Aptos, the blockchain platform making waves with its cutting-edge programming language, is driving a rollercoaster of progress and rising pains. Whereas its ecosystem is exploding with new customers and exercise, its native token, APT, can’t appear to catch a break. Let’s unpack what’s driving the hype—and why traders are biting their nails.

Ecosystem Growth Meets Market Blues

Aptos isn’t simply rising—it’s skyrocketing. In lower than a 12 months, energetic addresses on the community ballooned from beneath 100,000 to over 1.4 million. Transactions are up 30% this month alone, fueled by builders leaping ship from chains like Solana to construct on Transfer, Aptos’s glossy, scalable programming language.

However right here’s the twist: regardless of the frenzy, APT’s value lately nosedived to beneath $7.00, dragged down by a crypto-wide sell-off. On the time of writing, APT was buying and selling at $7.34, down 11.9% and 12.7% within the every day and weekly timeframes. Speak about a disconnect.

The Technical Tightrope

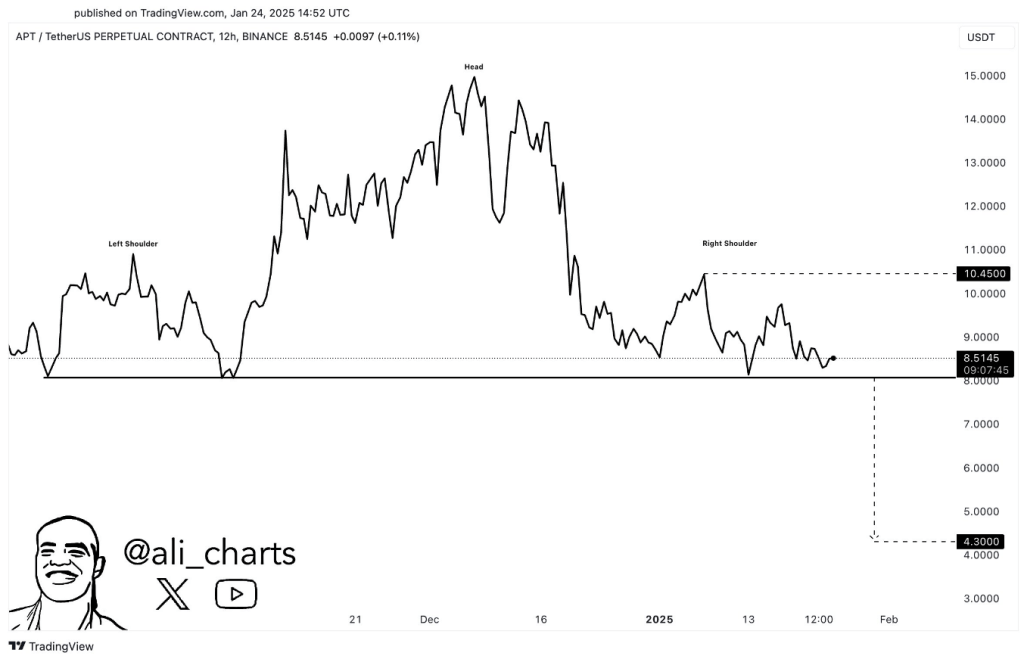

Charts aren’t portray a reasonably image for APT. Analysts, like Ali Martinez, are eyeing an ominous head-and-shoulders sample—a traditional bearish sign—that might ship the token tumbling towards 4.30. To flip the script, APT must claw its method above $10.50, and keep there. Some analysts, although, nonetheless see a glimmer of hope: if Aptos smashes by way of key resistance ranges, we’d see a rebound by summer time.

#Aptos $APT seems to be forming a head-and-shoulders sample, with a possible draw back goal of $4.30. A sustained shut above $10.50 is required to invalidate the bearish outlook. pic.twitter.com/4rHCGcOxyy

— Ali (@ali_charts) January 25, 2025

2025: Make-Or-Break Improvements

Aptos isn’t sitting nonetheless. It has lately rolled out Transfer 2, a turbocharged improve to its programming language designed to woo much more builders. Then there’s Raptr, a brand new consensus mechanism within the works that guarantees to deal with blockchain’s everlasting scalability complications. If these launches stick the touchdown, Aptos might leapfrog rivals in DeFi and past. However “if” is doing a variety of heavy lifting right here.

Ought to You Wager On Aptos?

Right here’s the deal: Aptos has the tech and the traction to be a long-term participant. Its eco-friendly edge and developer-friendly instruments are legit benefits. However tread fastidiously. Bearish charts, risky markets, and looming token unlocks might shake issues up in a single day. Savvy traders would possibly see this dip as a shopping for alternative—others would possibly name it a purple flag. Both method, do your homework. Crypto’s by no means a certain factor, however Aptos? It’s one to look at.

Backside Line

Aptos finds itself balancing spectacular progress with potential challenges for its token. For risk-tolerant traders, the current value dip would possibly current a golden alternative. For the cautious, watching resistance ranges could possibly be key. On this planet of crypto, fortunes can shift within the blink of an eye fixed.

Featured picture from DALL-E, chart from TradingView