The Bitcoin value drop to $91,500 triggered mass crypto liquidations throughout exchanges and high DeFi protocols like Aave and Compound – let’s late a glance.

After peaking at round $106,000 on Friday, Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !essential;

}

Worth

Quantity in 24h

<!–

?

–>

Worth 7d

dropped all through the NY session of that day earlier than extending losses over the weekend. With claims of potential market manipulation by main market makers, Bitcoin fell some extra on Monday, dropping to as little as $91,500.

Nevertheless, the surprising plunge within the earlier hours of February 3 was contained as costs recovered steadily, breaking $101,000 earlier than recoiling to identify charges. Amid this wavy value motion, billions of leveraged lengthy positions have been liquidated on Binance, OKX, and Bybit.

It’s now rising that leveraged longs and 100X speculators weren’t the one culprits. In line with Santiment, the fallout prolonged past buying and selling to lending, the place Aave, Compound, and different DeFi protocols needed to promote collateral to guard lenders. Their resolution shook DeFi to the core, sparking a sell-off in high pro-DeFi platforms like Aave, Injective, and even Compound.

The Bitcoin Worth Crash Noticed Extra Than $2.2Bn Vanquished in Mass Liquidation Occasion

From the BTCUSDT chart, the drop from January 31 to February 3 noticed BTC lose 10%, pushing losses from all-time highs to round 16%. Though costs are secure on the time of writing, the coin stays under $100,000.

(BTCUSDT)

During the last three days, the see-sawing, range-bound market has led to liquidations within the perpetual futures markets.

In line with Coinglass, over $481 million price of leveraged positions have been closed within the final 24 hours. Most of those have been leveraged longs, betting on Bitcoin and Ethereum to rally.

(Supply)

As of February 3, this determine stood at over $2.2 billion, which means many speculators have been flushed out, erasing extra leverage.

The similar liquidation was prolonged to DeFi lending protocols like Aave and Compound. On these platforms, customers can borrow loans, utilizing wBTC, ETH, or some other supported asset as collateral.

To borrow, one should deposit a bigger collateral than the mortgage quantity. For instance, to get a $1,000 mortgage in USDT, collateral of $1,500 or larger have to be locked to cowl volatility.

It’s a type of leverage as a result of offered costs hold rising, the borrower needn’t fear about liquidation. Solely as soon as costs start cooling off can the borrower contemplate repaying the mortgage lest the protocol liquidate the collateral.

