Cryptocurrencies stay topic to heightened market volatility because the hype surrounding President Trump’s return to workplace eases. Even so, greed stays the principle emotion controlling the market as buyers stay optimistic of a crypto-friendly setting beneath Trump’s administration.

Because the bullish sentiment gives assist to most cryptos, Ethereum is beneath strain from the criticism and management points rocking the Ethereum Basis. Alternatively, iDEGEN is prospering because it widens its horizon by the video content material embedded in its newest V3 improve. Past its recognition, savvy buyers are shopping for into its potential as a pacesetter within the AI meme coin house.

Ethereum value stays range-bound as its management fights detrimental sentiment

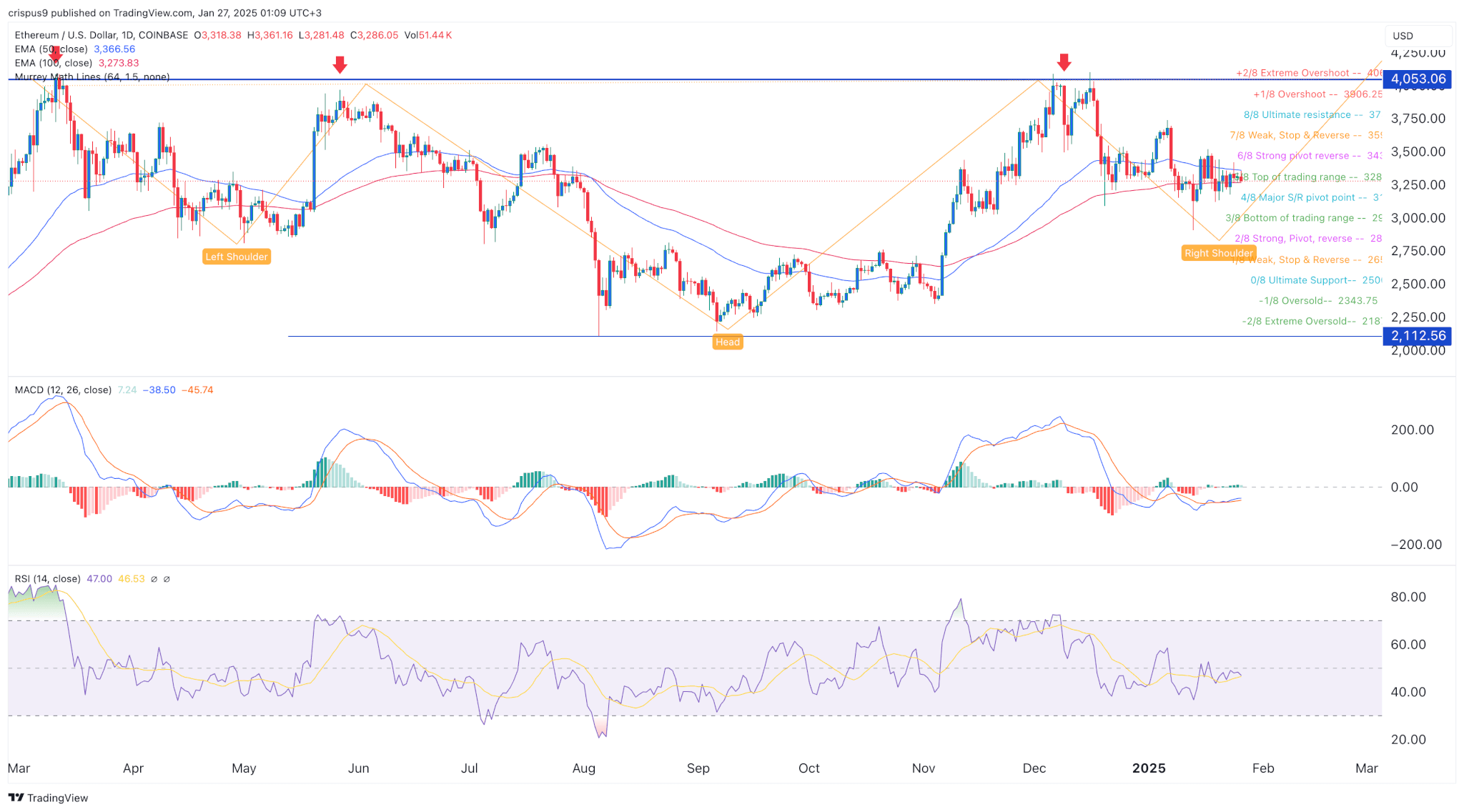

ETH value chart by TradingView

Ethereum value stays beneath strain even because the worry of lacking out (FOMO) sustains the broader crypto market. Notably, management points inside the Ethereum Basis have alarmed some buyers; main ETH/USD to underperform towards different crypto majors like Solana and Bitcoin.

For example, following the choice to host Trump’s meme coin, SOL/USD rallied to a contemporary all-time excessive of $294.94 on nineteenth January earlier than a corrective pullback to $254.96 as on the time of tis press launch. It’s such misplaced alternatives and seemingly misplaced priorities which have triggered Ethereum’s criticism from its neighborhood.

Apart from, as seen on SoSoValue, BTC spot ETF’s whole web influx for the week ending on twenty fourth January was at $1.76 billion. Compared, that of ETH spot ETF was $139.32 million.

Amid this promoting strain, ETH/USD has lacked sufficient bullish momentum to interrupt the resistance on the essential zone of $3,500. Certainly, the formation of a bearish demise cross about two weeks in the past factors to the continuation of its range-bound buying and selling within the ensuing classes.

