https://x&interval;com/GuerillaV2

In a latest announcement, Greatest in Slot, the infrastructure firm powering a number of the hottest Bitcoin purposes and wallets like Xverse and Liquidium, revealed that BRC-20s are getting an improve.

Dubbed BRC2.0, it’s anticipated to go reside on Bitcoin Testnet in Q1 of 2025, with the intention to deliver “smart contracts” to BRC-20s, enabling them to compete with Bitcoin sidechain designs.

Briefly, the “BRC20 Programmable Module” is designed to “unlock infinite new use cases for native assets on Bitcoin—including seamless DeFi, RWAs, DAOs, stablecoins, and more—without relying on multisig bridges or L2s.”

After a few years within the area, we are able to all agree that we’ve heard guarantees like this earlier than. Nonetheless, metaprotocols have one distinguishable benefit: they’re absolutely on-chain, fairly than counting on fully separate chains with new belief assumptions. Certain, metaprotocols might not be the perfect strategy to decentralizing the token financial system on Bitcoin, however they’re a begin.

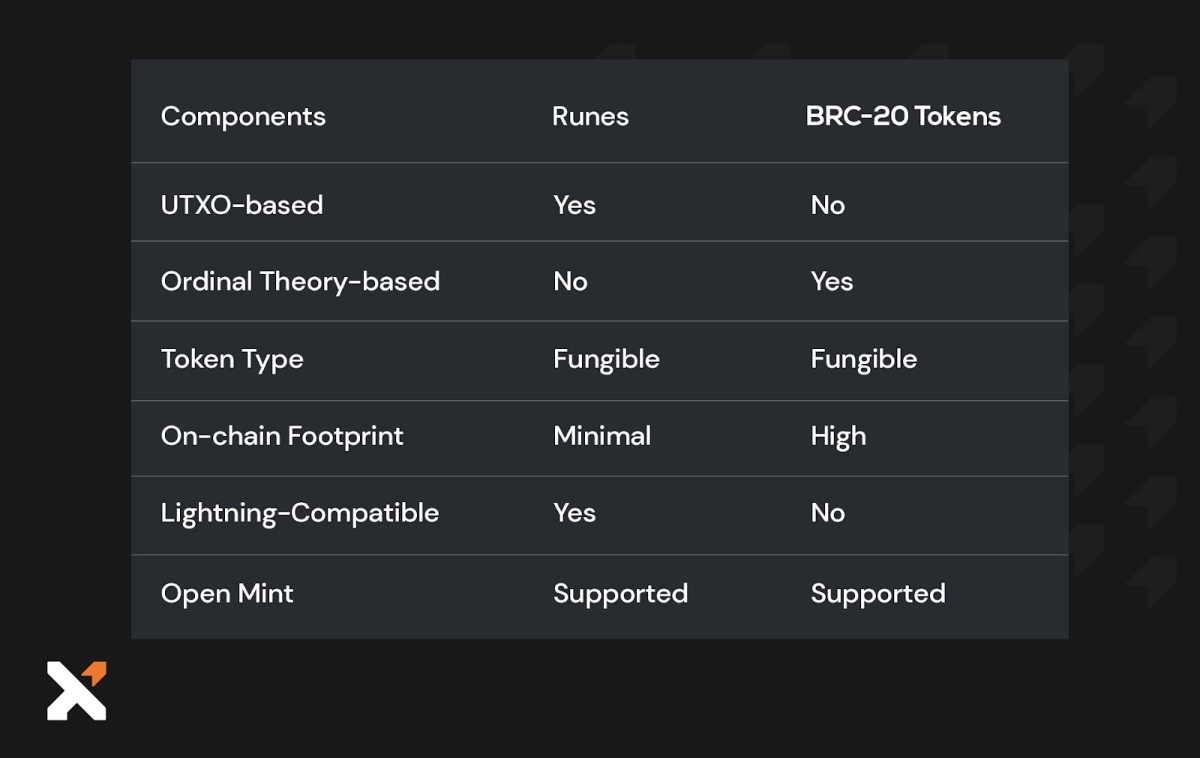

Runes suffered from overwhelmingly excessive expectations earlier than their launch, and this is a chance for BRCs to make a comeback. Irrespective of your stance on tokens on Bitcoin, competitors between completely different requirements will in the end deliver extra effectivity and cut back on-chain bloat—one thing we are able to all agree is fascinating.

The actual query is that this: for normal Bitcoiners who use Bitcoin purely as a financial community, do we actually have to undergo this once more? On-chain congestion, ineffective pump-and-dump schemes, skyrocketing charges…

My reply is: completely!

