Crypto New Year is right here, and the most important crypto tales of Crypto 2024 are again within the highlight alongside VanEck crypto predictions for 2025.

U.S. funding agency VanEck simply launched their conservative crypto predictions for 2025. Ideas?

If 2025 is the vacation spot, 2024 was the yr crypto hit full throttle. Spot Bitcoin and Ethereum ETFs grew to become actual, the Halvening dropped like clockwork, and a crypto-friendly U.S. cupboard took energy. Oh, and a squirrel named Peanut impressed a meme coin frenzy. It was a yr of absolute mania, the type you may’t script.

So maybe VanEck crypto predictions 2025 aren’t so unrealistic in spite of everything?

Let’s make a journey down Reminiscence Lane. Listed below are the highest crypto tales from 2024.

Bitcoin Halvening Is About to Make Crypto Explode

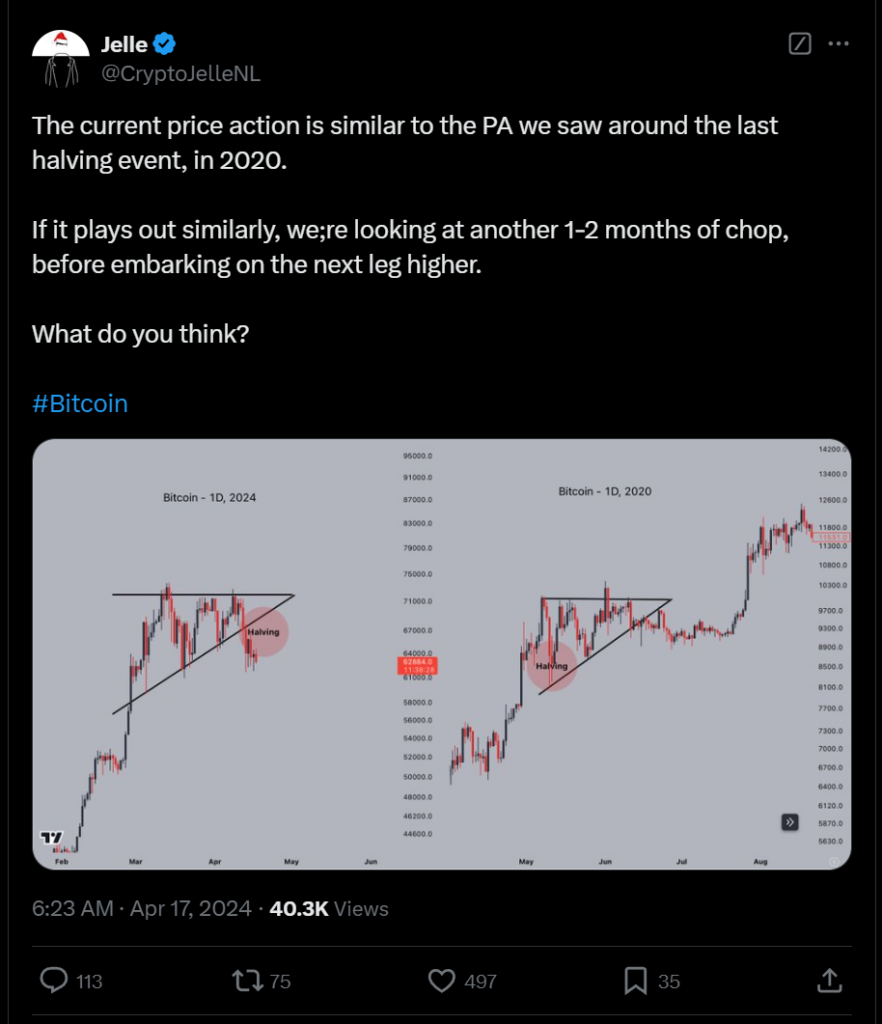

I received into Bitcoin in 2019, and when the 2020 Halving occurred, I didn’t actually know what to anticipate: Was my BTC going up, sideways, or down?

Effectively, I’m glad I held – Bitcoin crabbed post-halving, gaining a meager +6% regardless of the foremost occasion, however my holding habits was rewarded when the worth later exploded by 548% to new all-time highs.

We’re about to see the same pattern in 2025. Regardless of the 2024 Bitcoin Halvening in April and Bitcoin breaking $100k, sentiment continues to be blended. Trying on the market at present, particularly on crypto X, a lot FUD (worry, uncertainty, doubt) goes round – that’s by design.

The Bitcoin Halving implements a discount within the block reward given to Bitcoin miners. In 2024, mining rewards can be lowered from 6.25 BTC to three.125 newly minted bitcoins.

This course of progressively raises Bitcoin’s worth ground over time – with a 50% discount in recent provide – which might grip worth motion for as much as 14 months. Strap in; we’re nonetheless throughout the vary for a BTC provide shock.