Extra particularly, the vary between $3,410 and $3,240 is price watching. Past the vary’s higher restrict, the bulls will doubtless face resistance at $3,479. On the flip aspect, additional promoting strain may have the bulls defending the assist zone of $3,195.

iDEGEN’s strong social capital set to maintain its progress past the presale

In 2009, Bitcoin was launched as a decentralized digital foreign money difficult the fiat foreign money. What began as an asset with virtually no financial worth has since surged to $105,013 with analysts forecasting that it’ll hit $200,000 in 2025.

iDEGEN bears a comparable potential. In truth, some view it because the Bitcoin of AI meme cash. It has rightfully secured its place as a sentient meme lord revolutionizing the AI crypto house. In simply two months, the challenge that begun on a clean slate has had 1.44 million impressions and over 21,000 holders of the 1,560 million $IDGN tokens already offered.

Evidently, savvy buyers are trying past its virality and shopping for into its potential. To start with, the one-of-a-kind social experiment has a strong social capital that has already propelled it to heights past its creators’ wildest imaginations. Not even the 2 bans on X may comprise this challenge that has redefined the idea of “by the community, for the community”.

In truth, it has emerged stronger, garnering immense consideration within the US and the UK. With its newest V3 improve, video content material is ready to advance its recognition even additional. By getting into the Telegram frontier throughout its V2 improve, the challenge raised an extra $1 million inside 24 hours.

Apart from, there is just one month left earlier than its itemizing on twenty seventh February. Because the challenge captures the eye of extra meme coin fans, anticipation is build up and FOMO intensifying. Extra savvy buyers acknowledge that this can be the one alternative to personal $IDGN tokens on the present value of $0.0146. The early adopters are already sitting on hefty earnings with returns of over 13,000%.

