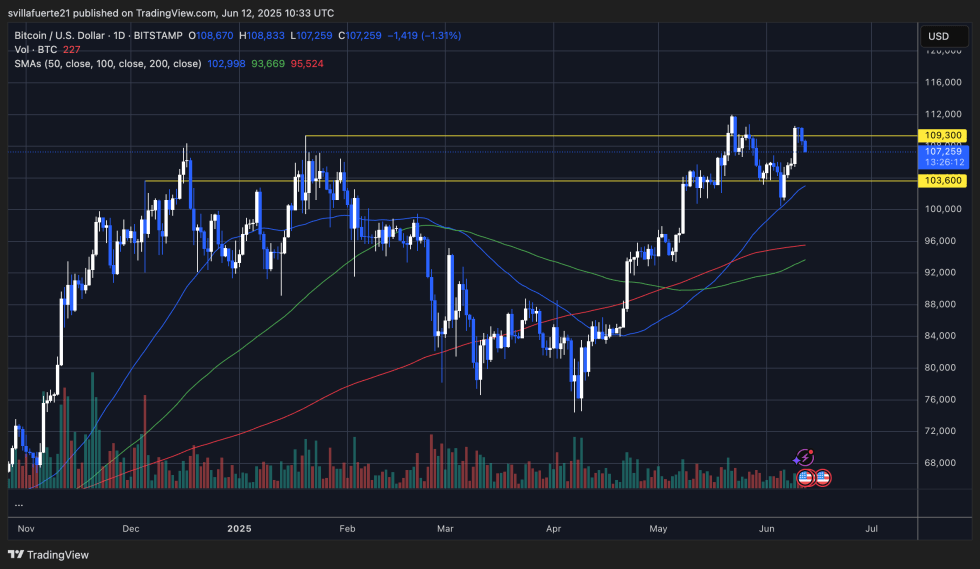

Bitcoin is at the moment buying and selling at $107,259 on the day by day chart after a minor 1.31% pullback from the $109,300 resistance stage. The value motion exhibits BTC forming a spread between $103,600 (help) and $109,300 (resistance), with a number of rejections from the higher boundary. Regardless of this, Bitcoin continues to carry above the 50-day easy transferring common (SMA) at $102,998, suggesting that the broader uptrend stays intact for now.

This consolidation comes after BTC rebounded sharply from the $103,600 help zone earlier this month. The construction remains to be constructive, however bulls must reclaim and maintain above the $109,300 stage to problem the $112K all-time excessive and push into value discovery. Failure to take action may result in a retest of $103,600, the place liquidity is probably going concentrated.

Quantity stays comparatively secure, although barely decrease on this newest leg up, hinting that momentum is cooling. That mentioned, so long as BTC holds above the important thing transferring averages and doesn’t shut under $103,600, the bullish construction is preserved.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.