The Biggest Story of the Year

Skipping forward a bit, the most important story of the yr needs to be President-elect Donald Trump getting back from the political graveyard.

Give it some thought:

- They falsely persecuted him for Russian collusion (failed Steele File)

- They tried to question him for colluding with Ukraine (calls to Zelensky)

- They went after him once more and failed for taking political paperwork (one thing each president has performed)

- They shot at him

- They referred to as him Hitler

And Trump nonetheless gained. Not solely that, however he’s now the primary pro-Bitcoin president and has probably the most pro-crypto congress in American historical past.

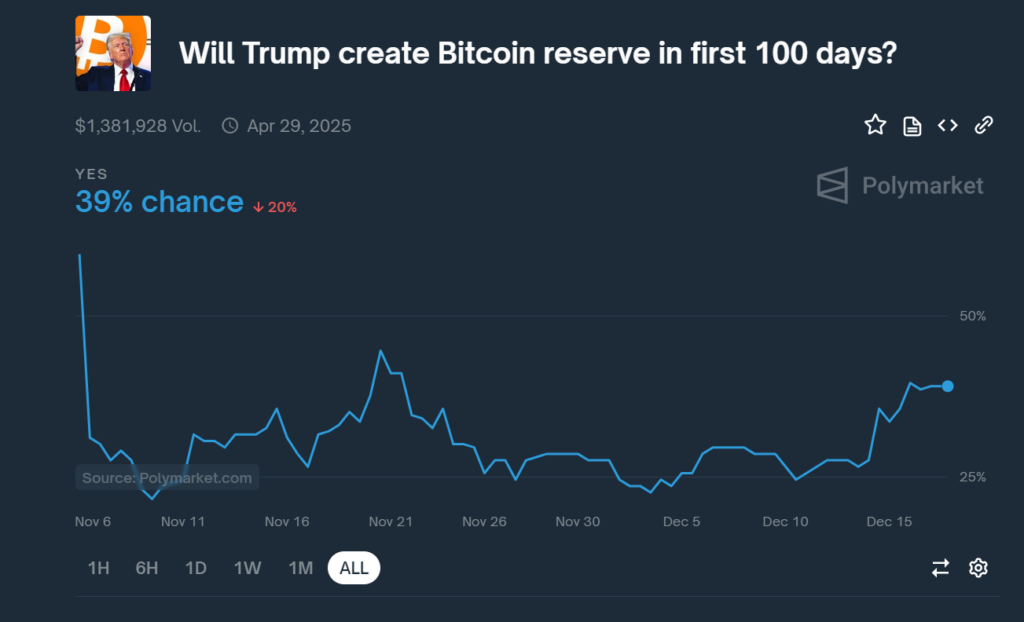

If Trump can create a BTC Strategic Reserve, free Silk Highway creator Ross Ulbricht, and make America the crypto hub of the world, then $100k BTC would be the solely starting.

Microsoft Rejects Bitcoin Investments

And lastly, Microsoft isn’t biting. Whereas flashy names like Tesla and MicroStrategy gamble on cryptocurrency, the tech big caught to its regular method. A proposal from the Nationwide Middle for Public Coverage Analysis (NCPPR) and Michael Saylor pitched Bitcoin as an inflation hedge, however Microsoft appeared unimpressed.

With $78 billion in money and marketable securities, the NCPPR recommended allocating 1%—a comparatively small portion—to Bitcoin to discover the potential for greater returns.

It was all the time going to be sudden if Microsoft purchased. Low threat characterizes Microsoft, and that’s the reason they’re nonetheless right here. Bitcoin might skyrocket previous $200k, and Microsoft wouldn’t flinch. This firm is Warren Buffett in a pillow manufacturing facility. Once they lastly step into crypto, count on them to carry for many years.

With that stated, it was by no means about getting Microsoft to purchase Bitcoin. It’s about sending a message. Within the subsequent cycle, they may suppose otherwise as soon as they notice their missed beneficial properties.

EXPLORE: The 18 Greatest New Cryptocurrencies to Put money into 2024

MicroStrategy’s Govt Chairman, Michael Saylor, is making an attempt to persuade these firms to commerce billions of nugatory fiat that banks preserve printing for literal gold (which is scarce).

He sees no less than 20 years into the longer term and tries bringing others alongside, like Microsoft. No banks will cuck this man, and no authorities will seize away his digital gold like they did in 1930. However, the board remained agency, emphasizing the dangers related to Bitcoin’s notorious worth instability, which makes it much less appropriate for long-term company methods. It’s a becoming finish to 2024.

This yr ends with a way of momentum—what we’ve achieved issues, however the larger battle continues to be on the market ready.

EXPLORE: Nvidia Hit with Class-Motion Lawsuit Over Crypto Miner Gross sales After Supreme Courtroom Denies Enchantment

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Biggest Crypto Stories of 2024: Crypto Year in Review appeared first on 99Bitcoins.