Study extra purchase IDEGEN

Cardano value double high sample factors to a consolidation section

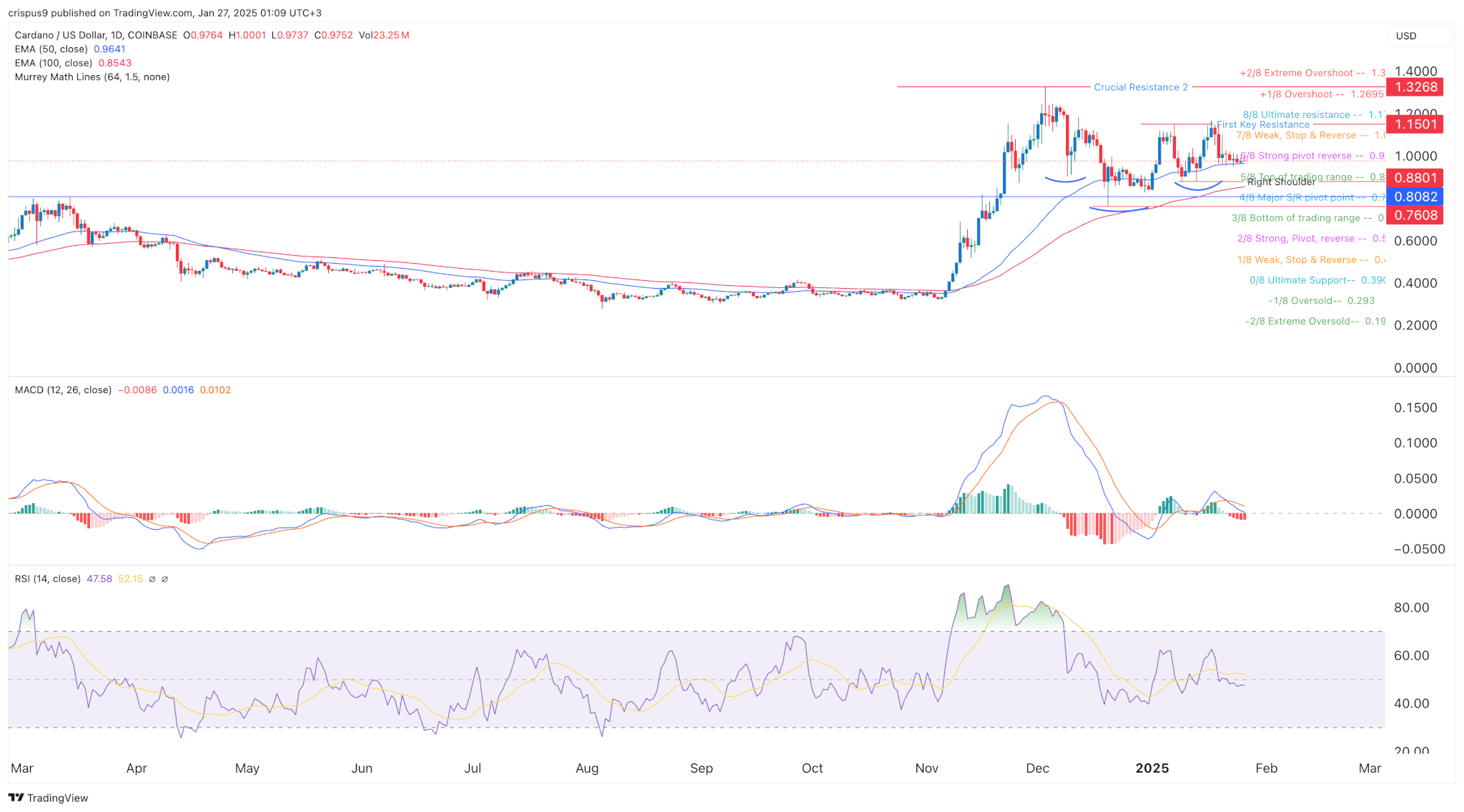

ADA value chart by TradingView

ADA/USD traded within the inexperienced for the second consecutive week even because it dropped by 14% from the one-month excessive it hit a few week in the past. Amid heightened market volatility, the altcoin will doubtless stay beneath strain within the close to time period.

A take a look at its day by day chart reveals the formation of a bearish double high sample through the first half of the month. Apart from, an RSI of fifty factors to a interval of range-bound buying and selling because the bulls defend the assist zone of $0.9608.

At its present stage, the crypto is hovering across the 20-day EMA at $1.0055. A rebound previous that stage will doubtless have it face resistance at $1.0471.