An analyst has defined how a shifting common (MA) that has traditionally served because the boundary for bear markets is located at this stage.

Bitcoin 50-Week MA Is At present At $75,195

In a brand new publish on X, analyst James Van Straten has shared a few necessary MAs associated to Bitcoin. An “MA” is a technical evaluation (TA) instrument that calculates the typical worth of any given amount and as its identify implies, it strikes in time together with the amount and updates its worth accordingly.

MAs may be taken over any window of time, whether or not that be simply 10 minutes or 10 years. The principle use of this indicator is for learning long-term developments, because it helps filter out any short-term deviations within the chart.

Right here is the chart shared by the analyst, that exhibits the pattern within the 50-week and 200-day MAs of the Bitcoin value over the previous 12 months:

As is seen within the above graph, the Bitcoin value has dropped beneath the 200-day MA after the current market downturn, which means that the asset’s worth now’s decrease than the typical for the final 200 days.

In TA, the 200-day MA is commonly checked out as a boundary line between bearish and bullish developments, with a breakdown of the extent being thought-about a foul signal. Thus, it could seem that BTC has misplaced this necessary stage with its newest plunge.

One other stage that will divide macro developments, nonetheless, is the 50-week MA, which the cryptocurrency nonetheless stays above. “Below 50WMA is a bear market,” notes Van Straten. At current, the extent is located round $75,195.

If BTC’s present bearish trajectory continues, it’s potential that this line is likely to be put to check. The analyst has identified, although, that the coin has dropped underneath the 200-day MA just a few occasions earlier than and managed to recuperate earlier than breaking beneath the 50-week MA. It now stays to be seen whether or not an identical sample would play out this time as nicely or not.

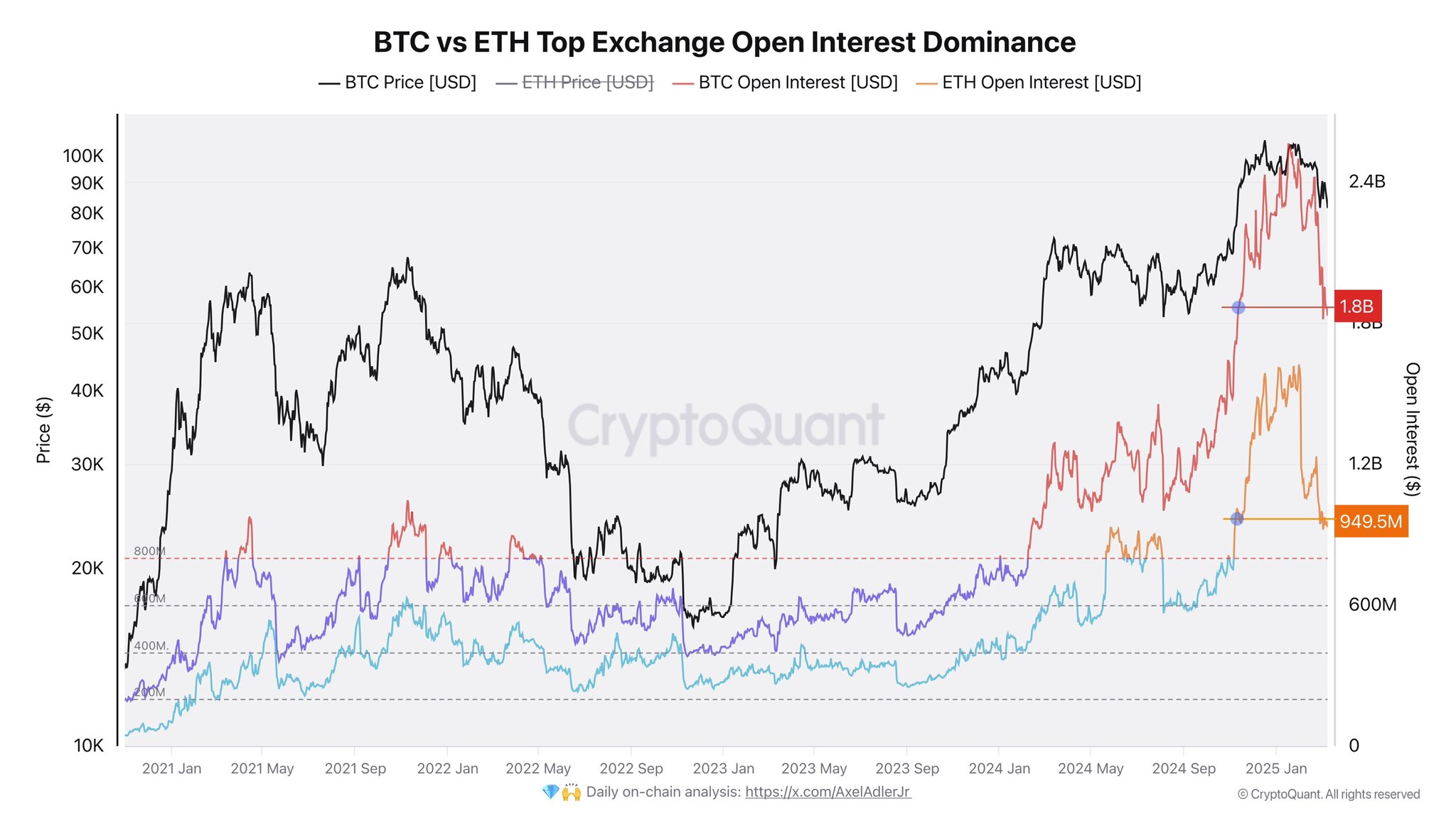

In another information, the downwards trajectory of the market has meant {that a} leverage flush has occurred over on the derivatives facet of the sector, as CryptoQuant writer Axel Adler Jr has shared in an X publish.

Within the chart, the analyst has connected the info for the “Open Interest,” an indicator that measures the entire quantity of derivatives positions associated to a given asset which might be presently open on all centralized exchanges.

It will seem that the metric has plunged by $668 million for Bitcoin and $700 million for Ethereum.

BTC Value

Bitcoin has made some restoration over the past 24 hours as its value has jumped 7%, reaching the $83,000 stage.