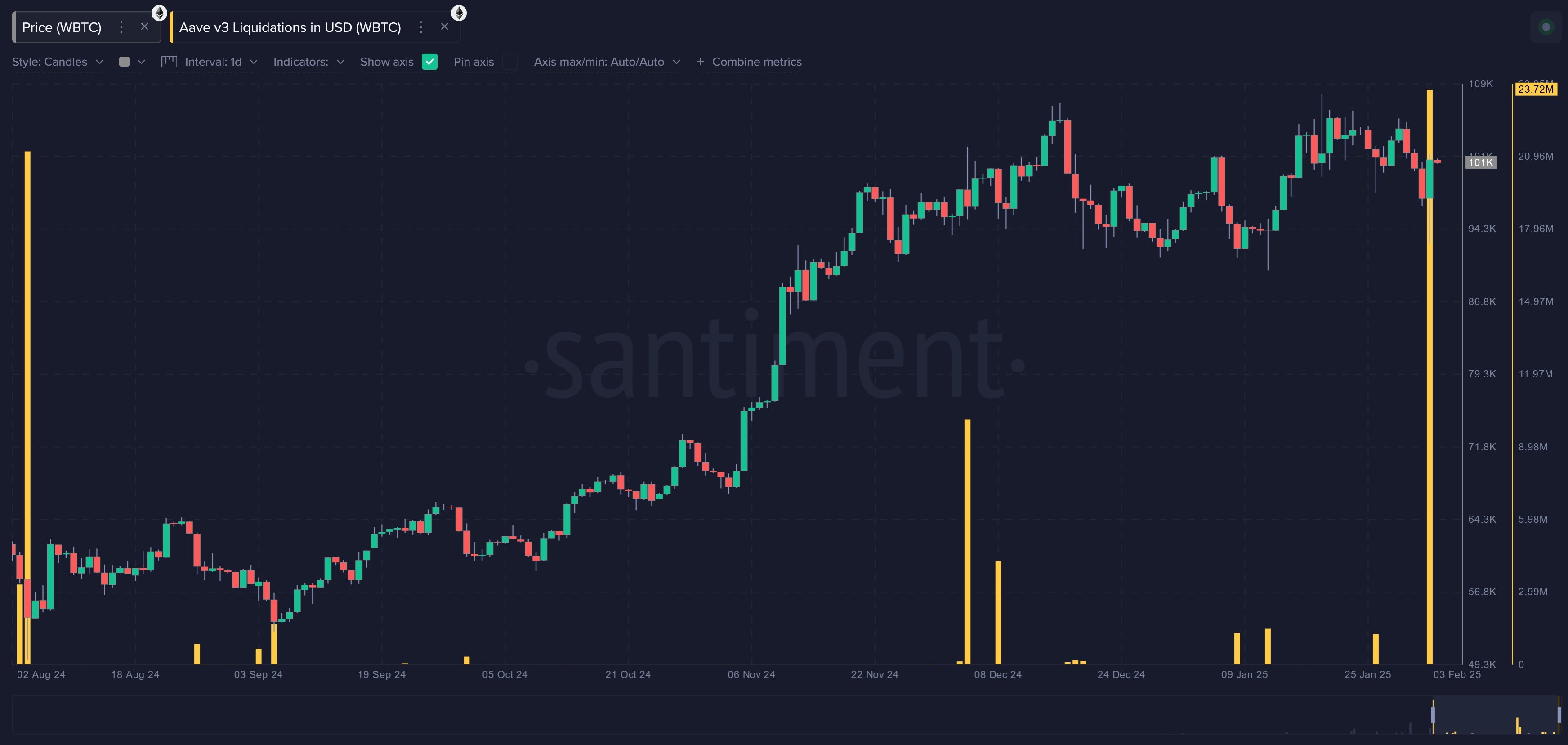

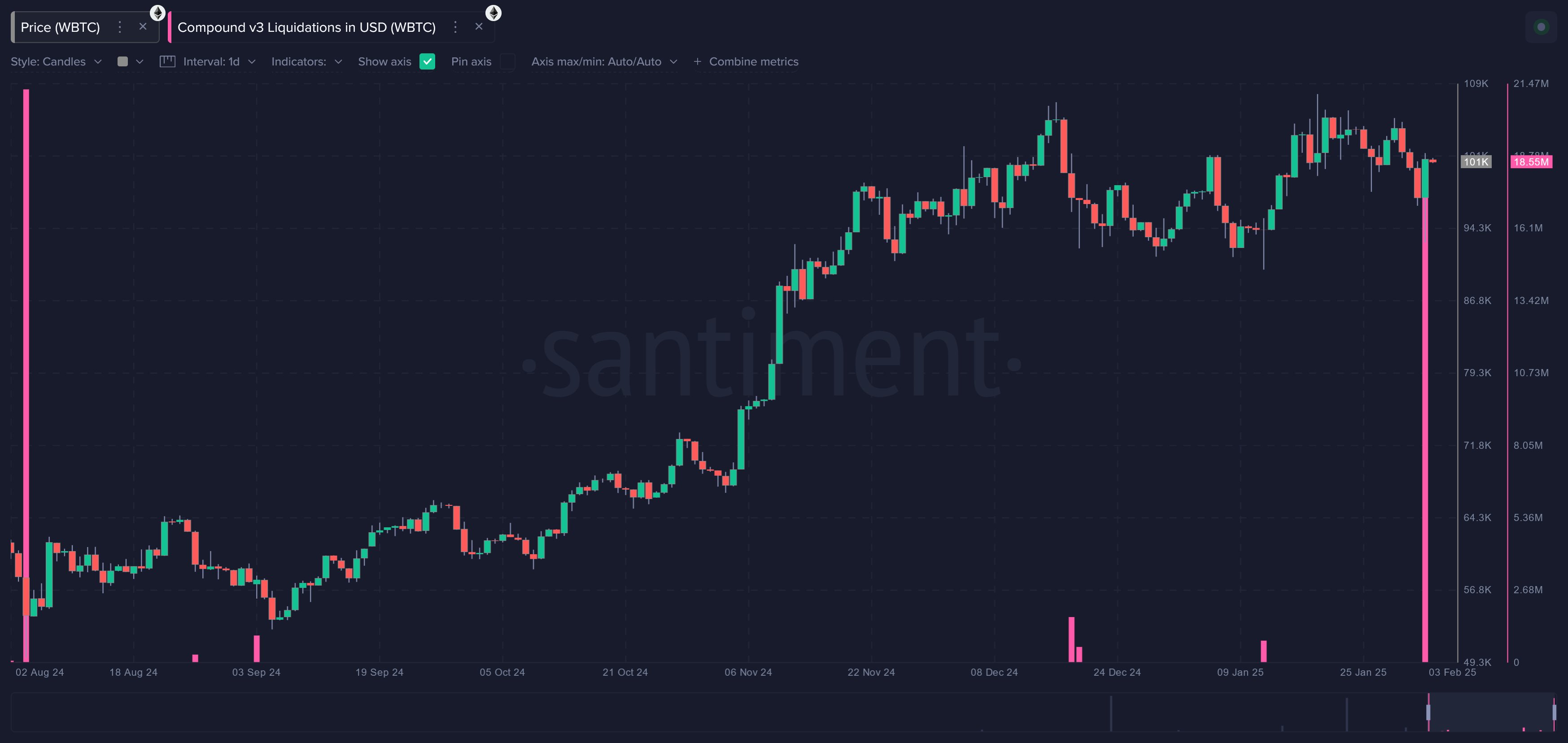

wBTC Liquidations on Aave and Compound DeFi

That is what exactly occurred on February 3 when costs tanked throughout the board.

Customers who had taken loans locking in wBTC, a stablecoin monitoring BTC costs, misplaced their belongings on Aave and Compound after the protocol mechanically liquidated these cash.

In line with Santiment, over $782,000 price of wBTC have been liquidated on Aave v2, the very best since August 1, 2024.

On Aave v3, which is thought for its enhanced danger administration and danger capabilities, over $23.7 million of wBTC have been offered–the very best liquidation day ever.

(Supply)

In the meantime, debtors on Compound weren’t spared. When costs crashed to $91,500, over $467,000 of wBTC have been forcefully closed. On Compound v3, greater than $18.5 million price of wBTC collateral needed to be offered to guard lenders and stabilize the protocol.

(Supply)

As sanity resumes after the deleveraging occasion, the overall worth locked (TVL) of Aave and Compound stands at $16.8 billion and $2.3 billion, respectively, in keeping with DeFiLlama.

(Supply)

On common, belongings below administration have shrunk by almost 8% during the last week.

EXPLORE: FTX Victims Despair As Mother and father Name on President: Will Trump Free Sam Bankman-Fried?

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish The Bitcoin Drop To $91,500 Triggered a Major DeFi Flushout appeared first on 99Bitcoins.