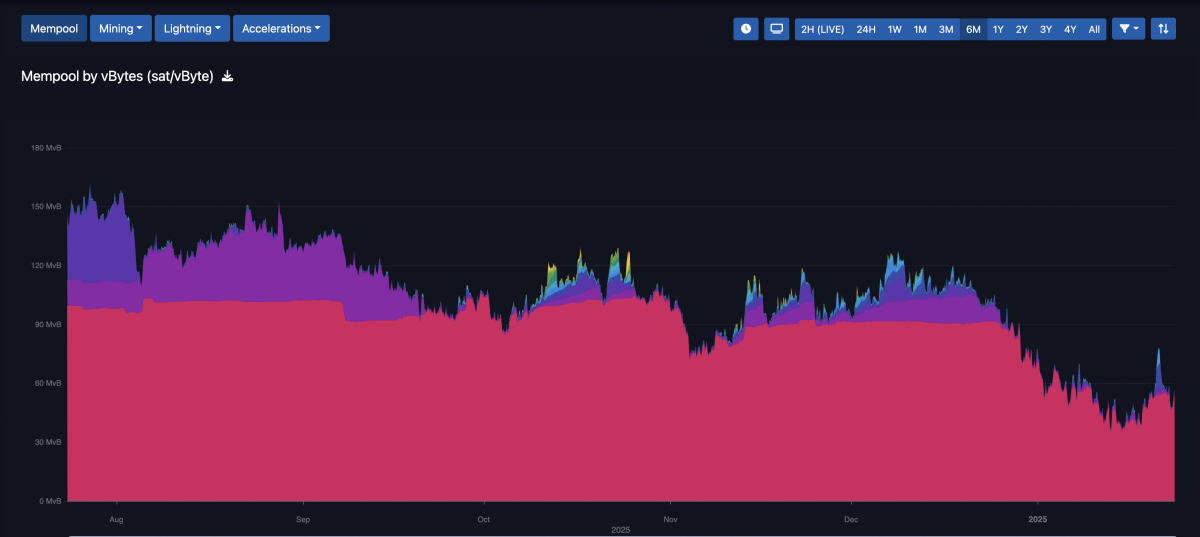

The mempool has been “dead” for the higher a part of the final six months.

First, as Bitcoiners, we’re purported to help free markets. Having extra fee-paying customers is actually the absolute best end result for Bitcoin’s survival. Miners have simply gone by means of one other halving, and preserving mining worthwhile is the one method to stop centralization within the fingers of sponsored actors (whether or not governments or monetary markets—sure, miners issuing limitless loans to purchase machines won’t final ceaselessly).

For context, in keeping with CoinDesk, Solana’s validators skilled a document inflow of over 100,000 SOL, price almost $25.8 million, in charges and ideas as a consequence of intense buying and selling exercise of the TRUMP and MELANIA tokens.

Second, the Pandora’s field has already been opened. Tokens on Bitcoin are right here to remain. If customers want extra programmability, who has the authority to cease it? (Except for pro-censorship thinkbois, in fact.)

As Bitcoin’s ecosystem evolves, the introduction of the BRC-20 improve presents a compelling case for why it’d eclipse the Runes token normal. Listed here are a number of the reason why:

- The first attract of BRC2.0 lies in its promise to reinforce effectivity. With sensible contract performance, BRC-2.0 tokens may deal with advanced operations immediately on the Bitcoin blockchain, probably lowering the necessity for added layers or sidechains. This might result in extra compact transactions, lowering on-chain bloat, an issue Runes have been criticized for as a consequence of their preliminary hype and subsequent congestion. This effectivity might be a game-changer for Bitcoin’s scalability, providing a streamlined strategy to tokenization with out altering the core protocol’s safety or decentralization.

- BRC2.0 is designed to combine with present Bitcoin infrastructure. Because of collaborations with the likes of the Layer 1 Basis, it may enhance consumer expertise and interoperability. Not like Runes, which confronted challenges in consumer adoption as a consequence of advanced minting processes and unhealthy UX, BRC2.0 goals to supply a extra user-friendly interface for token creation and interplay. This might result in broader acceptance and use, making Bitcoin a extra engaging platform for builders and customers alike.

My default place on something new associated to Bitcoin is at all times warning. We’ll have to attend for the precise specifics of this new protocol to be disclosed, however I’m excited in regards to the prospect of extra environment friendly DeFi use instances on Bitcoin—not on lesser chains.

In case you’re nonetheless skeptical, I’ll go away you with this query: If tokens on Bitcoin are inevitable, what’s worse?

- Metaprotocols utilizing Bitcoin’s block area in change for charges, with out altering the community’s guidelines?

- Or Bitcoiners bridging their hard-earned Bitcoin to centralized, competing chains to entry the identical token markets?

As a Bitcoin Maxi, I need all of the charges. I need all of the customers. Bitcoin Maxis ought to be FEE REVENUE Maxis, so long as the core ethos of the underlying community stays unchanged (taking a look at feline enjoyyyyers).

My TL;DR:

- Wait and see what BRC2.0 has to supply. Will it actually turn into programmable in a means that’s safe sufficient for Bitcoiners to belief?

- Runes might turn into irrelevant if BRCs stage an actual comeback, particularly with higher UX.

- Let the miners rejoice with degen charges.

- Tokens on Bitcoin with out altering the principles are higher than tokens on Bitcoin that require new opcodes or altered guidelines.

- Grateful for all of the gigabrain devs constructing on Bitcoin apps as an alternative of vaporware chains.

This text is a Take. Opinions expressed are fully the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Articles I write might talk about subjects or firms which can be a part of my agency’s funding portfolio (UTXO Administration). The views expressed are solely my very own and don’t characterize the opinions of my employer or its associates. I’m receiving no monetary compensation for these takes. Readers mustn’t contemplate this content material as monetary recommendation or an endorsement of any explicit firm or funding. At all times do your individual analysis earlier than making monetary choices.